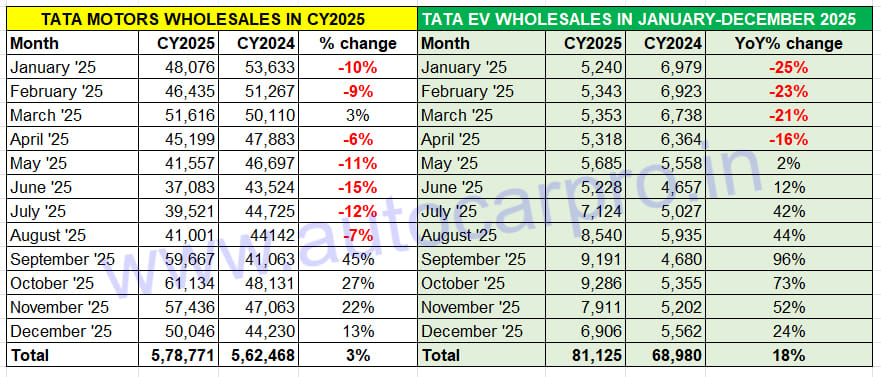

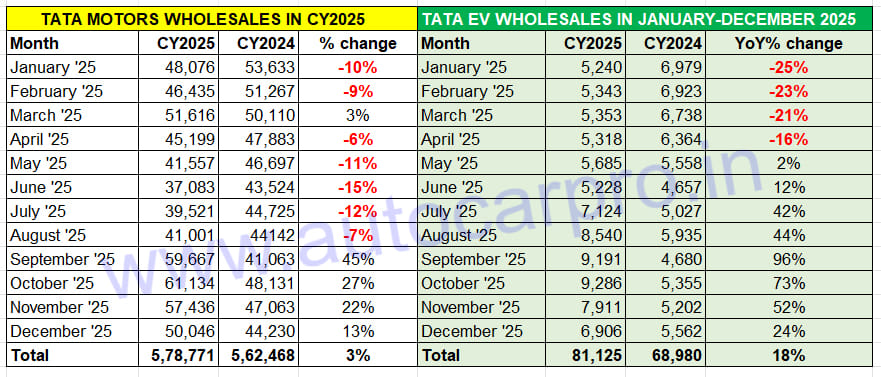

Tata Motors has closed CY2025 with its highest annual sales of passenger vehicles for the fifth year in a row, reflecting its sustained growth since CY2022. Last year, the car and SUV manufacturer dispatched 578,771 passenger vehicles, up 3% YoY (CY2024: 562,468 units). This gives the company No. 3 podium position in the PV market, after Maruti Suzuki (1.80 million units) and Mahindra & Mahindra (625,603 units), and ahead of Hyundai Motor India (571,878 units).

Like Maruti Suzuki and Mahindra & Mahindra, the fourth quarter (October-December 2025) was the best one for Tata Motors. While Q1 (146,1276 units, down 6%) and Q2 (123,839 units, down 10%) saw tepid sales, demand picked up in Q3 (140,189 units, up 8%). Q4 (168,616 units, up 21%), which was driven by GST 2.0-fueled sales, helped the company surpass its CY2024 total. However, with Mahindra & Mahindra selling a record 625,603 SUVs, Tata Motors has lost its No. 2 PV ranking of CY2024 and is ranked third in CY2025, ahead of fourth-ranked Hyundai Motor India (571,878 units) by just 6,893 units.

What continues to benefit Tata Motors, which retails eight passenger vehicles – Altroz, Tigor, Tiago, Nexon, Punch, Harrier, Safari and the Curvv – is that its portfolio covers petrol, diesel, CNG and electric powerplants at multiple price-points, thereby considerably expanding its consumer reach compared to most of its rivals.

While Q1 (-6%) and Q2 (-10%) saw sales decline YoY, Q3 (+8%) and Q4 (+21%) brought demand back for Tata Motors whose sales included record EV retails of 81,125 units, up 18% on CY2024.

While the first half of the year was tepid, demand bounced back in the second half. Q1 (January-March) sales of 146,127 units was down 6% YoY as was Q2 (April-June) at 125,839 was down 10% YoY. However, demand bounced back in Q3 (July-September) with 140,189 units, up 8% YoY and bettered that with 20% growth QoQ and 21% YoY.

October 2025 was a red-letter month for Tata Motors as also for the leading carmakers, what with it being a landmark month as a result of GST reform, Diwali festivity and resurgence of rural market demand. It was a month of fireworks for Tata Motors which reported record monthly wholesales of 61,134 units, up 27% YoY (October 2024: 48,131 units).

The Nexon compact SUV was India’s best-selling car/SUV in October (22,083 units) as well as November (22,434 units). What also helped drive the strong numbers in October was the 15% contribution by its electric vehicle portfolio. At 9,286 units, Tata EV sales in October are the highest monthly score yet for the company and rose 73% YoY (October 2024: 5,355 EVs).

Hitting a New High in EVs but Increased Competition Reduces Market Share

Tata Motors’ accelerated growth over the past three years has been a result of its first-mover advantage in the electric vehicle market, where it once had an over 70% market share albeit that has now fallen to 40% in retail sales (CY2025), mainly due to intense competition from the likes of JSW MG Motor India and Mahindra & Mahindra.

Of the mainstream PV OEMs, Tata Motors continues to have the largest e-PV portfolio in India comprising the Nexon EV, Tiago EV, Tigor EV / Xpres-T (for fleet buyers), Punch EV, Curvv EV and the recently launched Harrier EV.

CY2025’s record 81,125 EV wholesales make for an EV penetration level of 14%, better than the 12% in CY2024 (69,980 EVs / 562,468 PVs) and CY2023 (69,153 EVs / 551,378 PVs). Over the past three years, Tata Motors has sold 220,258 EVs, giving it 13% EV penetration in a total of 1.69 million PVs.

ALSO READ: Electric car and SUV sales hit highest level in CY2025: 176,500 units