Frank Ursomarso thinks the Trump administration is merely jawboning by floating potential tariffs of as much as

25 percent on imported autos. If the longtime dealer is wrong, he expects to be selling fewer cars.

Take some of the cheaper sedans Ursomarso sells at Union Park BMW in Wilmington, Delaware, for example. A 25 percent levy would send some 3 Series cars toward $60,000 sticker prices — causing some nouveau riche buyers to think twice about stretching their budget for

a Bimmer, Ursomarso said. His Honda and GMC stores would feel the pain, too.

“What you’re seeing is

posturing,” Ursomarso said by phone. “The tariff will be something less. But it will be a price increase that either the manufacturers have to offset with incentives, or we will just sell fewer of them.”

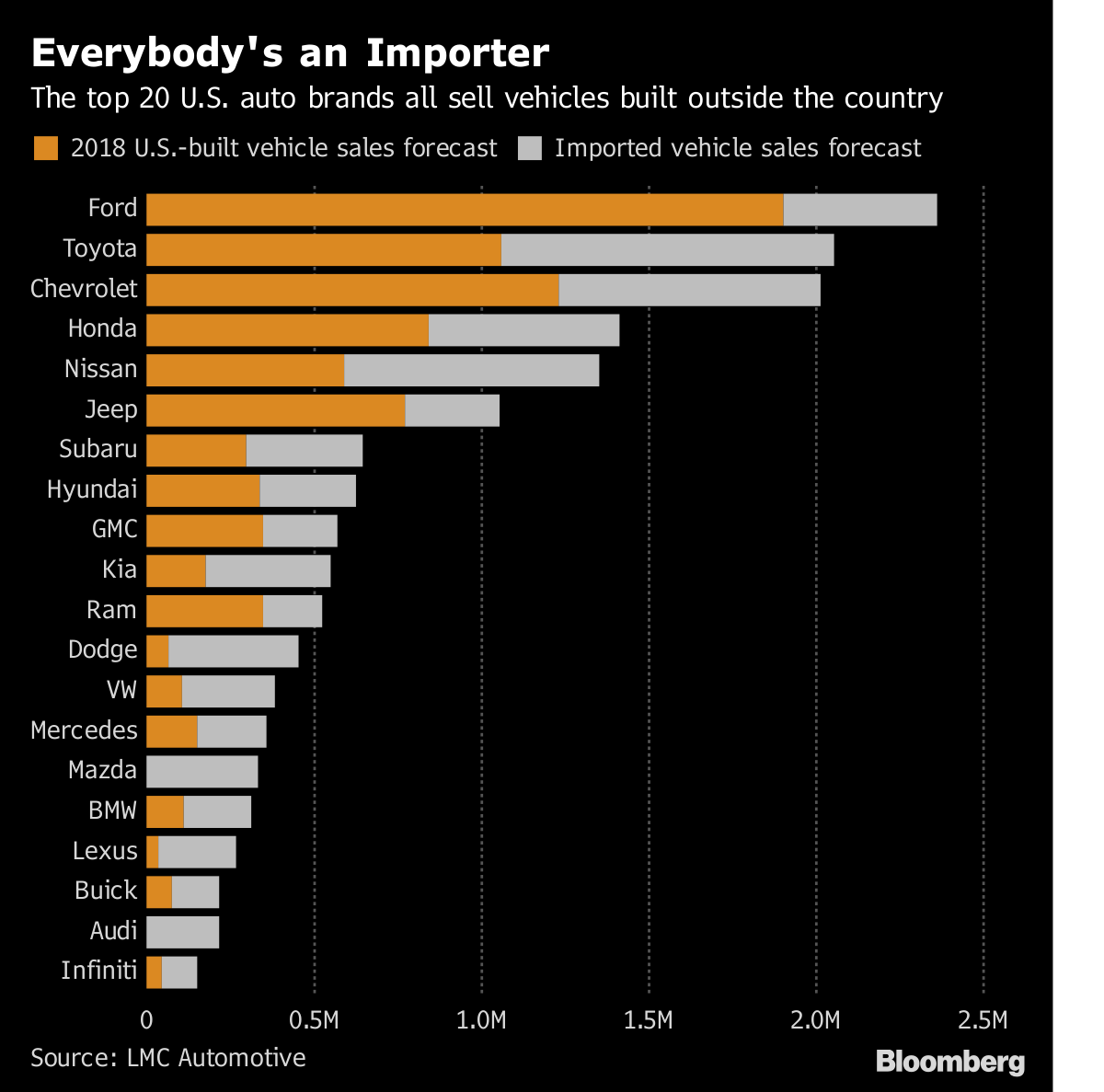

The U.S. auto market probably chugged along in May, with analysts expecting a vehicle sales pace roughly in line with a year ago. But the car imports investigation that President Donald Trump initiated this month looms as a threat with major potential to disrupt demand. Every major automaker imports at least some of the vehicles they deliver to American consumers, and more than 30 brands will source a majority of the models they sell this year from overseas assembly plants.

The hardest hit from a sheer volume perspective will be

Toyota Motor Corp., whose namesake brand will sell almost 1 million imported vehicles this year, according to researcher LMC Automotive’s estimates.

Japan-built Prius hybrids and

Ontario-assembled RAV4 crossovers would have plenty of company. General Motors Co. and Ford Motor Co. — America’s two largest carmakers — also own two of the top five brands selling imported autos in the U.S., according to LMC.

See: Chevy, Ford Could Be Sideswiped by Trump’s Import Tariffs

“I don’t like it at all,” said Jim Hardick, co-owner of Moritz Dealerships, which sells Chevy, Ram, Dodge and Kia models in Fort Worth, Texas. “It’s going to hurt our business. That would be a game changer for most people.”

The U.S. Commerce Department

