While automotive OEMs, transit agencies, car rental companies, and even energy corporations across the globe plan and launch smart mobility services such as carsharing, ride-hailing, dynamic shuttles, dockless scooters, and more — many of us can’t help but wonder if this marks “the beginning of the end” of car ownership in favor of shared-economy and sustainable transportation.

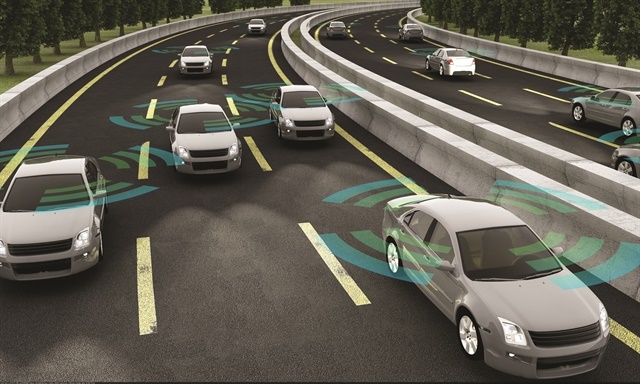

Photo via iStockPhoto/Karneg.

In today’s world of smart transportation, the various methods we use to transport people and goods continue to transform at a rapid pace. While automotive OEMs, transit agencies, car rental companies, and even energy corporations across the globe plan and launch smart mobility services such as carsharing, ride-hailing, dynamic shuttles, dockless scooters, and more — many of us can’t help but wonder if this marks “the beginning of the end” of car ownership in favor of shared-economy and sustainable transportation.

Private vehicles are only used about 5% of the time. Cars, which are known to be the second biggest investment a household can make, can cost around 17% of an average household’s income. So, it’s becoming tough for consumers to justify such a large investment given that they tend to remain parked and unutilized the remaining 95% of the time.

To better understand where the mobility industry is heading next, and what sort of changes we can expect in the coming years due to technological developments, Fleetonomy’s Ofir Gattenyo chatted with industry veterans Steve Girsky, former vice chairman at General Motors, and Mary Chan, former president of global connected consumer at General Motors.

Girsky: This is what I think at a high level: The average American driver spends about 40 minutes a day in a car. Now, if you were a CFO of a company, and one of your people said I’m going to buy an asset and I’m only going to use it 5% of the time, the CEO would move you right out of there and probably fire you.

One of the most exciting things about this technology is that it’s enabling much higher utilization of what’s essentially capital asset. Cars are becoming mobile phones on wheels, this allows you to do more things, changes your user experience, you can update your user experience remotely and get a lot more bang for your buck out of the vehicle.

Gattenyo: As younger generations become more inclined to travel with on-demand transportation such as ride-hailing, e-scooters, and bicycles, they seem less and less eager to own automobiles, or even be able to drive. 2018 showed a downward trend in obtaining a driver’s license among young Americans (16-24), and the numbers are only expected to continue dropping. Similar transformations of our time have already been witnessed in the way that people around the world listen to music, watch videos and even rent apartments.

Consumer demand seems to be shifting towards shared economy transportation, what are companies mainly focusing on in today’s smart mobility industry?

Chan: I think the main focus is on driving higher efficiency in shared economy business models. To have a meaningful subscription model you really have to have a robust user experience in terms of providing the right supply when the user wants it, having the capacity, and keeping the cost substantially better than what they have today.

Girsky: One of the things that you learn is that all companies are different and move at different speeds. New automotive companies seem to move faster than others depending on where they are. GM, for example, was very early in adopting connectivity in the car. Others are focusing on electrification and some have a “wait and see” attitude. That said, I think the world is opening everybody’s eyes to the fact that they need to try new things and there are new smart management platforms that can offer a substantial payback early on whether you are a rental car company, automotive OEM, car dealer or fleet operator.

