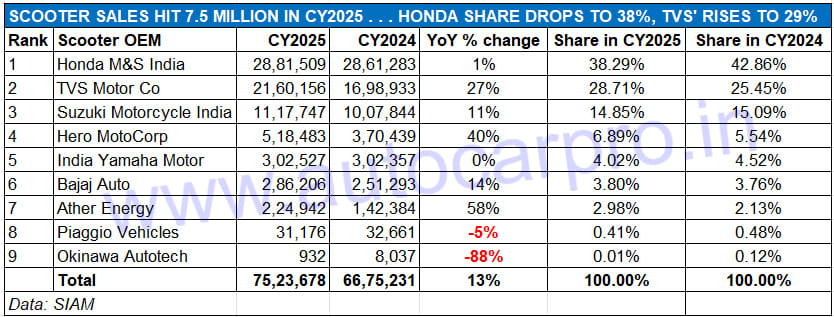

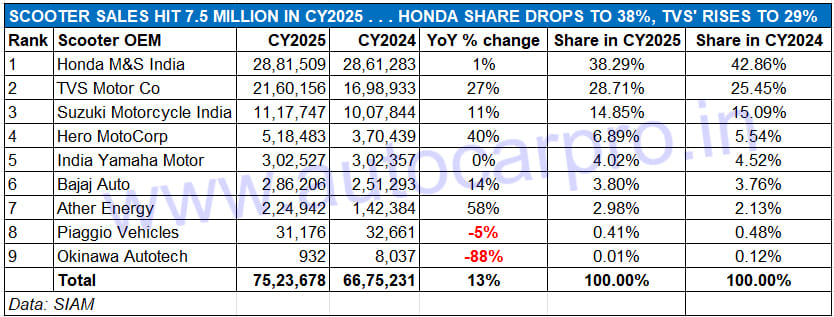

CY2025 turned out to be the year of scooters when it comes to the Indian two-wheeler industry. At a record 7.5 million units (75,23,678 units, up 13% YoY), annual scooter sales rode past the seven-million milestone for the first time and also helped the overall 2W industry achieve the 20-million-units milestone after seven years.

The scooter industry’s stellar performance in CY2025 saw it achieve its highest level of penetration in the overall two-wheeler market which comprises motorcycles, scooters and mopeds. In CY2025, the scooter share rose to 37%, further improving upon the 34% it had in CY2024. In comparison, the larger-volume motorcycle segment (12.48 million units, up 1.1%) had a 61% share of the 2W market last year (down from the 63% in CY2024) and mopeds (493,971 units, 2.40% share of 2W market).

Suffice it to say that had it not been for the robust scooter sales in CY2025, overall 2W sales would not have crossed the 20-million mark (2,05,00,639 units) after seven years.

A deep dive into the nine SIAM scooter-OEM member companies’ performance in CY2025 registers key takeaways. While two scooter makers saw their sales decline YoY, one witnessed flat sales and five registered double-digit growth.

Honda, TVS Motor and Suzuki with 6.15 million units accounted for 82% of the record scooter sales of 7.52 million. The e-scooter (969,439 units) share rose to 13% compared to 10% in CY2024.

Honda Motorcycle & Scooter India, the longstanding scooter market leader whose portfolio comprises the IC-engined Activa 110 and 125, Dio 110 and 125, along with the Activa-e and QC1 electric scooters launched last year, sold 2.88 million scooters last year, up 1% YoY (CY2024: 2.86 million units). This translates into the addition of just 20,226 units over 12 months. October 2025 (362,891 units, up 21% YoY) was HMSI’s best month – an additional 62,906 units sold YoY and a monthly scooter share of 44% as a result of GST 2.0-fueled price cuts.

While HMSI still holds the reins of the scooter market as a result of India’s best-selling model Activa’s huge dominance, the company’s slower rate of growth than in previous years means that it has shed market share. In CY2025, Honda’s scooter market share fell to 38% from 43% in CY2024. That’s a substantial share for India’s No. 1 scooter OEM.

TVS Motor Co, whose ICE portfolio (Jupiter, NTorq and Zest) and EVs (iQube and Orbiter) sold a record 2.18 million scooters, a jump of 27% YoY (CY2024: 1.69 million units), surpassing the 2-million annual milestone for the first time. This constitutes an additional 461,223 additional scooters YoY which has given the company a boost in market share. The sales gap between Honda and TVS, although still considerable, at 721,353 units in CY2025, has reduced from the 11,62,350 units in CY2024.

TVS exited CY2025 with a scooter market share of 29%, up four percentage points on CY2024’s 25 percent. What has helped TVS is the strong growth in its e-2W sales, estimated at 328,323 units, up 35% YoY (CY2024: 243,640 iQubes). This gives TVS an EV penetration level of 15% last year compared to 14% in CY2024. TVS Motor Co was the No. 1 electric 2W OEM in India in retail sales last year, one of the criteria that won Sudarshan Venu, chairman and MD, TVS Motor Co, the accolade of Autocar Professional’s Person of the Year 2025.

