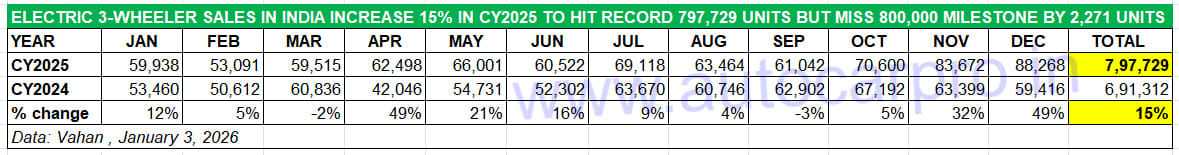

CY2025 turned out to be a repeat of CY2024 . . . a celebration of new sales heights but also a story of so near but yet so far. At 797,729 units, the Indian electric 3W industry registered its best-ever annual sales with 15% YoY growth (CY2024: 691,312 units). As in CY2024, when sales fell short of the 700,000 mark by 8,688 units, CY2025 was even closer to the 800,000 milestone. . . missing it by a whisker: just 2,271 units!

Given that the average monthly sales of Q4 CY2025 was 80,846 units or 2,694 units a day, just one more day would have helped achieve the 800,000 annual retail sales milestone for the first time. Nevertheless, this segment’s stellar performance has ensured that India remains the world’s largest e-3W market for the third year in a row, having beaten China in CY2023 for the first time.

Showing a higher level of maturity than the e-2W and e-PV segments, which have felt the heat of reduced GST on ICE vehicles since September, e-3W sales rose month on month in Q4 CY2025.

As is known, the e-3W segment continues to witness the fastest transition to electric mobility, mainly driven by legacy ICE OEMs which have diversified into zero-emission vehicles. It also displays more resilience than e-2Ws and e-PVs which have been impacted by the GST reduction on ICE rivals. In fact, compared to the e-2Ws and e-PVs, which registered their highest-ever monthly sales in festive October and then saw numbers drop in November and December, the e-3W segment has registered its best monthly retails in December 2025 (88,268 units, up 49% YoY).