started an investigation last week using a portion of 1960s trade law. If the

Section 232 probe finds that auto imports compromise national security, it would enable Trump to implement tariffs or limits on the inflow of cars from other countries.

For carmakers and their suppliers, shifting production or building

new assembly plants typically takes years and costs

billions of dollars. It’s difficult to do and risky, said Kristin Schondorf, executive director of EY’s automotive and transportation mobility practice.

A big import tariff would “totally destroy” the business case for many automakers — including American companies — that are building models outside the U.S., Schondorf said.

“Talk about throwing a monkey wrench into your strategy,” Schondorf said. “The economics of their fundamental business model will have to change,” as extra cost brought about by tariffs would “eat into margins.”

Some of the top U.S. sellers of imported autos also happen to assemble a lot of vehicles at domestic factories. While about 1.2 million of the vehicles GM will sell in its home market this year will come from overseas plants, about 1.8 million will be

American-made, according to LMC. And the X3 through X6 line of sport utility vehicles that BMW AG produces in South Carolina makes the German carmaker the

top exporter of vehicles from the U.S.

Everybody’s an Importer

The top 20 U.S. auto brands all sell vehicles built outside the country

Source: LMC Automotive

The auto import investigation is still at a preliminary stage, and the Trump administration hasn’t floated the idea of exempting Nafta partners from any tariffs the way it did with the steel and aluminum levies

implemented using Section 232.

Taking a similar tack with car imports would significantly limit the damage that could be done by tariffs. Among major automakers, Ford and

Honda Motor Co. will import less than than 5 percent of the vehicles they sell in the U.S. this year from outside Nafta, according to LMC. For GM and

Fiat Chrysler Automobiles NV, this share is less than 10 percent.

