India’s automobile sector is entering a new upcycle, with passenger vehicles expected to lead the recovery while two-wheelers see a more muted improvement, according to BNP Paribas. The financial services firm said recent GST reductions have emerged as a key catalyst after a prolonged period of weak demand, improving affordability and triggering a revival in volumes across segments during the festive season.

Ahead of the GST revision, demand across passenger vehicles, two-wheelers and commercial vehicles had remained subdued, weighed down by elevated ownership costs, tighter financing conditions and weak consumer sentiment. BNP Paribas said the combination of lower on-road prices following the tax cut and the timing of the festive period has now provided a meaningful boost to demand.

“From 2026 onwards, we see passenger vehicle OEMs to be better placed,” BNP Paribas said, adding that incremental volumes from GST-led price reductions, better operating leverage and lower discounting are likely to drive margin expansion across major manufacturers. The firm expects industry capacity utilisation to improve from around 70% in FY25 to about 75% by FY28, noting that planned capacity additions by OEMs should be sufficient to meet the anticipated rise in demand.

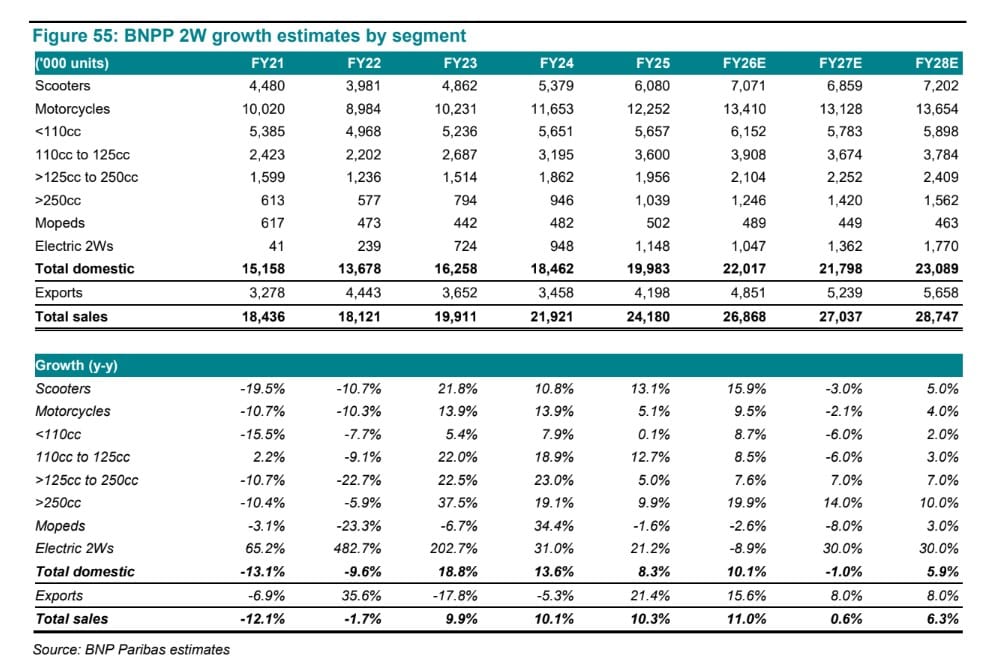

However, BNP Paribas has taken a more cautious stance on two-wheelers. While demand has improved in the near term, the firm said the benefits of the GST cut are likely to be largely offset by higher costs stemming from the mandatory implementation of anti-lock braking systems (ABS) on sub-125cc scooters and motorcycles, limiting the scope for a sustained volume upcycle.

Passenger Vehicles: Start of the Next Upcycle

The financial services firm expects passenger vehicles to see the stronger medium-term uplift, supported by improved price elasticity following the GST cut. According to BNP Paribas, lower prices are already driving a revival in demand, particularly in small cars and compact utility vehicles.

