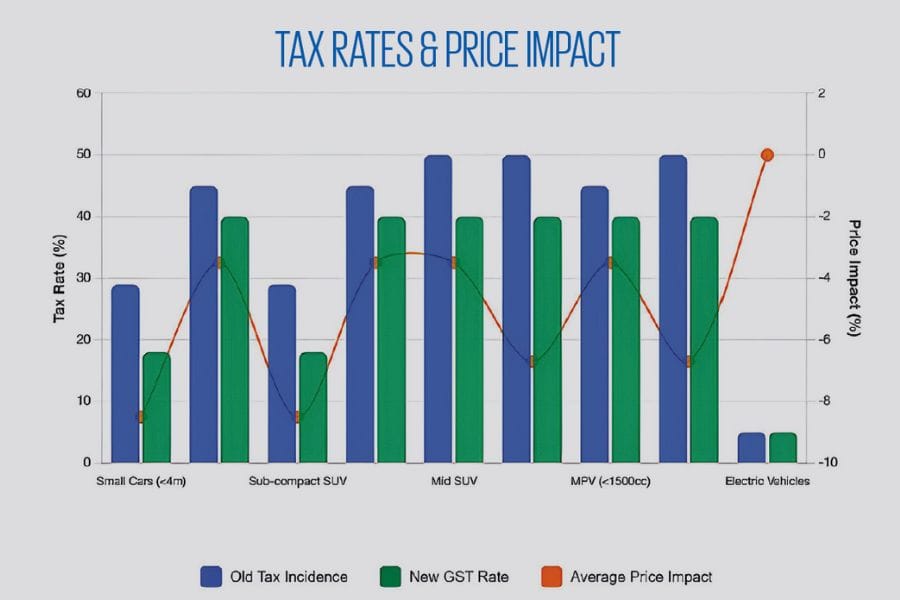

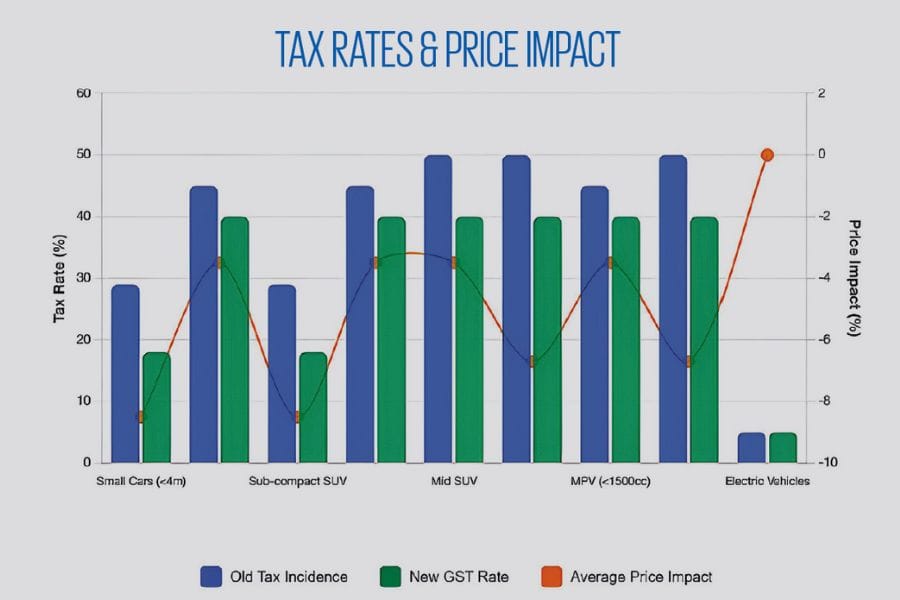

India’s passenger-vehicle (PV) market is steering through a crucial structural shift. With the rollout of GST 2.0, the automobile industry witnessed one of its most significant tax resets since 2017. The new regime, with three clear slabs of 5%, 18%, and 40%, replaces the earlier matrix of 28% GST plus varying cess (1–22%). This reform brings long-awaited simplicity and direction.

