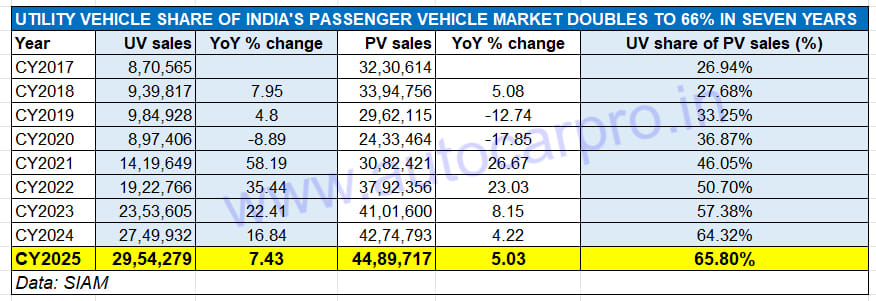

If the passenger vehicle industry in India achieved its best-ever annual wholesales of 4.48 million units in CY2025, up 5% YoY (CY2024: 4.27 million units), then the credit once again goes to the utility vehicle (UV) segment which comprises SUVs and MPVs. The UV sub-segment continues to be the shining star of the Indian PV industry, even as demand returned belatedly to the car segment (13,79,884, up 0.5% YoY) compared to CY2024 when hatchback and sedan sales were down 14 percent.

With record wholesales (factory dispatches) of 2.95 million SUVs and MPVs last year, improving upon Autocar Professional’s forecast of 2.80 million units, the UV segment grew 7.43% YoY on a high base (CY2024: 2.74 million units). This continuing strong performance has ensured that the UV share of the overall passenger vehicle market (cars, UVs and vans) has further risen in CY2025 to 66%, improving upon the 64% in CY2024 and 57% in CY2023.

Between CY2019 and CY2025, UVs have doubled their share of the PV market from 33% to 66%, which not only showcases the rapid consumer shift to UVs from hatchbacks and sedans but also how the UV segment has proved to be a bulwark against the sustained decline of the car market.

Utility vehicle sales rose to a new high of 2.95 million units in CY2025, with their share of the passenger vehicle market doubling to 66% from 33% in CY2019.

Of the cars, vans and UV sub-segments in the overall PV segment, UVs is also the most competitive with every OEM worth its wheel fighting for a share and slice of the mega action, with the battle for supremacy highest in the compact SUV and midsize SUV categories. These two sub-segments are also where the Top 30 best-selling models reside.

The UV arena is a tough one, what with 32 SUV and MPV manufacturers (including 16 SIAM member OEMs with 75 models), nearly 130 individual models and over 1,000 variants. Buyers are really spoilt for choice which makes the performance of these best-selling models important in the overall scheme of things.

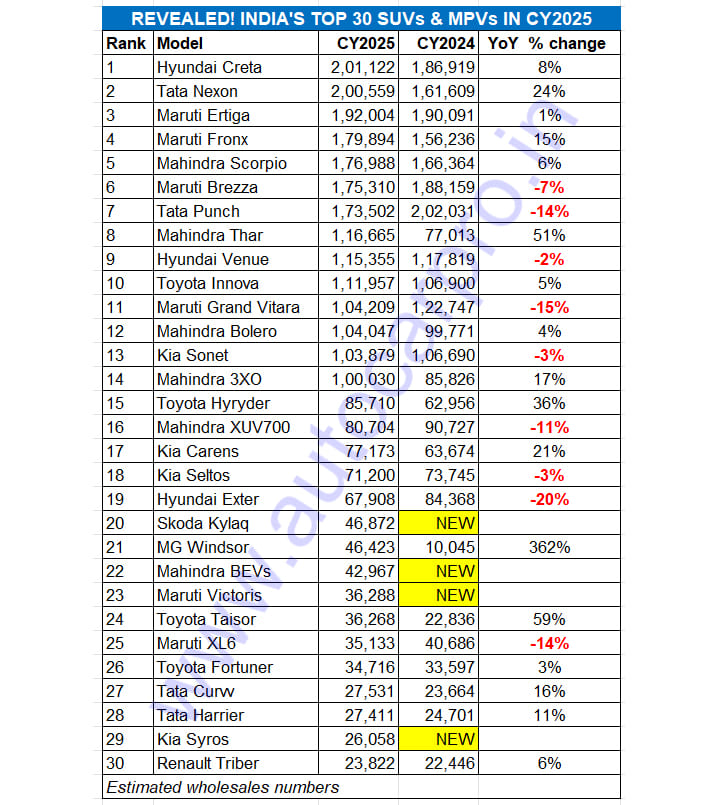

Let’s take a close look at the movers and shakers and their performance (see the ‘Top 30 UVs’ data table at the end of this analysis). Reflecting the intense battle for leadership in the high-stakes UV arena, market leader Maruti Suzuki and arch rival Mahindra & Mahindra have 6 models each in this listing. They are followed by Tata Motors, Toyota Kirloskar Motor and Kia India, each with 4 models. While Hyundai Motor India has 3, JSW MG Motor India, Skoda India and Renault India have one each.

