Maharashtra has maintained its numero uno position as the state with the highest demand for zero-emission cars, SUVs and MPVs in India. In CY2025, Maharashtra, which has India’s financial capital Mumbai as its leading buyer of electric passenger vehicles, doubled its new electric vehicle sales year on year.

In CY2025, 30,596 e-passenger vehicles were sold in Maharashtra, up 103% YoY (CY2024: 15,038 units), which gives it a 17% share of the record sales of e-PVs in India last year and improves upon the 15% share the state had in CY2024.

That’s not all. Maharashtra has also retained its title as the No. 1 state in India for retail sales of e-2Ws (216,148, up 3% and a 17% e-2W share) as well as for e-commercial vehicles (3,971 units, up 72% and a 25% e-CV share). However, it is ranked 10th in e-3W sales (15,792 units, up 10%, and a 2% e-3W share) after Uttar Pradesh.

In terms of overall EV sales for all four sub-segments in CY2025, Maharashtra accounted for 266,524 units. This gives it a 12% share and the No. 2 rank in India, after Uttar Pradesh which tops the all-India EV market (404,908 EVs) because of its huge dominance over the e-3W market.

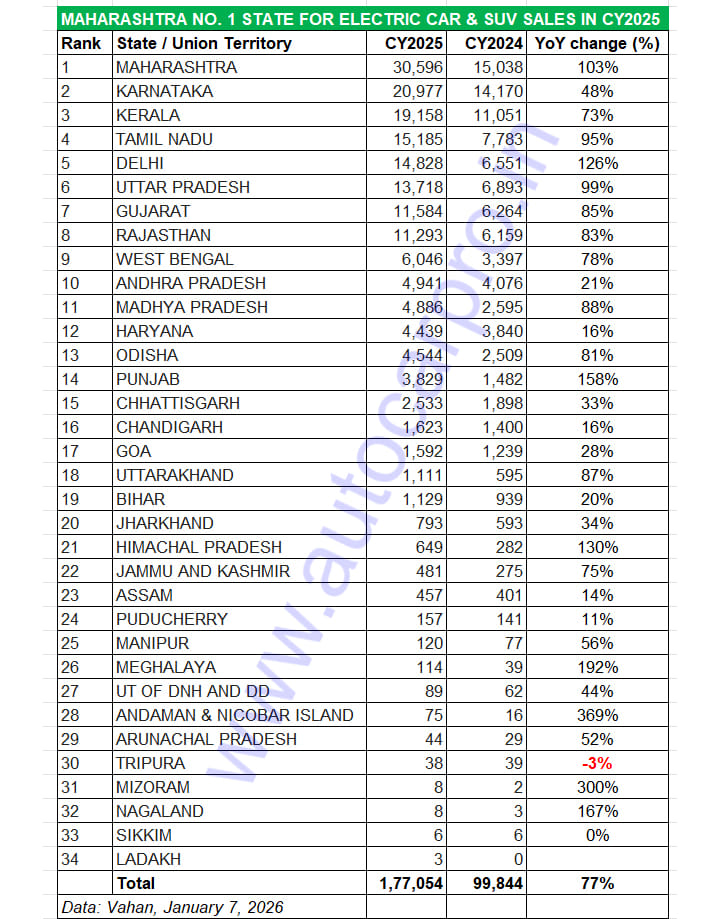

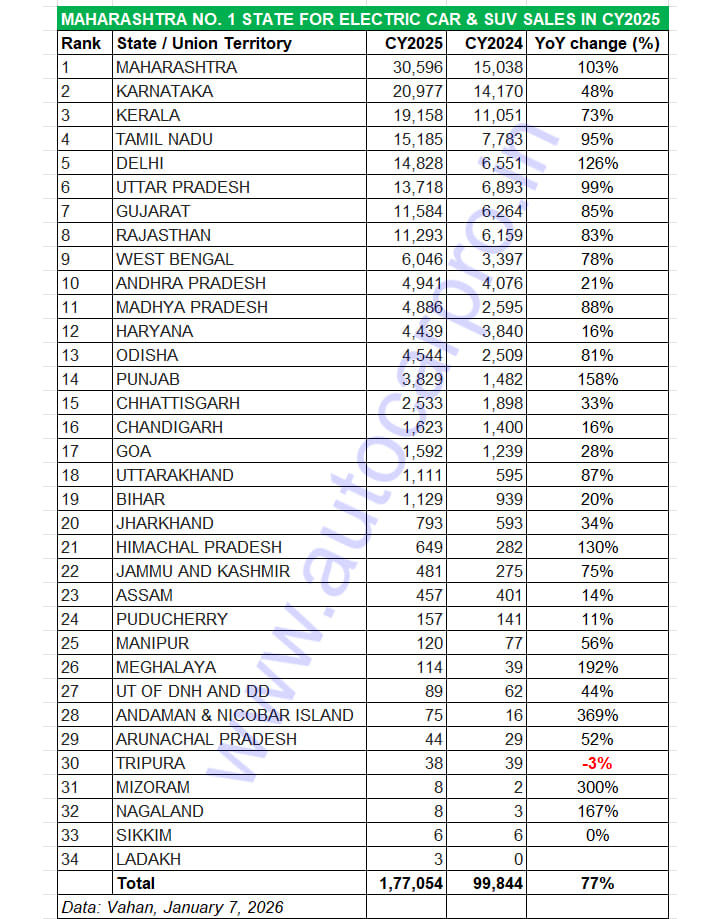

As per retail sales data on the Vahan portal (as of January 7, 2026), a total of 177,054 electric cars, SUV and MPVs were sold across India (barring Telangana for which the data is not available) in CY2025. This constitutes strong 77% YoY growth (CY2024: 99,844 units) with most of the leading e-PV manufacturers posting handsome YoY increases.

