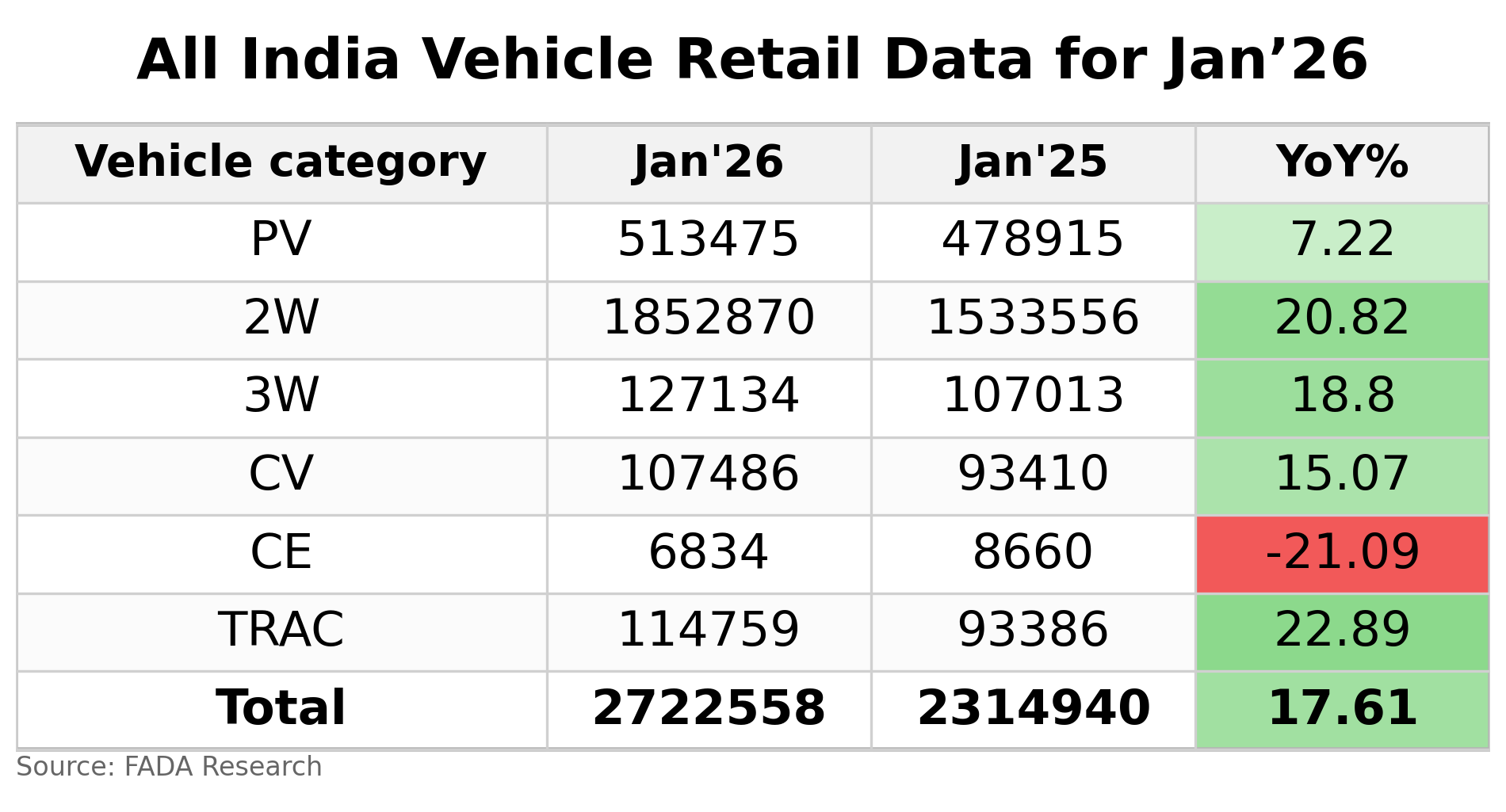

India’s auto retail sector began calendar year 2026 on a strong footing, registering overall year-on-year growth of 17.61 per cent to 27,22,558 units, according to data released by the Federation of Automobile Dealers Associations (FADA) on Tuesday.

The robust growth came on the back of post-GST momentum, healthy rural cash flows from harvest and weddings, and sustained demand across mobility and freight.

Dealers pointed to sustained demand in personal mobility segments, even as wholesale-to-retail alignment and selective financing moderated month-on-month momentum.

PV and 2W performance

Passenger vehicle retail sales remained steady in January 2026, growing by a healthy 7.22 per cent to 5,13,475 units, aided by sustained interest in SUVs and the revival of entry-level cars. According to FADA, rural PV sales grew over 14.43 per cent YoY, significantly ahead of urban growth at over 2.75 per cent.

“The growth was powered by continued post-GST momentum, healthy rural cashflows on the back of harvest and weddings, and sustained demand visibility across mobility and freight,” said C S Vigneshwar, President, FADA.

On the other hand, two-wheeler retail volumes rose by a robust 20.82 per cent YoY to 18,52,870 units, supported by improving rural sentiment and gradual recovery in commuter demand.

“Dealer feedback points to strong enquiry momentum driven by sharper customer engagement, quicker digital follow-ups, and a visible shift towards higher-value and mid-powered motorcycles. That said, selective model-wise supply constraints and aggressive competitive discounting continue to shape the near-term retail playbook in a few pockets,” Vigneshwar added.

Commercial Vehicles

Commercial vehicle retail sales stood at 1,07,486 units in January, registering a 15.07 per cent growth, driven by improving freight sentiment and replacement-led demand.

The recovery was broad-based across tonnage categories, with LCVs clocking 65,505 units (+14.94 per cent YoY) and HCVs at 34,287 units (+14.61 per cent YoY), reflecting stronger goods movement, ongoing infrastructure activity and renewed confidence among single-owner operators.

On a similar note, three-wheelers witnessed a growth of 17.86 per cent to 14,199 units, while tractors’ sales jumped by over 22.89 per cent to 1,14,759 units during the month.

Construction Equipment

Construction equipment retail sales saw stable-to-soft trends, mirroring a cautious pace of new project execution. Infrastructure-linked demand provided underlying support, though dealers highlighted delays in fresh orders, which are impacting sharper growth.

The segment at large continued to be under pressure, down 21.09 per cent YoY, indicating a high base impact and segment-specific recalibration.

Outlook

Looking ahead, dealers remain guardedly optimistic, expecting demand to firm up in the coming months, supported by the marriage season, rural traction and improved enquiry conversion post-January. Inventory levels across segments remained within the FADA-recommended comfort range, indicating balanced supply discipline.

FADA noted that the near-term macro setup is supportive, including tailwinds from a growth-oriented Budget with a visible infra and agri thrust, policy continuity post GST 2.0, and rate stability after 2025’s easing, which are collectively improving affordability, financing comfort and purchase intent.

It also said that on-ground feedback points to stronger enquiry pipelines, tighter follow-ups, and local marketing/activation intensity translating into higher conversion potential—while the key watch-outs remain election-related disruptions in select states, the usual seasonality/short-month effects, and model/variant availability in specific pockets.>