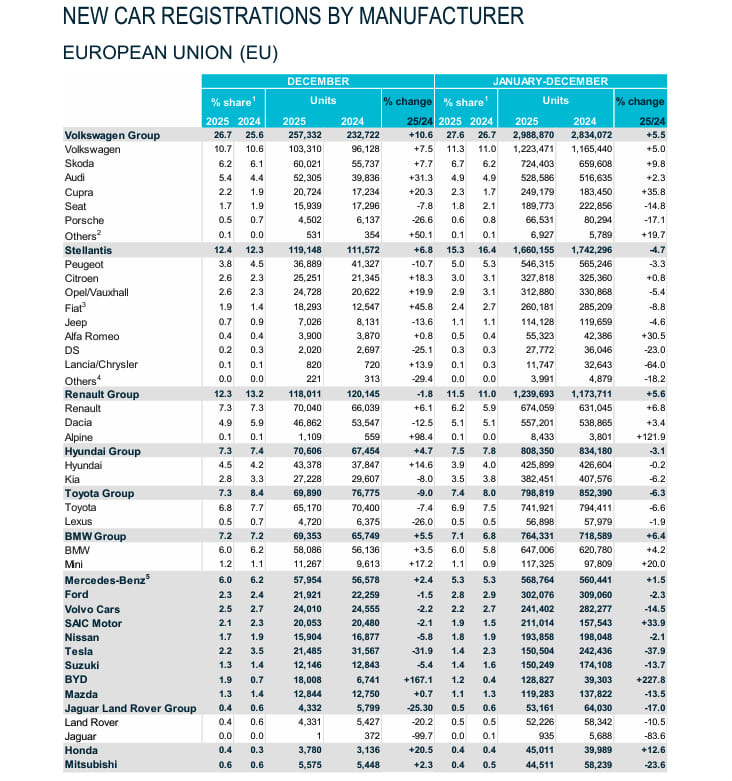

New car sales in the European Union last year increased by 1.8% to 10.63 million units (CY2024: 10,822,831 units), with the growth facilitated by the sustained demand for both battery electric cars (BEVs) and hybrid-electric cars (HEVs). However, overall volumes remain well below pre-pandemic levels.