Small cars (petrol ≤1,200 cc or diesel ≤1,500 cc and length ≤4 meters), which were once taxed at 29%, now fall under 18% GST, while larger cars and SUVs are now taxed at 40% from 45% or 50%. Electric vehicles continue to enjoy the 5% concessional rate. Equally important, all auto components now attract 18% GST (down from 28% for a few earlier), reducing input costs and improving aftermarket affordability.

According to CRISIL Intelligence, this recalibration lowers ex-showroom prices by approximately 8.5% for small cars and sub-compact SUVs, 3.5% for mid SUVs, and 6.7% for large SUVs and MPVs. The expected result is a mild volume recovery in FY26, led by compact formats and efficiency-driven models.

Quarter Two Pause, Year-End Promise

Overall, the macro-scenario is positive, where India’s GDP growth for fiscal 2026 is projected at 6.5%. The projected headline inflation is also at 3.2% for fiscal 2026. The lower inflation gives space for another possible rate cut of 25 bps this year. Low inflation, rate cuts, income tax relief, along with healthy agricultural growth, will boost consumption and increase discretionary spending.

While GST 2.0 offers a long-term tailwind, its introduction mid-fiscal caused a temporary demand deferral in Q2 FY26. Buyers postponed purchases in anticipation of price cuts, waiting till the new tax rates came into effect. This explains why several segments — notably entry hatchbacks, compact sedans, and mid SUVs — recorded sequential drops in Q2.

The volumes are expected to normalize in Q3 FY26 due to the pent-up demand, GST price drop and festivals. This momentum is expected to continue in Q4 FY26 as well, with total PV volumes expected to rise from 4.31 million units in FY25 to 4.4–4.6 million units in FY26.

SEGMENT-WISE ANALYSIS: WINNERS AND LAGGARDS

Entry & Mid Hatchback

This price-sensitive category has regained momentum from GST 2.0-led price reductions, with effective tax incidence down from ~29% to 18%. Ex-showroom prices of small hatchbacks such as the Alto K10, Tiago, and Celerio fell by Rs 40,000– Rs 70,000, supporting affordability in the rural areas. This improved affordability will not only encourage first-time buyers but will also increase the upshift from 2W/ pre-owned cars to small cars segment.

This segment has witnessed a continuous decline in overall growth for the last 2 years due to low OEM focus, price hikes and threat from pre-owned cars. However, projected FY26 trends show some recovery from a lower base. Due to deferment of purchases in Q2 FY26, the purchase volumes in that quarter remained low. Mild recovery is expected in Q3–Q4 FY26, driven by GST reform, festive season and positive rural sentiments. Overall, the segment’s revival is expected to remain gradual, anchored more towards the rural sentiments.

Premium Hatchback Segment

Premium hatchbacks like Baleno, I20 also get benefitted from GST 2.0, where the GST has reduced from 29% to 18%.This segment has also witnessed two years of continuous double-digit decline due to cannibalization from the micro-SUV segment and limited OEM focus. Due to mid-year purchase deferrals in FY26 and cannibalization from Compact SUVs, Q1 and Q2 volumes for FY26 have underperformed as compared to FY25.

However, traction for this segment has slightly improved post GST rate-cut. The last two quarters of fiscal 2026 are expected to show mild improvement. Despite its fiscal gain, the segment gains only limited traction and continues to lose aspirational appeal and now the price differential with the next segment has also shrunk—a structural challenge that cannot be solved by tax reform.

Compact Sedan Segment

Compact sedans such as the Dzire, Amaze, and Tigor benefited fully from the 18% GST slab, leading to 8.5% price corrections post-reform. The segment has continued demand traction primarily due to commercial usage. The first half of fiscal 2026 showed 23% YoY growth, off the lower base. The trajectory is expected to improve further in Q3–Q4 FY26.Fleet replacement and urban entry buyers would be driving this growth.

Mid & Premium Sedan Segment

Mid-sized and premium sedans like City, Verna, Slavia face 40% tax after GST 2.0. The segment’s momentum continues to remain sluggish for 2 years with no OEM focus and limited product launches and shifting consumer preference towards SUVs. The segment showed 22% YoY drop in H1 of fiscal 2026. CRISIL expects the volume for fiscal 2026 to decline. High taxation, limited differentiation, and migration to SUVs keep it under sustained pressure.