Top 7 States and Delhi Account for 77% of Retail Sales

Of the states / UTs covered by Vahan, Tripura is the only one to see a YoY decline in sales: 38 units, down 3% YoY. All the others, barring a couple, have registered high double-digit growth (see detailed Vahan-sourced State / UT sales table below).

A closer look at the data reveals that the top seven states for e-PV sales (Maharashtra, Karnataka, Kerala, Tamil Nadu, Uttar Pradesh, Gujarat and Rajasthan) along with Delhi (ranked No. 5) sold over 11,000 units each and together accounted for 137,339 units, which makes for a 77% share of the total e-PV sales in India in CY2025. West Bengal (6,046 units) and Andhra Pradesh (4,941 units) are ranked ninth and 10th respectively.

After Maharashtra, three southern states – Karnataka, Kerala and Tamil Nadu – command the next three ranks. However, with Maharashtra doubling its sales, the state has eaten into the market shares of other states. While Karnataka, ranked No. 2 state (20,977 units, up 48%), has seen its e-PV share decrease to 12% from 14% in CY2024. Kerala (19,158 units, up 73%) has maintained its 11% share, and Tamil Nadu (15,185 units, up 95%) sees its e-PV share increase to 9% from 8% in CY2024.

Delhi (14,828 units, up 126%, 8% share) is ranked fifth and is followed by Uttar Pradesh (13,718 units, up 99%, 7% share), Gujarat (11,584 units, up 85%, 6.5% share), Rajasthan (11,293 units, up 83%, 6% share), West Bengal (6,046 units, up 78%, 3% share) and Andhra Pradesh (4,941 units, up 21%. 2.79% share).

