Qualcomm published better-than-expected fourth quarter financial results on Wednesday. The semiconductor giant reported non-GAAP earnings of 90 cents per share on revenue of $5.8 billion, down two percent year over year.

Wall Street was looking for earnings of 83 cents per share with $5.52 billion in revenue.

For the full fiscal year 2018, Qualcomm reported non-GAAP earnings per share of $3.69 on GAAP revenue of $22.7 billion.

For the current quarter, Wall Street is expecting earnings of 95 cents a share on revenue of $5.57 billion. Qualcomm followed up with earnings estimates from $1.05 to $1.15 a share with $4.5 billion to $5.3 billion in revenue.

Qualcomm’s ongoing Apple dispute has strangled revenue in the company’s licensing division, Qualcomm Technology Licensing (QTL), which had accounted for a significant portion of its overall earnings. Qualcomm said it did not record any QTL revenues in fiscal 2018 for royalties it says it’s due on sales of Apple’s products.

The company’s other business segment, QCT (Qualcomm CDA Technologies), accounts for most of its revenue. The QCT segment in Q4 saw modest growth: QCT revenues for the quarter came to $4.65 billion, a 14 percent increase over last quarter. The segment generated $796 million in earnings before taxes for the quarter, a decrease of 18 percent year-over-year.

Meanwhile, QTL revenues declined 6 percent year-over-year, totaling $1.14 billion. The segment generated $739 million in earnings before taxes, a decrease of 11 percent year-over-year. Overall, Qualcomm said operating losses were $700 million, compared to $300 million operating profit the year prior.

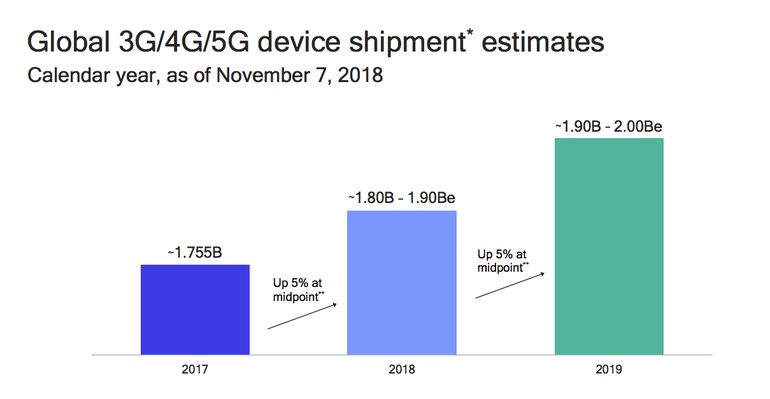

On the 5G front, Qualcomm expects a ramp up of device shipments starting in 2019 to support licensing revenue over the long tail.

“We delivered a strong quarter, with Non-GAAP earnings per share above the high end of our prior expectations, on greater than expected chipset demand in QCT and lower operating expenses,” said CEO Steve Mollenkopf. “We are executing well on our strategic objectives, including driving the commercialization of 5G globally in 2019 and returning significant capital to our stockholders.”