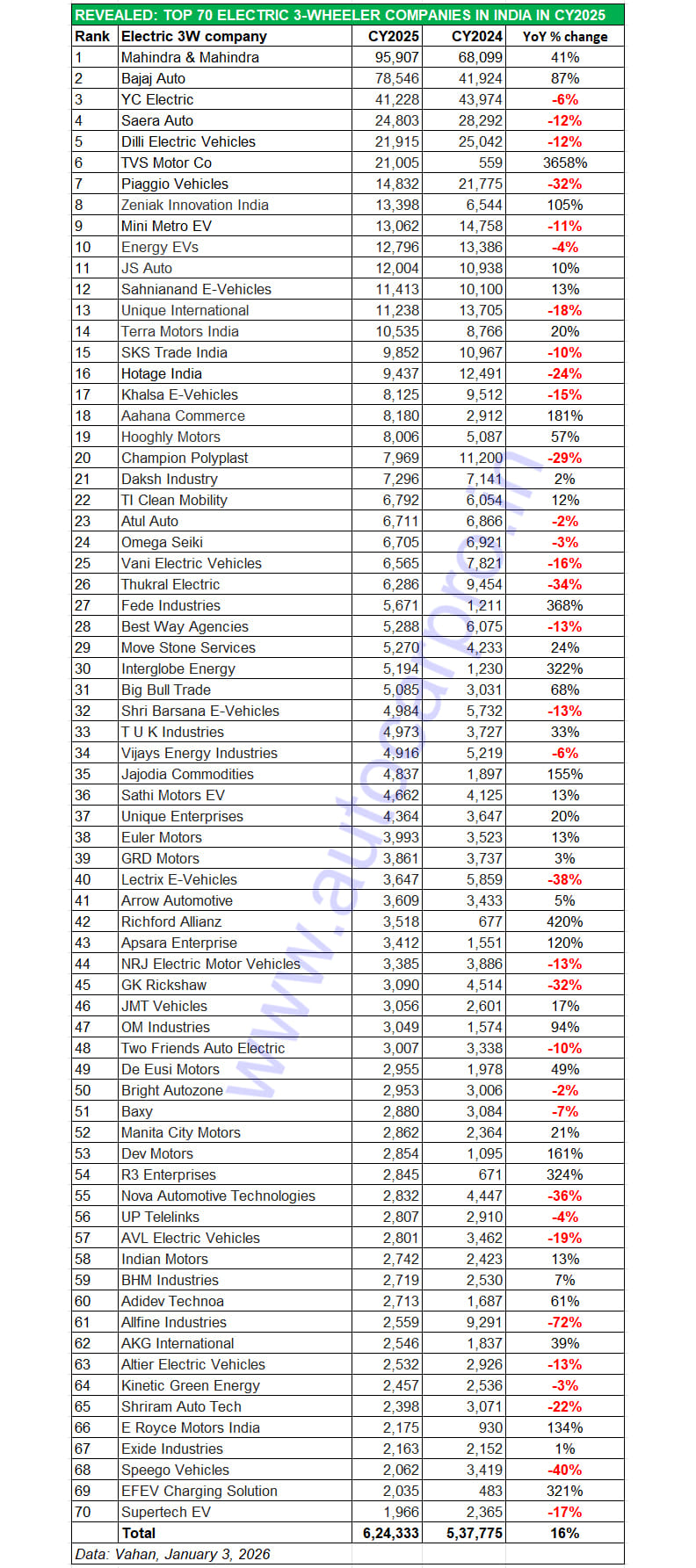

India e-3W Inc’s robust performance is driven by four legacy OEMs – Mahindra & Mahindra, Bajaj Auto, TVS Motor Co and Piaggio Vehicles – along with a few other players from amongst the 700-strong field. They ensured that India e-3W Inc raced past the 700,000 milestone in November itself went on to add record numbers in December.

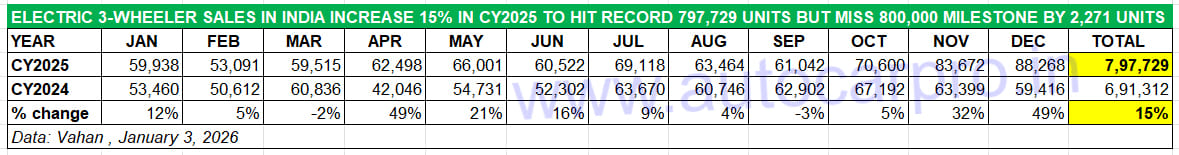

With government incentives and subsidies, electric 3W sales have risen sharply between CY2023 and CY2025, contributing 68% or 2 million of the 3.04 million units sold in the past 10 years.

E-3W SALES CROSS 3 MILLION UNITS OVER A DECADE, LAST 2 MILLION IN 3 YEARS

A deep dive into 10-year retail sales (see data table above) reveals that between CY2016 and CY2025, over 3 million (30 lakh) e-3Ws have been sold in India. Ten years ago, this segment (47,884 e-3Ws from 49,774 EVs) had 96% of the fledgling EV market, with e-2Ws accounting for a 3% share. The two sub-segments’ share of the overall EV market was the closest in CY2021 when 331,724 EVs were sold in India: e-3Ws (158,397 units, 48% share) and e-2Ws (156,327 units, 47% share). CY2022 saw e-2Ws (631,406 units) overtake e-3Ws (350,541 units) as a result of which their market shares changed to 62% and 34% respectively.

Let’s take a closer look at the top seven best-selling e-3W OEMs, who represent 1% of the 700 players in this segment in CY2025, and account for 37% (298,236 units) of the record 797,729 units sold last year.

No. 1 – MAHINDRA LAST MILE MOBILITY

CY2025: 95,907 units, up 41%. Market share: 12%

CY2024: 68,09 units, up 25%. Market share: 10%

CY2023: 54,594 units. Market share: 9%

Market leader Mahindra Last Mile Mobility (MLMM), with a record 95,907 units and strong 41% YoY growth, held onto its crown and saw its e-3W share increase to 12% from 10% in CY2024. In festive October, MLMM sold 11,862 units – its highest monthly sales yet.

As the first legacy OEM to plug into e-mobility nearly a decade ago, Mahindra & Mahindra and MLMM now offer the largest e-3W portfolio, including the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Plus, and e-Alfa Cargo.