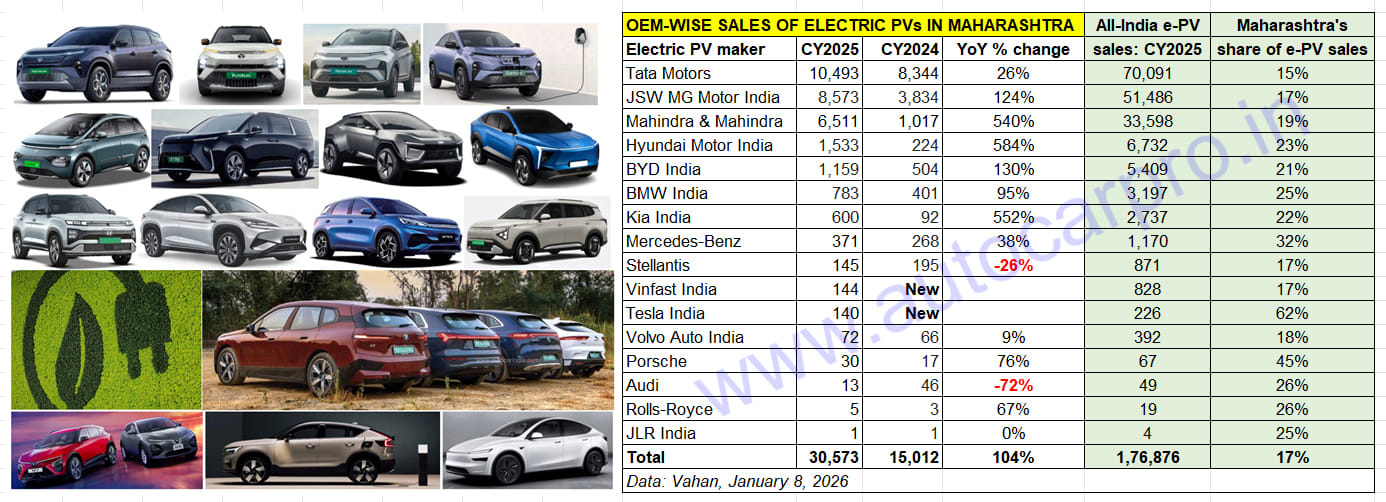

In CY2025, Tata Motors, JSW MG Motor and Mahindra sold 25,577 e-PVs in Maharashtra which accounted for a 17% share of the record 176,876 e-PVs sold in India.

In CY2025, Tata Motors, JSW MG Motor and Mahindra sold 25,577 e-PVs in Maharashtra which accounted for a 17% share of the record 176,876 e-PVs sold in India.

Revealed: How Maharashtra Stacks Up for 16 Electric Car and SUV OEMs

A deeper dive into state-wise retail sales splits reveals the growing importance of Maharashtra as a sales region for the 16 manufacturers of electric passenger vehicles in India. Market leader Tata Motors sold 15% (10,493 units, up 26%) of its record 70,091 e-PVs in CY2025 in the state. JSW MG Motor India, with 8,573 units and handsome 124% YoY growth, saw the state’s share at 17% of its highest-ever e-PV sales of 51,486 units. Mahindra & Mahindra, which is riding high on demand for its BE 6 and XEV 9e SUVs, delivered 6,511 units in Maharashtra, a 540% YoY jump and 19% of its all-India sales of 33,598 e-SUVs. These top three OEMs’ combined sales of 25,577 units in Maharashtra, up 94% YoY (CY2024: 13,195 units) clearly reflects the strategic importance of the state.

It’s the same scenario for nearly all the other 13 players. The comprehensive data table above reveals that Hyundai Motor India sold 1,533 units of its e-SUVs, mostly the Creta EV, in the state. Meanwhile, BYD India sold 1,159 units (21%) of its 5,409 e-PVs in Maharashtra.

Maharashtra also delivered strong sales for the two new EV makers which entered the India market last year: Tesla and Vinfast. Tesla sold 140 units of its Model Y priced at Rs 60 lakh in Maharashtra, which accounted for 62% of its total sales of 226 Model Ys in India. And Vinfast India saw sales of 144 units of its two e-SUVs – VF6 and VF7 – in the state, which is 17% of its all-India sales of 828 units last year.

For the eight luxury carmakers, Maharashtra remains a key growth driver. In CY2025, EV buyers in the state took delivery of 1,415 luxury cars, SUVs and MPVs, up 76% YoY (CY2024: 802 units). This constitutes 28% of over one-fourth of the all-India sales of 5,124 e-PVs last year.

Given the growing intensity of the competition in the electric passenger vehicle market, particularly amongst the top three OEMs (Tata Motors, JSW MG Motor India, Mahindra & Mahindra), and over 10 new electric passenger vehicles to be launched in CY2026 starting with the Maruti Suzuki e-Vitara, this state- and UT-wise EV sales performance data offers clues aplenty as to just where the consumer demand is currently emanating from as well as the regions which have potential to grow rapidly.

ALSO READ: EV sales in India hit record 2.27 million in CY2025, all 4 segments scale new highs