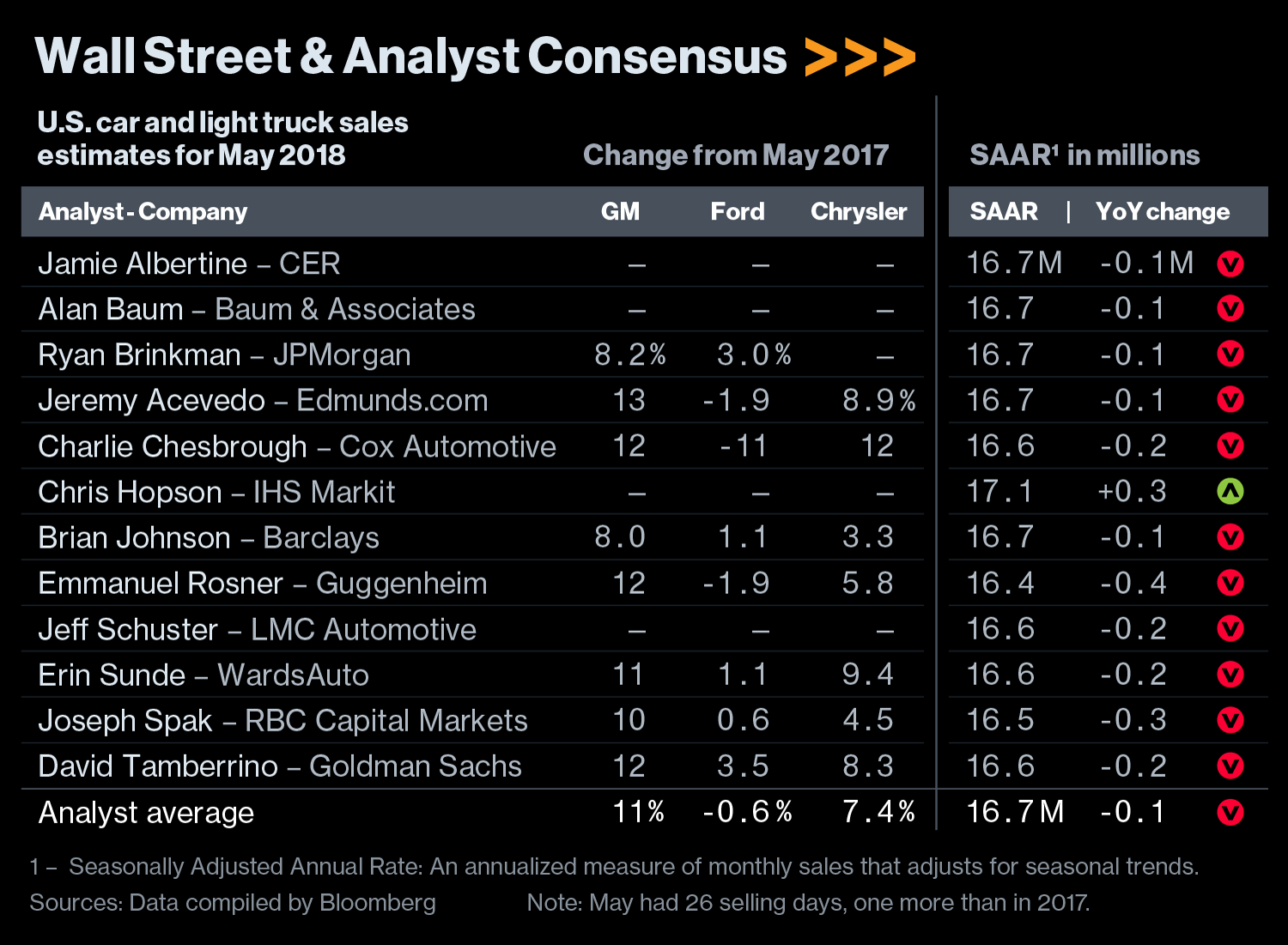

Regardless of how the investigation takes course, any tariffs would hit an industry that may no longer be growing but remains healthy. Analysts are expecting Ford, Toyota and

Nissan Motor Co. to report declining deliveries for the month of May, while other automakers may post gains thanks in part to an extra selling day. The annualized rate of vehicle sales may slip to 16.7 million, according to a Bloomberg News survey of analysts, from 16.8 million a year ago.

Trump’s administration was able to justify steel and aluminum tariffs because those industries were operating at unhealthy levels of production capacity, and because they’re commodities needed for the military, said Kristin Dziczek, head of the labor and economics group at the Center for Automotive Research. The car industry is in much stronger shape.

“I don’t know how you justify a tariff on cars,” she said.

— With assistance by Keith Naughton, and David Ingold