India’s auto component industry slipped back into a trade deficit during the first half of financial year 2026 after new tariffs imposed by the US restricted export growth to the region, while component imports from China rose sharply amid restrictions on the export of key raw materials.

According to data shared by the Auto Component Manufacturers Association (ACMA), the auto component industry clocked US$41.2 billion in revenue during April–September 2025, a growth of 3.5% year-on-year.

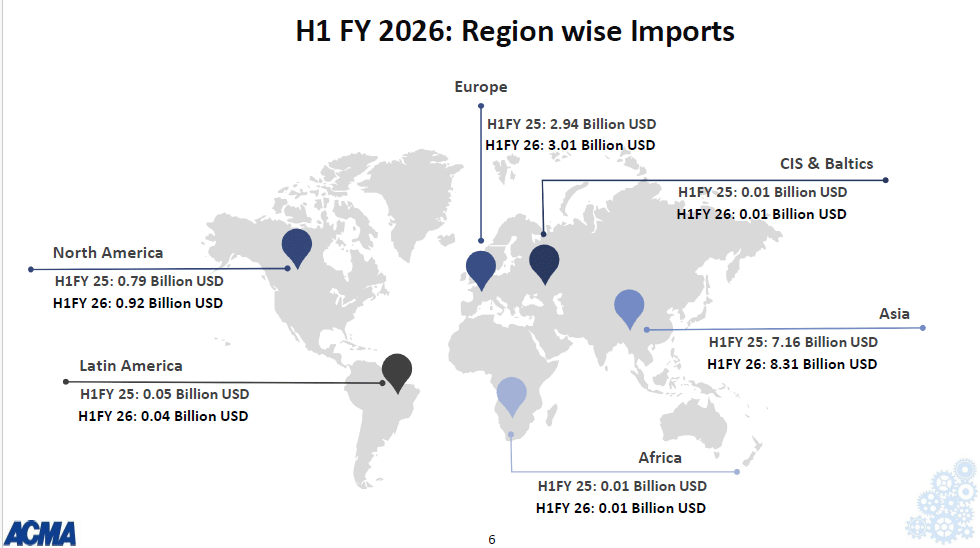

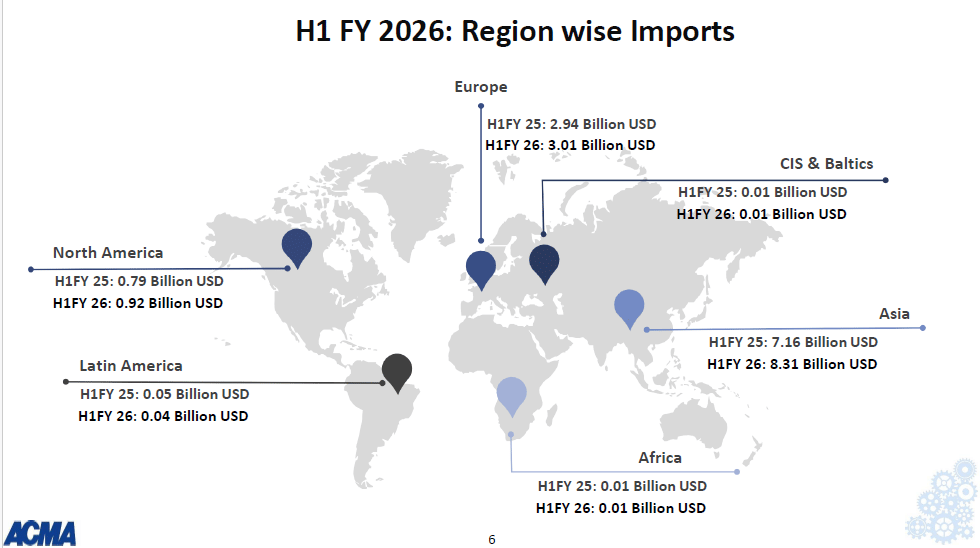

Component exports during the period rose 9.3% to US$12.1 billion, while the value of components imported into India rose at a faster rate of 12.5% to US$12.3 billion. The higher growth of imports has thus resulted in a trade deficit of around US$200 million.

“All are aware of the headwind that we have in exports. Yet, exports did well. But this time, there has been a bad trade deficit compared to the trade surplus that we had last year,” said ACMA Director General Vinnie Mehta.

The industry recorded a trade surplus of US$150 million in the year-ago period (first half of FY25). For the full financial year 2025, the trade surplus stood at US$453 million.

While exports to all major regions, including Europe, Africa and Asia, recorded robust growth, exports to the North American market remained almost flat at US$3.67 billion. This reflected pressure from the additional tariffs imposed on Indian exports by the US.

“I must qualify here that in the first six months, supplies to the US have remained the same. It’s been very steady. And that’s because the impact of Trump tariffs would be felt more in the second half than in the first half,” he added.

While exports to North America came down marginally by US$30 million, imports from the Asia region rose significantly by US$1.1 billion. Data shows that India’s component exports to the US were at US$3.12 billion in April–September 2025, compared to US$3.10 billion in the year-ago period. Imports from China, on the other hand, rose to US$4.05 billion from US$3.27 billion.

Auto components shipped from India to the US are now charged a flat 25% tariff. About 55% of India’s auto component exports to the US, mainly car parts, were covered under Section 232 tariffs, while commercial vehicle and off-highway parts were hit by additional reciprocal tariffs that pushed duties as high as 50% in some cases.

A clarification issued on November 1 rolled these higher rates back, bringing all these categories under a single 25% tariff, which is now applied uniformly to Indian auto component exports to the US.

ACMA President Vikrampati Singhania noted that new contracts from the US are in limbo even as existing supply chains continue.

“Tariffs imposed by the US on much of the world, including India, have led to a lot of hesitation among companies in the US and the NAFTA region to source new projects from companies in India. While immediate trade may not take a very big hit, the numbers you saw [exports to North America] were relatively flat, but there was 10% growth in the rest of the world,” he added.

ACMA officials noted that some countries have managed to secure more favourable rates even under the Section 232 tariff regime, leaving India at a clear disadvantage when competing in those markets.

Even a 10 percentage point gap in tariffs can significantly alter trade flows, as margins in the auto component business are thin and companies find it difficult to absorb such price differences, said Sriram Viji, ACMA president-designate.

“So, unless we see either some resolution on this front, or at least stability and clarity on where things are going, I think there will be some challenges going forward with respect to trade, specifically with respect to the US. Other markets are reviving. Europe is doing slightly better this financial year, so I think we are seeing some positive demand on exports there,” he added.