While India’s automotive floors are buzzing, with passenger vehicle (PV) production jumping 25.5% year-on-year, a silent margin-killer is lurking in the supply chain. Manufacturers are facing a harsh reality, where the cost of going green is becoming an unsustainable premium that will inevitably be passed on to the consumer’s invoice.

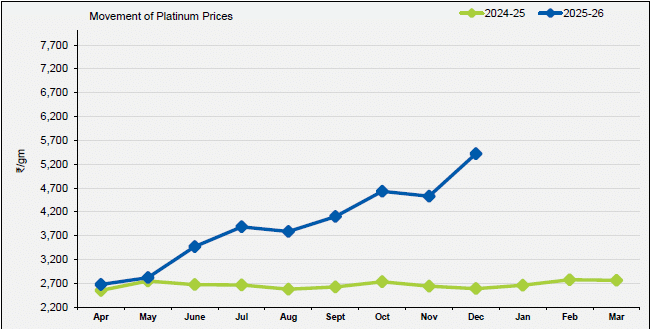

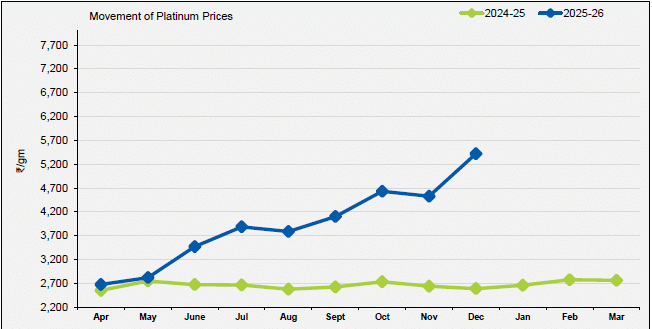

As per the SIAM commodity tracker updates for the month of December 2025, the most aggressive inflation is found in exhaust-cleansing minerals required to meet tightening emission standards. Platinum prices have skyrocketed by 110% compared to last year, reaching ₹5,419.39 per gram. Even more staggering is rhodium, a critical component for catalytic converters, which has surged 88% YoY to ₹23,523.36 per gram. Likewise, palladium prices averaged around ₹4,613.22 per gram in December 2025, which is about 75% higher than the previous year.

The surge seems huge, considering the fact that auto catalysts consume over 40% of platinum. Palladium, on the other hand, sees roughly 75% of its demand coming from the transport sector. Additionally, catalytic converters account for 84% of rhodium consumption.

The transition to electric vehicles (EVs) offers little relief. While traditional lead-acid batteries remain stable, with a 2% price decline, the market for battery-grade minerals is in a state of explosion. Cobalt oxide has seen a massive 209% price hike year-on-year, while refined cobalt has climbed 146%. Even lithium carbonate is trending upward, rising 10% as demand for rechargeable power cells intensifies.

For the automotive industry, these figures represent a fundamental shift. High production volumes are typically a sign of health, but when the cost of exhaust-cleansing minerals and battery-grade minerals outpaces growth, the industry’s bottom line comes under pressure. As manufacturers struggle to absorb these triple-digit increases, the “Clean Air” premium is no longer a future projection; it is a present-day fiscal crisis that threatens to make the next generation of vehicles a luxury few can afford.