Suzuki Motorcycle India, which has entered the e-2W market with the premium e-Access scooter in January 2026, registered total sales of 1.17 million units in CY2025. This marks 11% YoY growth (CY2024: 1 million units) and sees the two-wheeler arm of the Japanese major maintain its scooter market share at 15 percent. While the Access 125 remains its best-selling product, what helps Suzuki is that its two other scooters – Avenis and Burgman Street – are also powered by the same 125cc engine and are benefiting from the consumer upgrade to the 125cc segment.

Hero MotoCorp, the motorcycle market leader, is ranked fourth in the scooter segment with 518,483 units, up 40% YoY (CY2024: 370,439 units). This strong growth sees its market share increase to 7% from 5.54% a year ago. Hero’s ICE scooter range comprises the 110cc Pleasure and Xoom, 125cc Destini/Destini Prime and the 156cc Xoom 160. The company has received a growth accelerator through its e-scooter sales, particularly the new V2X. Hero Vida dispatches of 123,815 units were up 184% YoY (CY2024: 43,660 units) including a few units of the Dirt.E K3 e-motorcycle launched in early December.

India Yamaha Motor, with 302,527 units, witnessed flat sales last year (CY2024: 302,357 units), which results in its scooter market share reducing marginally to 4.02% from 4.52% a year ago. The company sells the 125cc-engined Alpha, Fascino and Ray ZR along with the 155cc Aerox scooter in the Indian market.

Bajaj Auto, which is in the scooter market because of its Chetak and Yulu electric scooters, sold a total of 286,206 units, up 14% YoY (CY2024: 251,293 units). While Bajaj’s No. 6 OEM ranking remains unchanged, its market share has risen by a minuscule level to 3.80% from 3.76% a year ago. The company, which launched the new Chetak C25 model on January 14, 2026, would have logged in higher wholesales but for the fact that it experienced a production slowdown in last July and August, due to reduced supplies of rare earth magnet supplies.

Ather Energy, which is witnessing strong sales traction for its Rizta family e-scooter and also has the 450S and 450X in its portfolio, has had a stellar year. In CY2025, the EV startup sold 224,942 e-scooters, which marks robust 58% YoY growth (CY2024: 142,384 units). As a result, Ather’s scooter market share has risen to 3% from 2% a year ago.

TVS, Bajaj Auto, Ather Energy and Hero MotoCorp together sold 963,286 electric scooters in CY2025.

EV SHARE INCREASES TO 13% EVEN AS GST 2.0 ACCELERATES DEMAND FOR ICE SCOOTERS

Of SIAM’s scooter-member companies, five – TVS, Bajaj Auto, Ather Energy, Hero MotoCorp and Okinawa Autotech – have been manufacturing zero-emission scooters for some time now. Honda has entered this segment with its Activa-e and the QC1 albeit with limited success, and Suzuki has just launched its e-Access priced at Rs 188,000.

The scooter industry, which has around 40-odd models including electric scooters, has benefitted from the sustained demand for zero-emission models. In CY2025, as per SIAM data, a record 969,439 electric scooters were sold by five OEMs (TVS, Bajaj Auto, Ather Energy, Hero Vida, Honda and Okinawa), constituting handsome 41% YoY growth (CY2024: 689,014 units). As a result, the e-2W share of the overall market has risen to 13% from 10% in CY2024 and contributed to the segment hitting a new annual sales high.

However, what really lit the fireworks for the segment (as well as for the rest of the automobile industry) was the much-awaited GST 2.0 reform which helped slash new vehicle prices and enabled a higher level of affordability, both for urban and rural India. In October 2025, scooter OEM dispatches hit a new monthly high of 824,003 units, with November adding another 735,753 units. Interestingly, December, which is usually a month of tepid sales due to buyers deferring purchases to the new calendar year, saw sales of 594,744 units, up 42% YoY. As a result, Q4 (October-December 2025) with 21,54,500 scooters, up 26% YoY (Q4 CY2024: 17,08,445 units), accounted for nearly 29% of the record 7.52 million scooters last year.

This year, which has already seen the launch of the new Bajaj Chetak on January 14, is expected to see a fair number of new e-scooters enter the market. These include the Ultraviolette Tessaract, River Indie-based Yamaha EC-06 electric scooter whose production has commenced, Yamaha Aerox-e, Ather Energy’s EL01 built on the new EL platform which helps spawn affordable models, and the Suzuki Burgman Electric.

Will the Indian scooter industry maintain the same strong momentum in CY2026? Will growth in the e-scooter segment, whose price differential with its ICE counterparts has increased following the GST 2.0-driven reductions, taper down even as more e-2W OEMs rush to develop affordable models? The trend will be known later this year even as India Auto Inc expects the Union Budget 2026 to sustain the robust momentum seen in CY2025.