Franchised dealer profits in October were up by £7,500 in October year-on-year.

Average dealer profits from the month were £6,000, compared to a £1,500 loss in October 2017, according to data from ASE Global.

Its chairman Mike Jones said: “This appears to be directly related to the unwinding of the WLTP supply issues with a number of brands who had a poor September starting to catch up vehicle sales.”

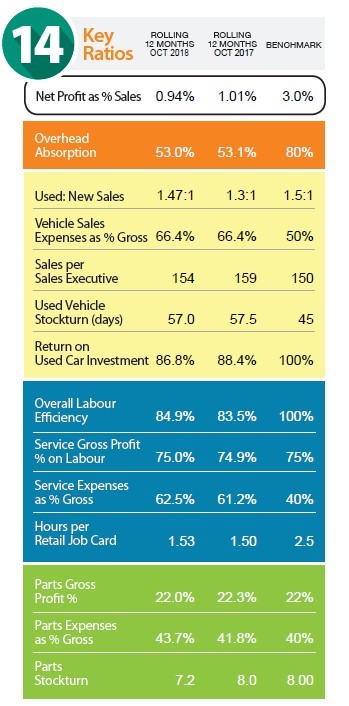

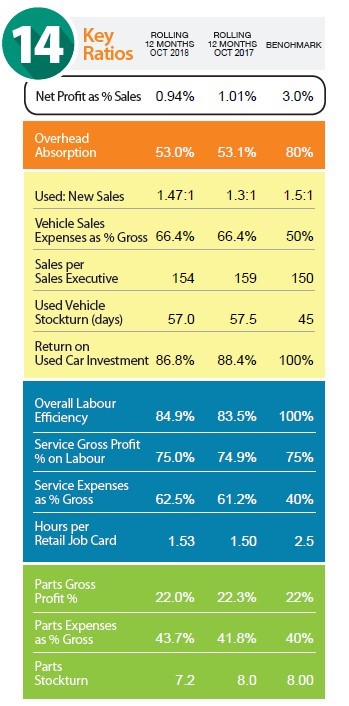

The rolling 12-month average return on sales for franchised dealers remains low, however, at 0.94% in October compared to 1.01% in October 2017.

Jones noted an apparent change in focus for franchised dealers onto growing used car sales, and highlighted that October’s rise in used car stock levels was untypical, although profitability remained strong and vehicles were in short supply.

He warned of a risk that motor retailers could store up potential problems in Q4.

He called for more focus on average retailers’ total absorption, improving the proportion of total overheads being covered by the profits in aftersales and used cars.

“Whilst some retail networks are a long way from the desired 100% total absorption (the dealership average is 53%), we need to move in that direction over the next five years to ensure the sustainability of the current retail model,” said Jones.