Compact SUV Segment

Compact SUVs continue to be the standout winners of the post-GST environment. The 18% slab on sub-4m, ≤1200cc petrol, ≤1500cc diesel models give a strong edge over mid- SUVs taxed at 40%. ~3% price reduction for compact SUVs and ~9% price reduction for sub-compact SUVs due to GST 2.0, is expected to contribute to the growth of this segment. The segment has witnessed 5% YoY drop in H1 of fiscal 2026 from a high base.

The volumes are expected to improve in Q3 and Q4 of FY 2026 showing marginal improvement. Consumer preference for SUV styling, coupled with affordability restored by GST 2.0, has ensured that compact SUVs remain the largest and most resilient segment of PVs. OEM activity remains intense in this segment, with upcoming EV variants reinforcing momentum.

Mid SUV Segment

Mid-SUVs (Creta, Seltos, Elevate, Grand Vitara) is also one of the segments providing thrust to the passenger vehicle industry in India. There is continued traction for popular models and the GST-led price reduction of ~3% (from 45% to 40% in GST 2.0) is providing added affordability for this segment. FY26 volumes are expected to sustain the category’s position as the aspirational mid-market backbone.

Premium SUV Segment

The GST for Premium SUVs has reduced from 50% to 40% leading to ~7% reduction in the ex-showroom prices. Premiumization from Mid SUVs is expected to provide an additional push. H1 volumes for fiscal 2026 were up 15% YoY and Q3–Q4 FY26 is projected to deliver a strong growth supported by sustained demand. FY26 is expected to witness the uptrend keeping this as the strongest performer in higherend PV segments.

MPV & Vans Segment

The MPVs and Vans segment including the likes of Ertiga, Carens and Innova Hycross is one of the primary drivers of the passenger vehicle industry. The segment remained stable, posting steady sales in H1 of fiscal 2026. The segment showed steady sales in H1 of fiscal 2026.

In H2, it is expected to benefit from diversified taxation within GST 2.0 – MPVs with <1500cc have witnessed ~3% price drop whereas MPVs >1500cc have witnessed ~7% price drop. In FY26, Q3–Q4 are projected to inch up sequentially. The volumes for fiscal 2026 is expected to show marginal growth on a high base of last year.

Electric Vehicles (EVs)

EVs remain shielded from GST changes and continue to be taxed at 5%. Currently their growth path is policy-driven rather than tax-driven. FY25 closed with EV penetration of 2.7%, and FY26 is inching towards a 4.5–5.0% penetration, supported by new model launches and price reduction.

Cross-Segment Insights: FY26 at a Glance

- Q1–Q2 softens, Q3–Q4 to catch-up: Across most segments, early FY26 volumes lag FY25 levels. It is expected that recovery builds from Q3 onward, especially in hatchbacks segment, owing to GST 2.0.

- GST 2.0 tailwind sustained: Price benefits realized due to GST 2.0 is expected to prevent further declines in demand for the entry-level segment.

- Hybrid and EV shift: OEM product strategies are increasingly including hybrids; EV launches expected to offset higher 40% GST in large car segments.

- Steady growth: Total PV volumes are projected at 4.4–4.6 million units in FY26 (+3–4% YoY), indicating a soft but steady uptrend.

Outlook

FY26 marks the beginning year of GST 2.0 implementation. It has led to simpler taxation, component cost rationalization, and increased affordability. Smaller cars and SUVs will lead industry growth, while premium sedans are expected to continue to contract. EV adoption is expected to steadily scale up going forward.

We expect GST 2.0 to also aid growth beyond FY26 on account of price elasticity. We estimate a 0.5-1% CAGR impact on growth as compared to earlier on account of GST which means that the passenger vehicles industry would possibly grow at a CAGR of 4.5-6.5% over the next five years.

Hemal Thakkar is Senior Practice Leader and Director, and Arpita Mathur is Associate Director, Mobility, Crisil Intelligence.