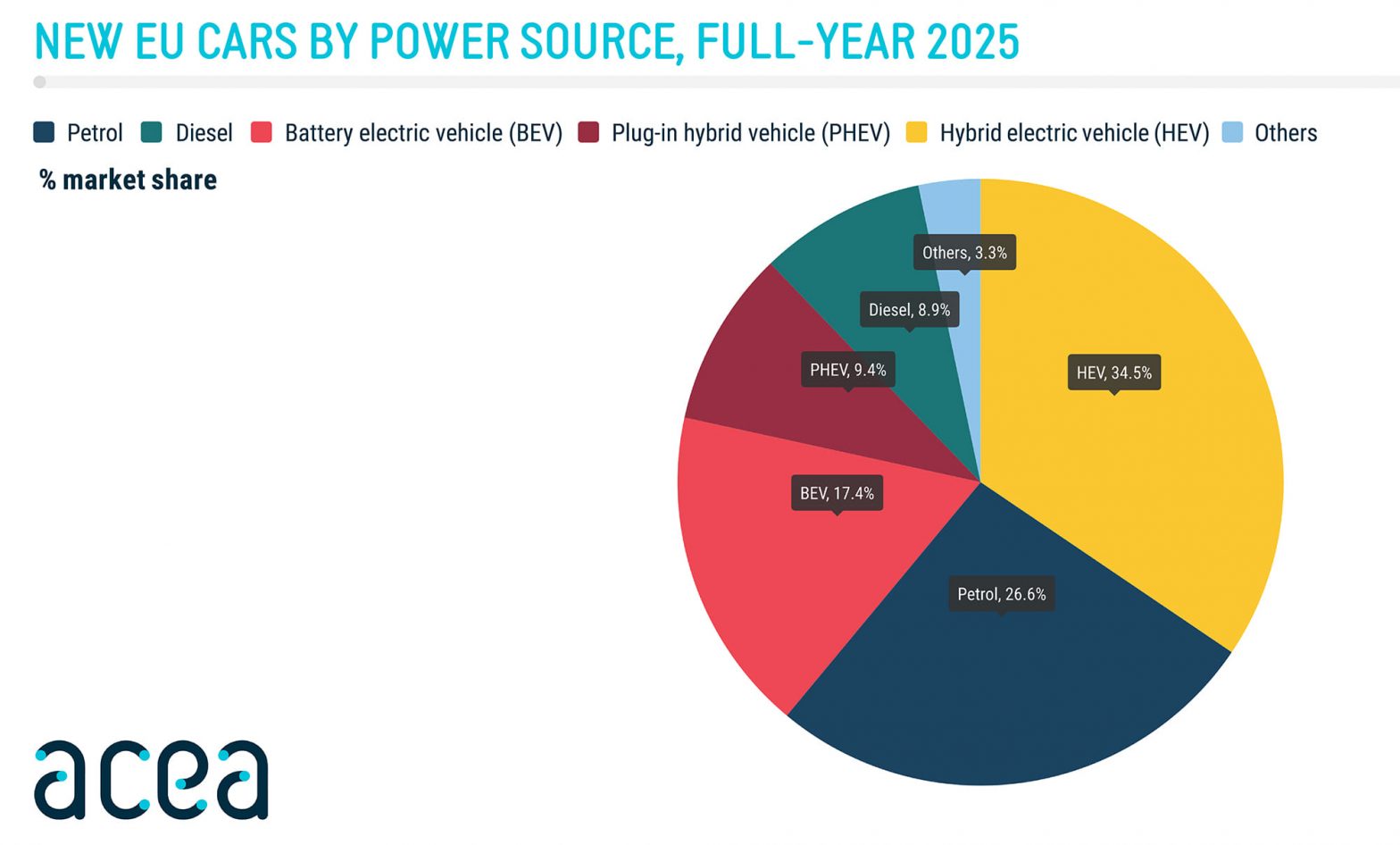

Annual retail sales of battery electric cars rose to a new high of 1.88 million units (1,880,370 units) in CY2025, up 29.9% year on year (CY2024: 1,447,631 BEVs). As a result, BEVs (battery electric vehicles) accounted for 17.4% of the EU market share in 2025, an increase from the low baseline of 13.6% a year ago.

This growth, according to the European Automobile Manufacturers’ Association (ACEA), is in line with projections for the year, yet still a level that leaves room for growth to stay on track with the transition. Meanwhile, hybrid-electric vehicles lead as the most popular power type choice among buyers, with plug-in hybrids consolidating their position in the market.

The European Union’s four largest BEV markets, which together account for 62% of battery electric car registrations of 1,172,052 BEVs), saw strong growth. This quartet comprises Germany (545,142 BEVs, +43.2%), France (326,922 BEVs, +12.5%), the Netherlands (156,139 BEVs, +18.1%) and Belgium (143,849 BEVs, +12.6%). Other markets which witnessed growing demand for BEVs include Denmark (126,542 units, +42.0%), Spain (101,627 units, +77.1%), Sweden (99,723 units, +5.7%), Italy (94,624 units, +44.2%), Austria (60,651 units, +35.9%), Portugal (52,256 units, +25.1%), Poland (43,311 units, +161.5%).

While the BEV share rose to 17% from 13.6% in CY2024, hybrid-electric car share grew to 34.5% from 30% and plug-in hybrids to 9% from 7%. Petrol car share dropped to 26.6% from 33% in CY2024 and diesel to 8.9% from 12% a year ago.

