Panasonic sells more lithium-ion batteries as production at the Tesla Gigafactory “significantly increased.”

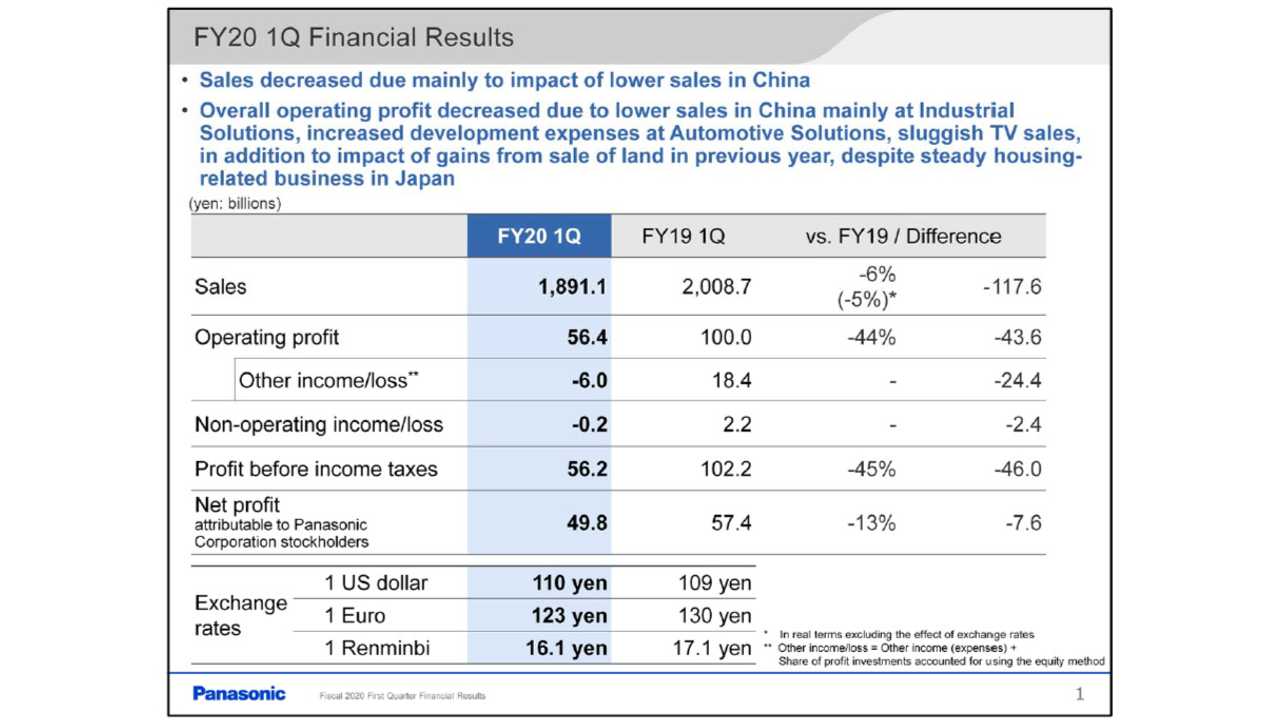

Panasonic recently released financial results for the second quarter of 2019 revealing that overall sales decreased 6% year-over-year, which also has affected net profits (down 13% year-over-year).

Our focus is on the Automotive category, which includes lithium-ion batteries. Here, thankfully, sales increased 6%, but operating profit remains negative.

The Japanese company is struggling with lower sales of various products in China as well as higher development expenses. Let’s now jump to the details in the battery segment below.

Panasonic Q2 2019 results

Segment info

Panasonic reports an increase of battery sales (both the prismatic and cylindrical cell types) due to previous investment in production capacity, at similar to past year profits.

Not everything is smooth though, as sales of cylindrical cells produced in Japan (the 18650) decreased. We are convinced that it must be directly related to noticeably lower sales of Tesla Model S and Tesla Model X. Without the drop, Panasonic probably would be able to increase the profits (finally).

The good news is higher sales of prismatic cells and significantly higher sales of cylindrical cells produced at the Tesla Gigafactory in Nevada, jointly with Tesla.

The next moves will be:

- enhancing the competitiveness of prismatic types, through an investment to expand production at factories in Dalian, China and Himeji, Japan

- improvement of profitability of cylindrical types, by improving productivity at the North America factory

Well, it seems that the Tesla Gigafactory is expanding towards the promised 35 GWh annually.