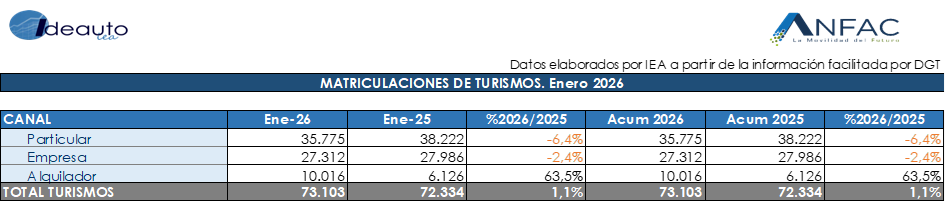

January records 73,103 registrations, 1.1% more than the same month in 2025, driven by sales made in December and which materialize this month

The number of electrified passenger cars (BEV+PHEV) grows by 48.3% this January, with 15,212 units reaching 20.8% of the total market

Light commercial vehicles start with 13,185 units, 4.7% more than in 2025

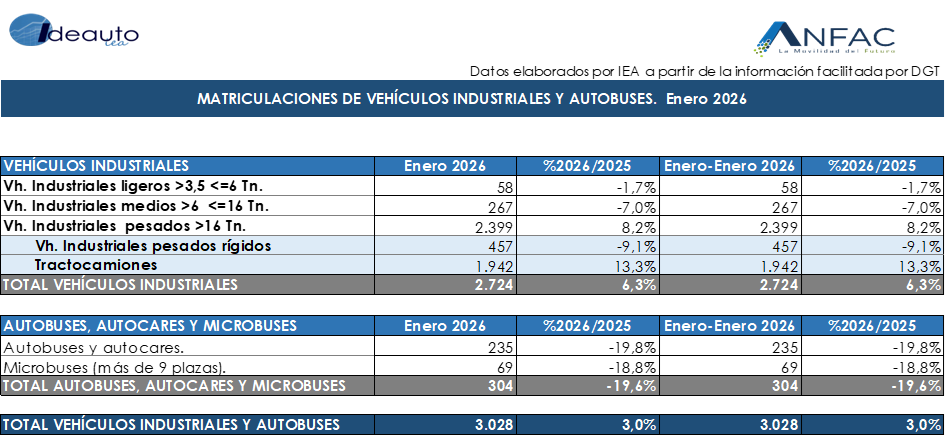

Registrations of commercial vehicles, buses, coaches and minibuses start 2026 with a 3% increase, with 3,028 units

Madrid, February 2, 2026. Sales of passenger cars open the year with 73,103 units, 1.1% more than in January 2025. The almost flat closing is a good figure if we take into account that, in the same month of 2025, 3,995 extraordinary units were added as a result of DANA with the aid of the Auto Restart Plan. In fact, without the DANA effect, the market would grow by 7% last month.

Regarding electrified passenger cars (BEV+PHEV), 2026 begins with positive figures, as they register an increase of 48.3% with a total of 15,212 units. The market share reaches 20.8% in this period, exceeding by 6 percentage points the 14.8% of the market that electrified vehicles accounted for in January 2025.

The average CO2 emissions of passenger cars sold in January remain at 103.1 grams of CO2 per kilometer traveled, 8.1% lower than the average emissions of new passenger cars sold in the same month of 2025.

By channels, only sales to renters, with an increase of 63.5% and 10,016 sales, managed to increase their volume compared to the same month last year and have been key in the closing of the January market. For their part, both individuals and companies suffer declines in sales in the first month. Specifically, private cars decreased by 6.4%, with 35,775 units, and sales to companies totaled 27,312 passenger cars, with a decrease of 42.4%.

LIGHT COMMERCIAL VEHICLES

Registrations of light commercial vehicles increased by 4.7% in January compared to the same period of the previous year, with 13,185 units. By channels in the first month, with the exception of the self-employed with a slight decrease of 0.8%, they managed to close positively. Renters register 1,327 sales, 20.2% more than the same in 2025. While companies increase 4.3%, with 9,386 units.

In January, registrations of commercial vehicles, buses, coaches and minibuses started positively, with 3,028 new sales, which represents an increase of 3%. En concreto, por tipo de vehículos, los industriales son los que empujan las ventas con un incremento del 6,3% y 2.724 nuevas ventas. Mientras que el mercado de autobuses, autocares y microbuses tienen un fuerte retroceso del 19,6% y 304 unidades.

Félix García, director of communication and marketing at ANFAC, explained “January is starting positively despite the uncertainties. If we discount the DANA effect, the growth rate would not be 1% but 7%. It is true that there have been rent-a-car purchases that have been key, but individuals also remain strong. From the sector we insist that right now there is no type of aid for electrified vehicles. Neither the Auto + Plan has been published nor is the extension of the 15% personal income tax deduction for the purchase of an electric vehicle. It is necessary to give certainty to the market and consolidate the transformation towards electromobility. It is an unstoppable trend as can be seen in the fact that diesel has less and less share and is already below 5%.

Raúl Morales, communication director of FACONAUTO, indicated that “the slight growth of the automotive market in the month of January is due to a mirage. These are operations that came from the month of December and that have been registered now. In addition, the vehicle rental channel has registered much more than expected.

The fact that there has been no aid plan for the acquisition of electrified vehicles has delayed many purchases and has meant that an order book is not being generated for the coming months. That is why it is so important that the details of that plan be communicated as soon as possible, especially the amounts and their retroactivity, because that will give confidence to the buyer and will allow us to put aside this market stoppage that we are already seeing in the month of January.”

Tania Puche, communications director of GANVAM, highlighted that, “although it manages to maintain itself in January, the market needs certainties and not promises. The delay accumulated by the activation of the Auto+ plan, announced at the beginning of December, together with the repeal of the 15% personal income tax deduction for purchases of electric vehicles, slows down operations, at a time when the market was growing in double digits, driven, to a large extent, by the good performance of electrified vehicles.

Hence, the need to recover tax incentives and activate urgently and retroactively to January 1 the aid announced by the Government; a strategy that must be completed, let us not forget, with the national park renewal plan contemplated in the Sustainable Mobility Law.”