This story was delivered to BI Intelligence Transportation and Logistics Briefing subscribers hours before it appeared on Business Insider. To be the first to know, please click here.

US ride-hailing giant Uber revealed its Q4 and full-year 2017 financials earlier this week. Below are some of the highlights:

- The company’s losses narrowed nearly 25% from $1.46 billion in Q3 to $1.1 billion in Q4. The good news comes after two consecutive quarters in which the ride-hailing giant’s losses widened considerably.

- Uber’s Q4 revenue came in at $2.26 billion, a 12% increase from the priorquarter’s $2 billion. Interestingly the company’s UberEATS food delivery business made up 10% of this figure, according to the initial report from The Information, indicating the business unit is quickly becoming a key driver of the firm’s overall revenue. UberEATS is also already profitable in 40 cities in the US.

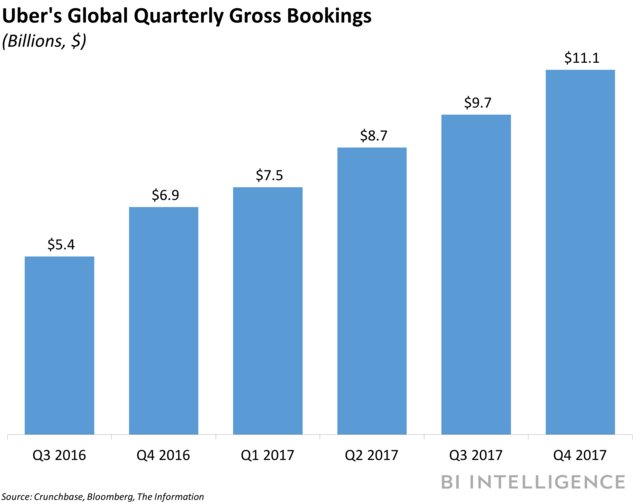

- In addition, Uber reported that it earned $11.06 billion in gross bookings — the money it brings in before paying its drivers — which is up about 14% from Q3.This means the ride-hailing company’s growth in gross bookings accelerated slightly from the prior quarter when they grew about 11%.

- For all of 2017, the company lost $4.5 billion on revenue of $7.5 billion. For context, in 2016, the firm brought in $6.5 billion and lost $2.8 billion, although it’s difficult to compare the two years since Uber changed its accounting practices midway through 2017. In addition, the firm’s full-year financials show its gross booking rose at least 10% during each quarter last year. These figures indicate the company continues to bring in more business, even as it struggles to cut down its expenses.

Uber appears committed to taking the long road toward profitability, rather than trying to get there as soon as it can by sacrificing its long-term R&D projects and presence in international markets. At a Goldman Sachs conference earlier this week, CEO Dara Khosrowshahi said Uber could right now “turn the knobs” to become profitable, but it would have to sacrifice innovation — likely its self-driving technology efforts — and its presence in Asian markets.

Given Uber’s extensive efforts to retain a place in the autonomous car race, the company is clearly unlikely to pull back in this area. In addition, despite leading shareholder SoftBank’s reported desire for Uber to narrow its focus on the core markets of Europe and the Americas, Khosrowshahi said the company won’t stop investing in Asian markets anytime soon. In particular, Uber faces stiff competition for market share from Singapore-based Grab in Southeast Asia and Ola in India. As long as these competitive battles require massive investment on Uber’s part, it’s unlikely to reach profitability soon. Instead, the best case scenario is that it will gradually narrow its losses the way it did this past quarter, even as it looms closer to a potential IPO.

To receive stories like this one directly to your inbox every morning, sign up for the Transportation and Logistics Briefing newsletter. Click here to learn more about how you can gain risk-free access today.