No. 2 – BAJAJ AUTO

CY2025: 78,546 units, up 87%. Market share: 10%

CY2024: 41,879 units, up 816% YoY, 6% market share

CY2023: 4,574 units, 0.78% market share

Bajaj Auto, which entered the electric 3W market in mid-CY2023, has increased its market share 10-fold since then. From 4,574 units in CY2023 to 41,879 units in CY2024 and 78,546 units (up 87% YoY) in CY2025, the growth has been rapid and the company’s market share has risen to 10% from 6% in CY2024. Monthly sales crossed the 8,000-unit sales mark for the first time in October and have scaled a new high of 8,766 units in November.

The company, which has the GoGo brand of passenger and cargo e-3Ws, has recently expanded its portfolio with the Riki e-rickshaw. According to the company, early feedback from Riki buyers has been very positive and the company is scaling up production.

MLMM was a good 17,361 units ahead of Bajaj Auto last year but with the Pune-based Bajaj entering the volume segment of e-rickshaws (estimated at 40,000 units a month), the industry could be looking at an exciting battle between the market leader and the challenger in CY2026.

No. 3 – YC ELECTRIC

CY2025: 41,228 units, down 6%. Market share: 5%

CY2024: 43,974 units, up 8%. Market share: 6.36%

CY2023: 40,785 units. Market share: 7%

Despite the advance of M&M and Bajaj Auto, third-ranked and longstanding player YC Electric remains a formidable competitor. In CY2025, the company delivered 41,228 units to customers, down 6% YoY (CY2024: 43,974 units). This decline sees its market share reduce to 5% from 6% in CY2024, and from 7% in CY2023. The company offers five models: Yatri Super, Yatri Deluxe, and Yatri for passenger transport, and E-Loader and Yatri Cart for cargo operations.

No. 4 – SAERA AUTO

CY2025: 24,803 units, down 12%. Market share: 3%

CY2024: 28,294 units, down 4%. Market share: 4%

CY2023: 29,321 units. Market share: 5%

Rajasthan-based Saera Electric Auto, which manufactures the nine-model Mayuri brand of electric rickshaws, ranks fourth amongst the 700 players in this segment. The company sold 24,803 units in CY2025, down 12% YoY (CY2024: 28,294 units). This total is down 3,491 units on the year-ago sales and 4,518 units n CY2023. Like several other e-rickshaw makers, Saera Auto has been impacted by the growing presence of legacy OEMs in the e-3W industry and has seen its e-3W market share reduce to 3% from 5% in CY2023.

No. 5 – DILLI ELECTRIC AUTO

CY2025: 21,915 units, down 12%. Market share: 2.74%

CY2024: 25,042 units, down 0.01%. Market share: 3.62%

CY2023: 25,069 units, up 79%. Market share: 4.29%

The Haryana-based Dilli Electric Auto sold 21,915 units in CY2025, down 12% YoY. This company manufactures electric rickshaws (CityLife brand), a category which is now under pressure as legacy players like MLMM, Bajaj Auto, TI Mobility and TVS target sales with better-built, safer products. The impact of increasing competition in the volume e-rickshaw market can be seen in Dilli Electric Auto’s reducing market share which is 2.74% in CY2025, down from the 4.29% it had two years ago.

No. 6 – TVS MOTOR CO

CY2025: 21,005 units, up 3658%. Market share: 2.63%

CY2024: 559 units. Market share: 0.08%

The No. 6 OEM for CY2025 is TVS Motor Co with 21,005 units, which is an over 3,600 YoY increase on very low year-ago sales of 559 units. TVS, the new electric 2W market leader in CY2025, is the latest legacy ICE player to enter the e-3W market and has seen a good customer response to its King EV Max passenger and King Kargo HD EV models in a competitive market. Retail sales have risen month on month since January and December’s 2,889 units are its best monthly score yet, capping a year which gave it a 2.63% market share with a noteworthy performance.