Germany, France, Italy and Spain command 72% of 3.7 million hybrid car sales

The data generated by ACEA reveals that new EU hybrid-electric car registrations between January to December 2025 rose by 13.7% YoY to 3.7 million units (3,733,325 HEVs), driven by growth in the four biggest markets: Germany (816,111 units, +8%), France (716,154 units, +21.6%), Italy (671,923 units, +7.9%) and Spain (482,880 units, +23.1%) which together with 2.68 million units commanded 72% of total HEV sales last year. Hybrid-electric models account for 34.5% of the total EU market, up from the 31% they had in CY2024.

Meanwhile, registrations of plug-in-hybrid electric cars also continued to grow, reaching 1,015,887 units during the same period. This was driven by increases in volume for key markets such as Germany (311,398 PHEVs, +62.3%), Spain (123,989 PHEVs, +111.7%) and Italy (98,340 PHEVs, +86.6%). Therefore, plug-in-hybrid electric cars now represent 9.4% of EU car registrations, up from 7.2% in CY2024.

Petrol and diesel cars continue to see sales decline

By the end of 2025, petrol car registrations dropped by 18.7% to 2,880,298 units (CY2024: 3,542,976 units). With all major markets experiencing decreases. France (345,233 units) experienced the steepest drop, with registrations plummeting by 32%, followed by Germany (777,641 units, -21.6%), Italy (372,150 units, -18.2%), and Spain (318,20 units, -16%). With 2,880,298 new cars registered in 2025, the market share for petrol fell to 26.6% from 33.3% a year earlier.

The diesel car market continued to decline, with registrations down by 24.2% and now belong the million-units mark to 960,024 units, resulting in an 8.9% share in 2025 (CY2024: 1,267,347 units). Both the top two markets saw a high rate of YoY decline: Germany (395,022 units, -18.3%) and Italy (147,277 units, -31.5%).

ACEA represents the 17 major Europe-based car, van, truck and bus makers who, with an estimated 13.6 million personnel, account for 8.1% of all manufacturing jobs in the EU, 414.7 billion euros (Rs 3,644,383 crore) in tax revenue for European governments, over 8% of EU GDP generated by the auto industry, and 84.6 billion euros (Rs 743,464 crore) in R&D spending annually which is 34% of the EU total.

ACEA, SIAM and ACMA welcome India-EU FTA

ACEA has welcomed the recently signed free trade agreement (FTA) between the European Union and India. In a statement, the association said: “The successful end to negotiations is a landmark moment in global trade relations. Running contrary to the global trend, this FTA is a strong statement of intent by both parties to furthering more open and mutually beneficial trade relations. It will greatly help European automobile exports enter a market of 4 million passenger cars that, until now, has been protected by prohibitively high import tariffs of up to 110%. ACEA members support this FTA and will ask EU member states and the European Parliament to give their timely approval to allow for its implementation as soon as possible.”

India Auto Inc’s key associations SIAM and ACMA have also given their vote of confidence to the FTA.

Shailesh Chandra, president, SIAM and MD and CEO of Tata Motors Passenger Vehicles, commented: “The FTA with EU will play a key role as India marches on towards ‘Viksit Bharat’. While we look forward to specific details of the India-EU FTA with respect to the auto industry, the calibrated approach to balance market access and domestic manufacturing, should give us a win-win between increased global participation on one hand and growth of the domestic auto Industry with investments and employment on the other hand. This will also enable increased choice for consumers in both regions.”

The FTA will also benefit made-in-India automotive components. The EU is India’s largest trading partner for goods and accounts for nearly 30% of India’s auto component exports. Vikrampati Singhania, president of ACMA and vice-chairman and MD, JK Fenner (India) said: “For the auto-components industry, it has the potential to unlock new opportunities for exports, technology partnerships, and investment-led growth. As global OEMs and suppliers look to build resilient supply chains, a well-balanced and pragmatic FTA can position India as a reliable manufacturing and sourcing partner for Europe.”

All data tables: courtesy ACEA