The Hyundai Creta, which was joined by the Creta Electric (201,122 units), outsold the Tata Nexon by just 563 units to be India’s No. 1 SUV.

Hyundai Creta Is Best-selling Uv In Cy2025 With 201,122 Units

The battle to be the boss of the utility vehicle segment was very intense. So much so that the difference between the top two models was a piffling 563 units! Only two SUVs – the Hyundai Creta and the Tata Nexon – surpassed 200,000 sales last year.

The Hyundai Creta (201,122 units, up 8%) is the new No. 1 SUV and UV for CY2025, narrowly beating Tata Nexon. The Creta, which was joined by the Creta Electric in January 2025, remains India’s best-selling midsize SUV and rises three ranks from No. 4 in CY2024. The Creta remains the company’s biggest sales contributor. Of Hyundai Motor India’s total passenger vehicle sales of 571,878 units in CY2025, down 6% YoY, the Creta with 201,122 units accounted for a 35% share.

The Tata Nexon compact SUV (200,559 units, up 24%), which was India’s best-selling SUV for three straight fiscals – FY2024, FY2023 and FY2022 – and ranked No. 6 in CY2024, has risen four ranks this year to be No. 2, missing out on the crown by a whisker. Like the Creta, the Nexon was also Tata Motors’ best-selling model last year and accounted for a 35% share of the record 578,771 PV sales in CY2025, improving upon its 31% share in CY2024.

The popular Maruti Ertiga MPV (192,004 units, up 1%) is No. 3 on the podium, dropping one rank from CY2025. The Ertiga was the best-selling Maruti UV but was beaten to the title of Maruti’s best-selling model per se by the Dzire sedan (214,488 units) which is also India’s No. 1 PV for CY2025, and the Wagon R (194,238 units).

The Maruti Fronx compact SUV (179,894 units, up 15%) moves up to No. 4 from No. 7 in CY2024. In November, the Fronx became the first Nexa-sold SUV to register cumulative sales of 400,000 units.

The Mahindra Scorpio maintains its No. 5 ranking. In CY2025, the best-selling Mahindra model which comprises the Scorpio N and Scorpio Classic sold a total of 176,988 units, up 6% YoY (CY2024: 166,364), which translates into an additional 10,624 units. In CY2025, the Scorpio twins had a 28% share of Mahindra & Mahindra’s record SUV sales of 625,603 units.

The Maruti Brezza (175,310 units, down 7%), is the first of the nine models to register a YoY decline. The Brezza, which kicked off the compact SUV juggernaut all those many years ago and was the No. 1 in CY2023, is ranked No. 6, down three ranks from No. 3 in CY2024.

No. 7 UV for CY2025 is the Tata Punch (173,502 units, down 14%), which has been punched down six ranks from the No. 1 position in CY2024 when it sold 202,031 units. It’s likely that Punch aficionados had delayed their purchase decisions in view of the new Punch, which was launched earlier this month.

When a model moves up eight ranks and sells an additional 39,652 units YoY, it clearly positions itself as a mover and a shaker of the industry. This is the Mahindra Thar brand (5-door Thar Roxx and 3-door Thar) which, with 116,665 units, registered 51% growth and jumped to No. 8 from No. 16 in CY2024. The bulk of the sales belong to the Thar Roxx, which is more of a mainstream mode than the 3-door Thar.

The Hyundai Venue compact SUV (115,355 units, down 2%) retains its ninth rank of CY2024. Demand for the Venue, which has crossed cumulative sales of 700,000 units since its launch in May 2019, were tepid for most of last year as it was well known that the next-gen Venue was to be launched, which happened early November.

Toyota Kirloskar Motor’s best-selling product remains the Innova MPV. Ranked No. 10 – the same as in CY2024 – the Toyota Innova MPV with its Hycross and Crysta variants – clocked estimated wholesales of 111,957 units, up 5% YoY (CY2024: 106,900 units). Demand for the Innova Hycross has been particularly strong which is estimated to account for around 65% of the brand’s sales with the Crysta contributing the rest.

In 11th position is the Maruti Grand Vitara (104,209 units, down 15%), a decline of three ranks over CY2024 when it ranked eighth.

The indefatigable Mahindra Bolero (104,047 units, up 4%) holds onto its 12th ranking. What helped revive numbers was the launch of the new Bolero and Bolero Neo in early October 2025.

The Kia Sonet compact SUV (103,879 units, down 3%) checks in at No. 13, down two spots from its No. 11 a year ago. This is the second year in a row that the Sonet has outsold the Seltos, the longstanding No. 1 model for the company which took third place after the Carens MPV.

Utility Vehicle No. 14 is the Mahindra 3XO (100,030 units, up 17%), at the same position as in CY2024.

One of the star performers in CY2025 is the Toyota Urban Cruiser Hyryder (85,710 units, up 36%). This midsize SUV, which has recently surpassed 200,000 sales in the domestic market, moves up four ranks to be UV No. 15 in CY2025 from No. 19 in CY2024.