Gattenyo: While the industry is using electrification as a stepping stone to the autonomous vehicle era, fleet managers must keep up and aim towards higher consumer utilization in order to run efficient and cost-effective operations.

What are your thoughts on electrification when examining some of the current business models?

Steve Girsky, former vice chairman at General Motors.

Photo courtesy of Ofir Gattenyo.

Chan: For electrification to really make it for consumers and be more cost effective you obviously have to drive utilization higher than 5%. So, this whole concept of the fleet, in a shared economy, where people are utilizing the vehicle a lot more than 5% could really justify the additional equipment and all the things that you bolt into the EV as part of the cost equation.

The cost of the traditional ICE versus the EV takes a long time for the payback to show because the cost of the battery is higher. So, the tradeoff is really not there in an immediate sense. The only way the tradeoff is going to be there is if you can drive utilization higher when looking at the bigger picture.

The industry is looking at this as the future of mobility. When the vehicle is not offered in an ownership model like we are used to today but is available in a shared model, there are going to be a lot more companies interested in figuring out how to manage that fleet in the marketplace.

For instance, how do you make sure that the fleet is optimized for where the traffic demand is going to be? I think that AI and data that goes through a management platform is really going to add to the business intelligence of some of these car companies.

Gattenyo: What do you see players in the industry doing in order to harness these new technological abilities? What kind of technologies are they looking for?

Girsky: I always found the concept of white labeling a fleet solution across a number of customers interesting. The technology allows mobility operators to aggregate more data in the backend, but from the brand experience, it can be very specific.

Chan: No car company is going to build this as a vertical solution, and they can go to a third party and receive a very simplified end-to-end fleet management solution. I put more faith in the backend piece of the solution. It depends on the OEMs — they may want to choose their own interface, but the backend solution should be a very common algorithm.

Gattenyo: As next-generation fleet management solutions have moved from being tested by innovation departments to actual deployments within formal business units, the shift to providing on-demand services seems more present than ever.

Mobility operators are testing how they can provide a better experience for their customers while simultaneously creating immediate profit by improving fleet utilization, and some companies are already ahead in the game. Who, in your opinion, is leading the revolution and how are they doing it?

Girsky: Key players could be anybody from car companies, fleet managers, rental companies, and dealers, but this stuff also enables people who are not traditionally in the business.

You can see car dealers starting to get into subscription model services, so I think this also lowers entry barriers for certain companies and creates profit opportunities for others to better utilize existing assets. For example, if you’re a car dealer then you sell used cars, new cars, parts, service, and financing. Now, if you can add a shared model on top of that it can create an opportunity to sustain your business and position it in the new market.

Gattenyo: Many companies are still struggling to execute profitable business models from these services. For instance, this past January Ford’s dynamic shuttle service Chariot was shut down due to failing ridership numbers.

Where does that leave mobility operators that are integrating AI and Machine Learning into their systems?

Mary Chan, former president of global connected consumer at General Motors.

Photo courtesy of Ofir Gattenyo.

Girsky: In my opinion, stuff traditionally in the car business takes a lot longer than anybody thinks. So, people who are getting into it now have a big learning curve. The payback may take a little longer than they think but it is going to be there.

I think we are going to improve utilization and do a lot of things with data that will improve the customer experience, but it will take longer than people think. So, there are first-mover advantages in understanding the friction points early on.

Chan: The usage model would also change as you get more and more vehicles in a fleet or shared economy taking a larger percentage of the marketplace. Really being able to collect data and predict how people are going to utilize the fleet more efficiently is going to create value for mobility operators.

Traditionally, car companies don’t have that data today and service companies will end up losing their direct relationship with the consumers if they don’t shift into these new services.

Ofir Gattenyo is the Marketing Manager for Fleetonomy, providers of a cloud-based, end-to-end fleet management platforms for automotive OEMs, car rental companies, and smart mobility operators designed to maximize fleet operation efficiency, reduce operational costs, and create new revenue streams based on new smart mobility services.