No. 7 – PIAGGIO VEHICLES

CY2025: 14,832 units, down 32%. Market share: 2%

CY2024: 21,775 units, up 3%. Market share: 3%

CY2023: 21,080 units. Market share: 3.61%

Piaggio Vehicles is ranked seventh on the e-3W ladder board with 14,832 units, down 23% YoY (CY2024: 21,77 units). Last July saw the company launched two new models under its Apé Electrik range — the Apé E-City Ultra and Apé E-City FX Maxx.

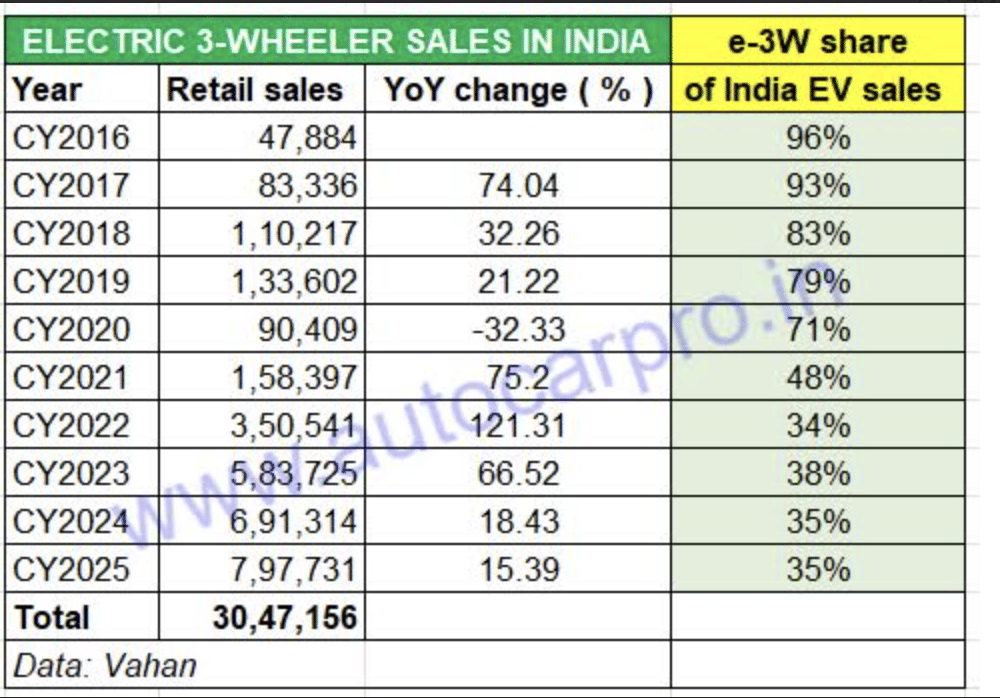

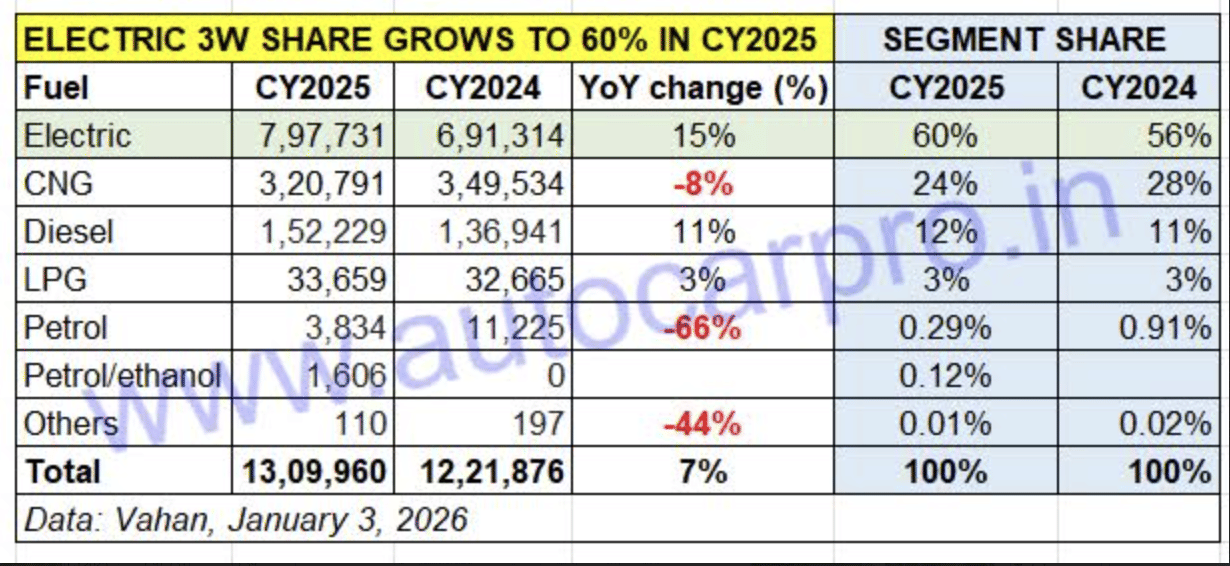

The electric 3W segment’s record retail sales have given the category a 60% market share – an additional 4% – while that of CNG 3Ws has dropped to 25% from 28% a year ago.

E-3Ws EAT INTO CNG SALES BUT WILL WITHDRAWAL OF L5 CATEGORY SUBSIDY IMPACT DEMAND?

The smart growth of India’s e-3W industry, which displays the fastest transition from conventional fuels to electric mobility amongst all vehicle segments, continued to eat into the CNG-powered 3W sub-segment which is the second largest in volume.

As per Vahan data, of the total 1.30 million 3Ws across all powertrains (electric, CNG, diesel, LPG and petrol) sold in India in CY2025 (see fuel-wise sales data table above), electric 3Ws accounted for the bulk of them – 60% – clearly establishing their stranglehold over this vehicle segment. Furthermore, it is also the one to register the highest YoY growth. The 15% YoY growth in sales has given it an additional 4% market share to touch 60%, increasing from the 56% it had in CY2024.

In comparison, CNG three-wheelers have lost exactly the same level of market share that EVs have gained: 4 percent. The 320,791 CNG 3Ws sold were 8% YoY. Among the impediments to better adoption of CNG models have been regular price hikes of this fuel which increase the total cost of vehicle ownership, which is critical in this vehicle category which caters to both passenger and cargo transport. As of today, CNG costs Rs 80.50 per kg in Mumbai (inclusive of State and Central government taxes) versus diesel’s Rs 90.01 per litre and petrol’s Rs 103.54 per litre.