One rank behind the Hyryder is the Mahindra XUV700 (80,704 units, down 11%). The sales decline sees the Mahindra flagship SUV drop three ranks to No. 16 ranking from No. 13 in CY2024. In CY2023, the XUV700 was the 14th best-selling UV in India.

The Kia Carens (77,173 units, up 21 is ranked 17th, up from 18th a year ago. Demand revved up for this MPV following the launch of new siblings – the Carens Clavis (in May) and the Clavis EV (in July).

The Kia Seltos midsize SUV (71,200 units, down 3%) is the third Kia UV in this Top 30 models list at No. 18, losing its No. 17 spot of CY2024 to its MPV sibling. The slowdown in the demand for Seltos over the years amidst newer midsize SUV competition is revealed in the fact that it was the 10th best-selling SUV in CY2023.

The Hyundai Exter compact SUV (67,908 units, down 20%) is down four ranks on the 15th position it had in CY2024 with 84,368 units when sales were up 39% YoY. Earlier this month, the Exter has driven past the 200,000 sales milestone, 30 months after launch.

The Skoda Kylaq compact SUV (46,872 units), launched in January 2025, makes its entry into best-selling UVs list as No. 20. With a 64% share, this model has single-handedly Skoda Auto India’s record PV sales of 72,666 units in CY2025, up 107% YoY (CY2024: 35,164 units).

The all-electric MG Windsor checks in at No. 21 with 46,423 units sold in CY205, up 362% YoY (CY2024: 10,045 units). This strong growth ensured that this JSW MG Motor India model was India’s best-selling electric passenger vehicle last year.

Mahindra & Mahindra’s Born Electric SUVs – the BE 6 and XEV 9e and the recently launched XEV 9S – together are ranked No. 22 with 42,967 units. The bulk of the sales belong to the XEV 9e, whose share is estimated at 63% with the rest split between the BE 6 and the new XEV 9e.

The new Maruti Victoris midsize SUV, which is based on the premium Maruti Grand Vitara and launched in mid-September, also checks into the CY2025’s Top 30 UV listing. The Victoris, with 36,288 units, sold more than the Maruti XL6 last year which has dropped five ranks to be UV No. 25.

Like the Innova and Hyryder, the Taisor compact SUV has helped power Toyota Kirloskar Motor’s record PV sales of 3,51,267 units in CY2025. The Taisor, which battles in this ultra-competitive segment, sold 36,268 units, up 59% YoY (CY2024: 22,836 units).

UV No. 25 is the Maruti XL6 MPV, the fifth model from the passenger vehicle and SUV market leader in this Top 30 UV list. The XL6 sold 35,133 units, down 14% YoY (CY2024: 40,686 units), which sees its ranking down five positions from No. 20 in CY2024.

The butch Toyota Fortuner (34,716 units, up 3%) is the fourth best-selling Toyota UV in CY2025. At No. 26, the Fortuner has dropped five ranks YoY.

The Tata Curvv (27,531 units, up 16%) is ranked No. 27. The SUV-coupé (petrol, diesel, and electric) is estimated to have sold 52,105 units since its August 2024 launch. Peak monthly sales reached 5,351 units in October 2024, while November 2025 recorded the lowest at 1,094 units.

The Tata Harrier midsize SUV (27,411 units, up 11%) takes the No. 28 position. Tata Motors’ striking-looking, feature and tech-laden premium diesel-engined five-seater midsize SUV has benefited from the launch of the Harrier EV and should see better monthly sales with the new petrol-engined model.

The fourth all-new SUV to be in the Top 30 list is the Kia Syros compact SUV (26,058 units). It was the fourth best-selling model for Kia India after the Sonet, Carens and Seltos and contributed 9% to the company’s record UV sales of 280,286 units in CY2025.

Wrapping up the Top 30 Utility Vehicle list for CY2025 is the Renault Triber MPV (23,822 units, up 6%).

With a 41% share of UV sales in CY2025, midsize SUVs are fast reducing the gap with compact SUVs which had a 43% share. MPVs had a 15.6% share.

Midsize Suvs Closing In On Compact Suvs

What the UV wholesales data of these Top 30 best-selling models in CY2025 also reveals is that compact SUVs, which have ruled the segment for quite a few years now, are now facing stiff competition from midsize SUVs.

Of the total 2.82 million units that these 30 models add up to, compact SUVs (1.22 million units) account for a 43% share, while the midsize SUVs (1.15 units) are close behind with a 41% share. Compare this to the scenario in CY2024 when compact SUVs had a 48% share of UV sales versus midsize SUVs 36 percent. CY2025 stats reveals that the compact SUV segment has retreated while the midsize size segment has gained percentage points YoY.

As Autocar India’s latest cover story (January 2026 issue) points out CY2026 is set to be the year of the midsize SUV segment what with a slew of new models including the Tata Sierra, Maruti Suzuki e-Vitara, Renault Duster, Vinfast VF7, Nissan Tekton and Toyota Urban Cruiser EV joining the existing model and planned facelifts.

Meanwhile, the MPV segment with an estimated 440,089 units sold accounted for 15% of the Top 30 models sales, a ratio similar to that in CY2024.