After a few rough weeks on the market, Tesla’s stock (TSLA) is rising today following the announcement of the automaker’s new insurance division and a positive outlook on Tesla’s market in Europe.

Yesterday, Tesla launched its own insurance program and claimed it will offer up to 30% cheaper rates.

So far, it’s only available in California and early quotes from local owners have been hit or miss. It’s indeed cheaper for some, but it is more expensive for others.

Wedbush Securities analyst Dan Ives is also out with a new note to clients today with a look at Tesla’s demand in Europe.

Their channel checks showed a high volume of Tesla vehicles going to Europe:

“We expect a stream of cargo ships to hit Zeebrugge over the coming weeks as the flagship Model 3 is delivered to customers throughout Europe.”

Despite starting European Model 3 deliveries months ago, Wedbush believes that there’s still a significant backlog of Model 3 demand in some European markets.

He added:

“Norway, the Netherlands, and Germany are front and center as the countries with good pent up demand so far for Model 3’s in Europe with orders/lease driven demand being filled over the next month in the region,”

However, Wedbush remains conservative on Tesla’s stock. They hold a ‘neutral’ rating with a $220 price target.

Tesla’s stock (TSLA) was up by as much as 3% this morning.

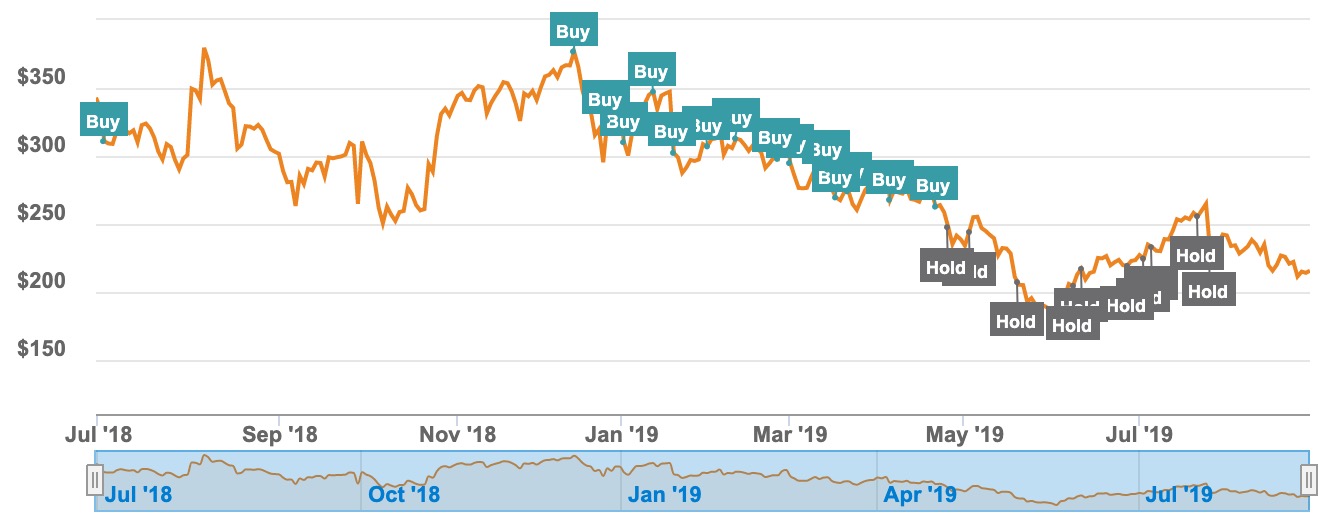

Dan Ives is ranked #1,378 out of 5,263 Analysts on TipRanks with a 52% success rate and an average return of 2.9%. He turned more conservative on Tesla’s stock earlier this year:

Electrek’s Take

Tesla’s stock took a beating after the last earnings and it was partly due to bad timing with the broader market also sliding over other issues.

I am long TSLA and I expect the next few months to be solid.

I agree with Ives that demand in Europe for Model 3 is still strong. I think Tesla only scratched the surface with Model 3 in some European markets.

But the difference-maker is going to be China with the start of production at Gigafactory 3.

That will bring a lot more demand, but the timing is not clear.

I doubt Tesla will achieve 3,000 units per week by the end of the year, but if they can achieve even just 1,000 units per week, it would make a big difference for Tesla’s global business.

What do you think? Let us know in the comment section below.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.