In a highly price- and value-conscious market like India, which have scores of individual-owned 3Ws and a growing number of last-mile mobility fleet operators, the e-3W value proposition is hitting home. When compared to electric 3Ws, CNG loses out on the zero-emission wallet-friendly alternative. EVs offer a much lower running cost per kilometre of around Rs 1.40 per kilometre with a 90-120km range on a full charge. Meanwhile, a CNG 3W has a running cost of around Rs 1.40 per kilometre, which works out to a 140% increase compared to an e-3W.

On December 31, the Ministry of Heavy Industries, officially announced that the “aggressive target set for the e-3W (L5) segment under the PM E-Drive Scheme have been met (288,000 units) ahead of time and the incentivization under the scheme for e-3Ws (L5) has been closed after December 26, 2025. EV penetration within the e-3Ws (L5) segment is now estimated at around 32%, aligning perfectly with the government’s vision to establish a self-sustaining ecosystem.”

Fifteen e-3W OEMs (L5 category) were registered under the Scheme. The L5 category includes both passenger and cargo e-3Ws, powered by motors rated above 0.25 kW and with a top speed of over 25kph.

Meanwhile, the incentive for e-rickshaws/ e-carts and e-2Ws is to continue up to March 31, 2026. At present, e-2Ws have seen sales of 18,40,007 units against a target of 24.79 lakh units.

The subsidy cut for L5 category e-3Ws will reduce the price differential between them and their CNG and ICE rivals which could have an impact, albeit a temporary one, in what is a very price-sensitive market. The long-term lower ownership cost of a zero-emission 3-wheeler versus other fuels should help tide over any short-term sales hiccups and will reflect the growing maturity of this sub-segment of the Indian EV market.

ALSO READ:

Record 1.28 million e-2Ws sold in CY2025, TVS, Bajaj, Ather and Hero clock best-ever retails

Electric car and SUV sales hit highest level in CY2025: 176,500 units