Tesla

As tax credits threaten to run out and more powerful and expensive versions launch, buyers are still waiting

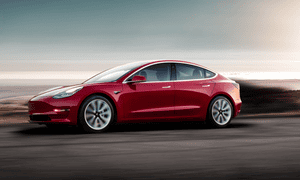

Tesla’s Model 3 … has Elon Musk bitten off more than he can chew?

Photograph: Tesla

This week saw Tesla’s enigmatic chief executive Elon Musk take to Twitter to announce two more powerful, and more expensive, versions of the auto firm’s Model 3 – the much lauded “mass market” vehicle that appears, for now, to be veering further and further away from its $35,000 price tag.

The new dual-motor Model 3 and its souped-up range-topping “performance” version, which costs $78,000 and, as Musk claims, will be 15% quicker than German rival BMW’s $66,500 (£59,905 in the UK) M3, are not unexpected. Tesla did a similar thing with its Model S, launching dual-motor and performance versions with ever more dizzying price tags.

High-end versions grab headlines and serve the enthusiast market well. But by producing them instead of the base model and at double the price that gave the Model 3 its all-important “mass market” moniker, Tesla is seemingly in danger of becoming more niche – more like Porsche, which sells 246,000 a year, rather than its parent company VW, which sells over 6m Volkswagen-branded vehicles a year.

Brian Johnson, senior analyst at Barclays, said the company’s current investment and valuation level is built on the promise that “Tesla will be a dominant market share player in the mass market auto industry, similar to the iPhone in the cellphone business”.

You could be forgiven for thinking that Tesla was already shipping $35,000 Model 3s, given it is still the quoted starting price for the vehicle and every news report comes attached with that “mass market” caveat. But it isn’t. The cheapest version that is shipping to owners is the long-range variant with a bigger battery that starts at $44,000.

Tesla Motors unveils the new lower-priced Model 3 sedan in 2016. Photograph: Justin Pritchard/AP

In a tweet this week, Musk said that Tesla needed “three to six months after [producing] 5,000 vehicles per week to ship the $35,000 Tesla” to achieve target cost. Tesla only produced around 2,270 Model 3s per week in April. But the company is still targeting 5,000 vehicles a week in “about two months”, delaying the $35,000 version to at least October and probably into 2019.

Why? “Shipping the minimum cost Model 3 right away would cause Tesla to lose money and die,” said Musk.

Given Tesla burned through $750m in cash in the last quarter while fighting Model 3 production woes, it can’t afford to make its record losses any bigger than they already are.

Ivan Drury, senior manager of industry analysis at Edmunds, said: “Despite setting Tesla apart in so many other ways, Musk is taking a page out of the old-school automaker book by prioritising the release of the highest trim levels first.

“This initial wave of the Model 3 is meant to wow consumers and help with profitability.”

Tesla still has more than 450,000 reservations for the Model 3, each secured with a $1,000 (£1,000 in the UK) refundable deposit, which will take years to fulfil and proves there is strong demand for the electric car.

Drury said that Musk was banking on being able to make those who want the most basic version of the Model 3 wait. He said: “While Tesla is notorious for production delays, it benefits from having the most forgiving customer base in automotive [industry].”

The majority of Tesla buyers are early adopters and have bought into the brand, allowing them to overlook delays and other niggles that a regular mass-market buyer otherwise might not.

The big question is how many of those reservations are made by more cost-sensitive buyers drawn in by the chance to own a Tesla for only $35,000. They currently benefit from a not inconsiderable $7,500 income tax rebate in the US for buying electric or plug-in hybrid cars.

’Shipping the minimum cost Model 3 right away would cause Tesla to lose money and die,’ said TEsla CEO Elon Musk. Photograph: Scott Olson/Getty Images

Drury said: “The one potential fly in the ointment is that Tesla is encroaching on the end of its tax rebates – the most price sensitive buyers might not stick around once those run out.”

The US government tax credit only lasts until Tesla, or any other manufacturer, sells 200,000 electric vehicles in the the country. It will then remain available for two quarters before being phased out over the next 12 months. Tesla has more than 300,000 vehicles on the road worldwide and is expected to cross the 200,000 barrier in the US soon.

“We don’t really know what percent of reservations wanted the $35k version, or how many wanted the Model 3 for $27,500 with the federal tax rebate,” Johnson said. “But once it steps down (likely in the first quarter) and people realise they won’t get it, that’s likely when cancellations could start.”

Even once the $35,000 base model does become available, it could be a rare thing. It only comes in black (add $1,000 for anything else), lacks Tesla’s “Enhanced Autopilot” (that’s an extra $5,000) or its future “Full Self-Driving Capability” ($3,000 on top of Autopilot), all of which quickly add up.

Drury said: “Typically luxury compact car buyers tack on 20-30% more in terms of options or higher-priced trim levels beyond the base. It is highly unlikely you’d see consumers at this price point not selecting at least one or two options.”

While cancellations would mean Tesla refunding $1,000 a piece, it would be the perceived weakening of demand that is likely to have a larger impact on the company, its share price and ability to raise further funds, if needed.