NSK Ltd. has been making transmissions and ball bearings for Japanese cars for half a century, but the 102-year old manufacturer is now undergoing a major shift as it supplies components critical to digital products and services.

A photo illustration of NSK’s ball screws.

Source: NSK Ltd.

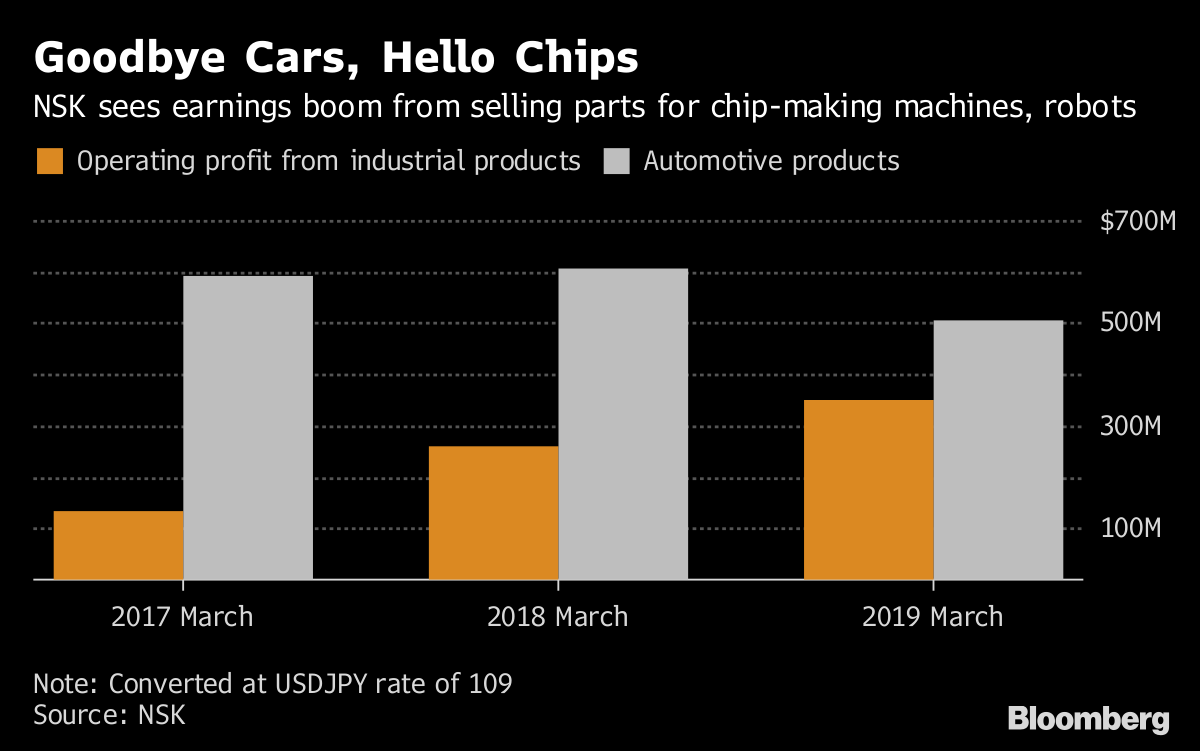

Sales of components for chip-making machines and robot parts are helping to fuel earnings growth. Operating profit from industrial products will grow 34 percent this fiscal year to 38 billion yen ($350 million), according to NSK’s outlook, helping to make up for a 17 percent profit decline in the automotive business.

Demand for industrial components is being felt across the industry, with total orders for machine tools jumping 32 percent in 2017 to a record 1.65 trillion yen, according to the

Japan Machine Tool Builders’ Association. That’s also benefited NSK competitors including THK Co. and Nippon Thompson Co., which have seen their shares climb 52 percent and 81 percent since the end of 2016. Tokyo-based NSK hasn’t fared as well, declining about 6 percent during the same period due to slower sales to automakers.

Goodbye Cars, Hello Chips

NSK sees earnings boom from selling parts for chip-making machines, robots

Source: NSK

Bloomberg spoke with NSK’s Hiroya Achiha, deputy head of the industrial machinery division, and Kenjiro Kikuchi, general manager of precision machinery, about the transformation at the company, the tech trends driving the shift, and his outlook for the next several years. NSK is the world’s largest maker of ball screws, which are used to move objects back and forth with a high degree of precision.

How is business?

Achiha: “Last spring we simultaneously got hit with orders from various customers. Smartphone chipmakers, injection molds, Chinese factories looking to automate with robots, 3D NAND memory producers, bitcoin miners. Suddenly everyone needed new chips and the machines to make those chips. That boosted demand for our ball screws.”

But chips are nothing new. Why was this such a surprise?

Kikuchi: “3D NAND memory is a new type of memory chip you can’t manufacture with existing semiconductor machines. You need new machines, which resulted in an explosion of inquiries. And then China is seeing rising labor costs and the need to automate. Factories are making more precision products, so if you used a general processing machine before, now you need to replace it with multi-axis one. And you have all kinds of new electronics, so factories are using more electric injection molding robots. All of this is boosting demand for our ball screws.”

What does that mean for your forecasts?

Kikuchi: “We could see another 10 percent jump in revenue in precision machinery by March 2021. It could come by March 2020 or March 2022 depending on what our clients do. But we want to be ready to reach 70 billion yen.”

Are you planning to boost output? Where?

Kikuchi: “We’re forecasting a 20 percent bump in output for ball screws this fiscal year. We have 5 billion yen in new capital expenditures for our factories in Kyushu and Shenyang. We’re increasing ball screw production lines, which will come on-line by the second half of this fiscal year. We’ve already doubled headcount to 1,400 people across both locations.”

Kikuchi: “Longer-term, we do think we may need more physical space. But if that were to happen, we would likely build infrastructure in the same places, so Kyushu or Shenyang.”

Will you be hiking prices again?

Kikuchi: “We still need to keep hiring people and training them, so we’re leaving some ample room for higher expense costs. So as far as prices go, that’s something we expect our customers to continue helping with.”

So the trend is for higher prices going forward?

“Yes.”

Are you worried about global cooling demand for smartphones?

Achiha: “Within smartphones we’re seeing some slowing, given the iPhone X didn’t do so well. And chips are also entering a little bit of a break. So we do see a slight drop in the short-term. But the amount of data the world is producing and the amount of chips being used is increasing. So we’ll be watching the ebb and flow, but we see growth basically moving in the right-and-up direction and expecting growth over the medium-term.”

But your stock price is flat over the past year. Why?

Achiha: “Of course investors look at the total value of the company. Right now our automotive side is going through a rough period given the weakness in steering and the need to replace things. But perhaps we should be valued over a slightly longer term. Up until now the spotlight was on the automotive side, but from last year our ball screws are being used in new industrial areas. This has raised our profile and we want to keep increasing our presence there.”

Going forward, what are the big trends to watch?

Achiha: “We’re all consuming and creating more data. Social media, YouTube, et cetera. And we see self-driving cars creating massive amounts of data which will need to be absorbed and then analyzed. So if that takes-off globally, we’ll need massive amounts of chips and data centers to process all that data. Chips are being created everywhere. So we will see more need for manufacturing machines.”

Kikuchi: “5G will also contribute to the amount of data produced in the world.”