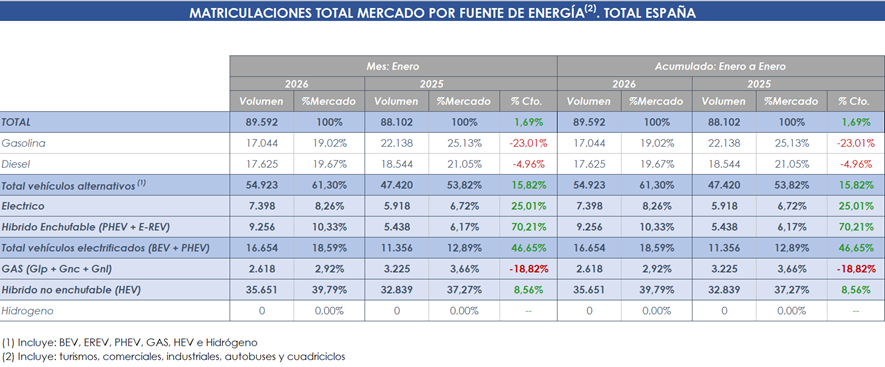

The month of January begins with an increase of 46.65% in registrations of electrified vehicles (BEV + PHEV), which represents 18.6% of the total market

Electrified passenger cars open 2026 with 15,212 units sold, 48.3% more than the same period in 2025, which would increase by 55% if we discount the extra DANA sales

With an increase of 15.8%, alternative vehicles (electrified, hybrid and gas) represent 61.3% of the total market

Conventional hybrid passenger cars are consolidated as the first purchase option with 35,651 units, being 1 in every 2 passenger cars sold

Madrid, February 2, 2026.- Sales of electrified vehicles (electric and plug-in hybrids, including passenger cars, quadricycles, commercial and industrial vehicles and buses) open 2026 with 16,654 units sold, an increase of 46.7% compared to January 2025. The market share of electrified vehicles this beginning of the year stands at 18.59%, 6 percentage points above January 2025.

Regarding registrations of alternative vehicles (electrified, hybrid and gas), they grew by 15.82% this January, with 54,923 units sold and representing 61.3% of the total market. Due to technology, conventional hybrids are once again the preferred option for users, with close to 40% of sales.

ELECTRIC VEHICLES – Label Zero

Sales of pure electric vehicles increased by 25% in January 2026, with 7,398 units registered. These vehicles represent 8.26% of the total market for the month, 1.5 p.p. more than the same in 2025.

PLUG-IN HYBRID VEHICLES – Label Zero

Sales of plug-in hybrid vehicles grew by 70.2% during January and reached 9,256 registered units. It represents 10.33% of the market share for the month, increasing the volume registered in January 2025 by 4 p.p.

HYBRID VEHICLES – ECO Label

Sales of non-plug-in hybrid vehicles increase slightly this month, with 8.6% more units sold. In total, 35,651 vehicles with this technology have been registered during the month of January, which represents 39.79% of the total market share.

GAS VEHICLES – ECO Label

Sales of gas vehicles showed a drop of 18.82% in January with 2,618 units registered. These figures represent 2.92% of the total market for the month of January.

PASSENGER CAR MARKET

Registrations of electrified, hybrid and gas passenger cars increase their sales this beginning of the year by 15.7% compared to January 2025, up to 53,271 units delivered. This type of technology begins the year, once again leading all sales with 72.87% of the market share. Regarding non-plug-in hybrids, they reach a share of 48.69%, which means that they are 1 in every 2 passenger cars sold during this month.

Regarding the electrified passenger car market, 2026 starts with an increase in sales, with 48.3% more and 15,212 units compared to January 2025. This percentage would rise to 55% if we discount the 438 sales of plug-in passenger cars that were produced in an extraordinary way by DANA. The market share reaches 20.8%, placing it 6 percentage points above the first month of 2025, where it reached 14.8% of the total market. Pure electric vehicles (BEV) grew by 29.1% with 6,472 units in the month, while plug-in hybrids (PHEV) increased their sales by 66.7% with 8,740 new units.

STATEMENTS

José López-Tafall, general director of ANFAC, indicated that “2026 starts off strongly and maintains the pace of the end of the previous year, with more than 15,000 new electrified registrations. But the majority of these registrations are a consequence of the closure of operations in the last quarter of 2025, so we must act in 2026 to consolidate the pace.”

The general director has indicated that “to maintain the pace of electrification in 2025, we must recover many of the tools that we had last year that drove the market. We are waiting for the announced Auto+ Plan to be launched as soon as possible and for the 15% personal income tax deduction for the purchase of electric vehicles to be urgently recovered; once we manage to accelerate the market in 2025, we must provide certainty to the citizen in 2026 and avoid confusion. Electrification is in a process of maturation in our country and these types of tools are especially necessary if we want to get closer to the European average and consolidate the good progress of the market. A separate mention, unfortunately, is the non-existence since May 2024 of any aid or incentive for the decarbonization of heavy vehicles. This must be corrected in 2026 without delay, Spanish road transport is risking its future.