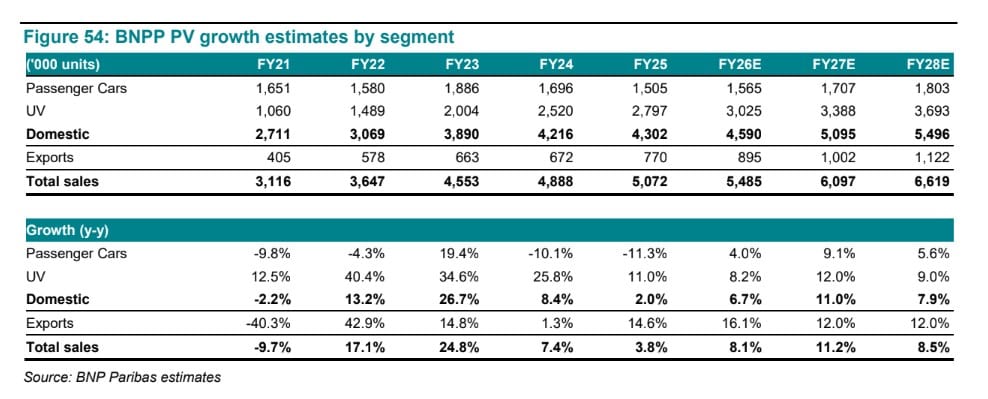

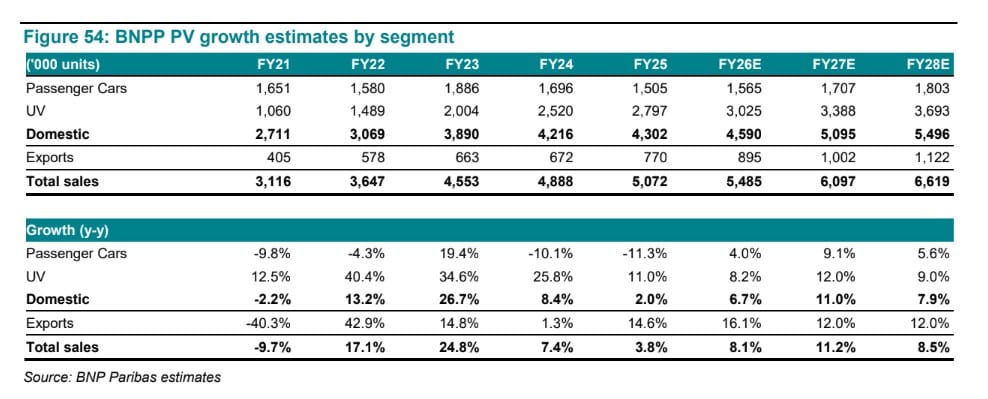

While passenger vehicle volumes in the early part of FY26 had been largely flat, trends turned positive after implementation of GST 2.0 during the festive season. The firm expects domestic PV industry volumes to grow by 8-10% in FY27-28.

Kumar Rakesh, Associate Director at BNP Paribas covering the India technology and automobile sectors, said recent data is already showing a divergence between passenger vehicles and two-wheelers. “If you look at December numbers, two-wheeler growth was around 10%, while passenger vehicles grew closer to 25%,” he said, adding that while such a gap may not be sustainable, it highlights the underlying outperformance of PVs.

Kumar Rakesh, Associate Director at BNP Paribas covering the India technology and automobile sectors, said recent data is already showing a divergence between passenger vehicles and two-wheelers. “If you look at December numbers, two-wheeler growth was around 10%, while passenger vehicles grew closer to 25%,” he said, adding that while such a gap may not be sustainable, it highlights the underlying outperformance of PVs.

Rakesh attributed this to pent-up demand in passenger vehicles following a prolonged slowdown. “The PV industry was in a severe slowdown for almost two years. Purchases were postponed and demand got pushed out. In contrast, two-wheelers were relatively resilient during that period,” he said. As a result, the affordability kicker from lower prices is having a much greater impact on passenger vehicles than on two-wheelers, where the base is already high.

Two-Wheelers: Structural Constraints Limit Upside

In contrast, BNP Paribas sees limited medium-term upside for the two-wheeler industry. Rakesh said that while the segment is closer to crossing pre-pandemic volume levels, this does not necessarily signal the start of a strong new growth cycle.

“What often gets missed is that two-wheeler prices have gone up 30-40% since 2018-19,” he said. “In value terms, the industry is already significantly larger than it was earlier, but the capacity to absorb further price increases is among the lowest across auto segments.”

“What often gets missed is that two-wheeler prices have gone up 30-40% since 2018-19,” he said. “In value terms, the industry is already significantly larger than it was earlier, but the capacity to absorb further price increases is among the lowest across auto segments.”

The brokerage also flagged high penetration as a structural constraint. India already has roughly 300 million two-wheelers on the road, broadly in line with the number of households, with multiple ownership common. Rakesh estimates current penetration at around 55%, with limited headroom beyond 65-70% before the market plateaus.

“Two-wheelers are not a final aspirational product. As incomes rise, consumers eventually want to upgrade to cars,” he said. Given the long lifespan of two-wheelers–often close to 20 years–replacement demand remains limited, capping annual volume growth even as the vehicle park size expands. These factors, combined with the cost impact of ABS norms, explain BNP Paribas’ relatively cautious outlook for the segment compared with passenger vehicles.

Top Picks: Maruti Suzuki India and Mahindra & Mahindra

BNP Paribas identified Maruti Suzuki and Mahindra & Mahindra as its top picks within the PV space, citing improving demand visibility and scope for margin expansion.

For Maruti Suzuki, the financial services firm highlighted a strong export outlook driven by market diversification and export-oriented products, alongside a revival in small-car demand following the GST cut. BNP Paribas expects the company’s revenues to begin reflecting the full benefit of the tax reduction from the third quarter of FY26, supported by higher volumes and improved operating leverage.

Addressing regulatory risks such as tighter emission and fuel efficiency norms, Rakesh said Maruti’s multi-powertrain strategy provides a buffer. “CNG is already a big pillar for them, and later this year we should see their own series hybrid coming in. That should help improve fuel efficiency and keep emissions largely under control,” he said.

Mahindra & Mahindra, meanwhile, has been delivering consistently on both volume growth and margin expansion, particularly in utility vehicles. BNP Paribas expects this momentum to continue, aided by new launches in CY26 and a recovery in tractor demand.

While regulatory changes pose a greater challenge for Mahindra, Rakesh said the company’s improving EV economics reduce the risk to profitability. “Their EV profitability has improved quarter after quarter. By FY28, they are targeting per-car profitability in absolute terms to match ICE vehicles, excluding PLI benefits,” he said. If achieved, this would make the powertrain mix less critical to margins.

Rakesh also pointed to Mahindra’s execution capabilities, citing the launch of the XUV 3XO as an example of scale-driven margin improvement despite lower price points. “They leveraged common content across models and renegotiated supplier contracts. The same approach is being applied to EVs through localisation and cost optimisation,” he said.

According to BNP Paribas, the key risk for Mahindra lies not in regulation but in execution–specifically, whether market acceptance of new EV models can be sustained as competition intensifies.

Overall, the brokerage believes the Indian auto industry is transitioning into a more favourable phase, with passenger vehicles emerging as the primary beneficiary of GST-led affordability and pent-up demand, even as structural factors keep two-wheeler growth in check.