Robust performance leads to upgrading 2019 guidance

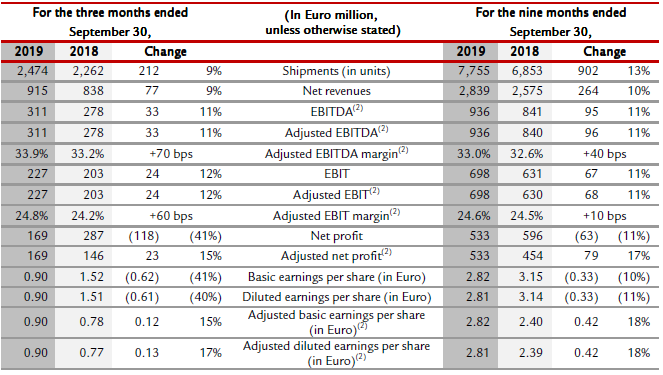

Ferrari N.V. (NYSE/MTA: RACE) today announces its consolidated preliminary results(5) for the third quarter and nine months ended September 30, 2019, summarized as follows:

- Total shipments of 2,474 units, up +9.4%

- Net revenues of Euro 915 million, up +9.2% or +7.1% at constant currency(1)

- Adj. EBITDA(2) of Euro 311 million, up +11.5% with an EBITDA margin of 33.9%

- Adj. diluted EPS(2) of Euro 0.90 (+16.9%)

- Industrial free cash flow(2) generation of Euro 138 million

The Guidance 2019 is upgraded as follows:

- Net revenues: ~Euro 3.7 billion (from > Euro 3.5 billion)

- Adj. EBITDA: ~Euro 1.27 billion (from Euro 1.2-1.25 billion)

- Adj. EBIT: ~Euro 0.92 billion (from Euro 0.85-0.9 billion)

- Adj. diluted EPS: Euro 3.70-3.75(3) per share (from Euro 3.50-3.70(4) per share)

- Industrial free cash flow: > Euro 0.6 billion (from > Euro 0.55 billion)

Maranello (Italy), November 4, 2019 – Ferrari N.V. (NYSE/MTA: RACE) (“Ferrari” or the “Company”) today announces its consolidated preliminary results(5) for the third quarter and nine months ended September 30, 2019.

Shipments(6)(7)

Shipments totaled 2,474 units in the third quarter 2019, up 212 units or +9.4% vs. prior year. This achievement was driven by a 9.5% increase in sales of our 8 cylinder models (V8) and an 8.9% increase of our 12 cylinder models (V12). The performance was mainly led by robust deliveries of the Ferrari Portofino as well as the 812 Superfast. This was partially offset by lower volume from the 488 family, with the 488 GTB and the 488 Spider now phased out, partially compensated by the 488 Pista and the ramp up of the 488 Pista Spider. Very first deliveries of the Ferrari Monza SP1 and SP2 also began towards the end of September.

EMEA(7) grew 13.7%, Americas(7) was substantially flat, while Mainland China, Hong Kong and Taiwan were down by a few units as per the decision to concentrate client deliveries in the first part of the year to anticipate the early introduction of new emission regulations. Rest of APAC(7) was up 23.1%.

Total net revenues

Net revenues for the third quarter 2019 increased to Euro 915 million, up 9.2% at current currency and up 7.1% at constant currency(1). The increase of revenues in Cars and spare parts(8) to Euro 708 million (+14.8% at current currency or +12.5% at constant currency(1)) was supported by the Ferrari Portofino, the 812 Superfast, the 488 Pista and the ramp up of the 488 Pista Spider. This was partially offset by lower sales of the 488 GTB and the 488 Spider, now phased out, as well as deliveries of the strictly limited edition Ferrari J50 in 2018. Revenue growth was also supported by a positive contribution from personalization programs. Engines(9) revenues (Euro 46 million, – 34.3% at current and constant currency(1)) continued to decline reflecting lower shipments to Maserati. Sponsorship, commercial and brand(10) revenues (Euro 135 million, +5.8% at current currency or +3.9% at constant currency(1)) slightly increased due to higher revenues generated by Formula 1 racing activities. Currency, including translation and transaction impacts as well as foreign currency hedges, had a positive impact of Euro 17 million (mainly USD).

Adjusted EBITDA(2) and Adjusted EBIT(2)

Q3 2019 Adjusted EBIT(2) was Euro 227 million, +11.7% at current currency or +4.4% at constant currency(1) due to higher volumes (Euro 20 million) and a positive Mix / price variance (Euro 23 million). This performance was also attributable to the impact of the personalization programs and the very first deliveries of the Ferrari Monza SP1 and SP2. Industrial costs / research and development costs increased (Euro 40 million), mainly to support the innovation activities on our product range and components, Formula 1 racing activities and higher operational start up expenses in connection with the introduction of new models. SG&A (up Euro 8 million) reflected new product launches and the Company’s organizational development. Other (Euro 14 million) also included a release of provisions related to favorable developments in emissions regulations that occurred in Q3 2019.

The tax rate in the quarter was 20% mainly as a result of the previously disclosed advance agreement on the Patent Box.

As a result of the items described above, Adjusted diluted earnings(2) per share for the second quarter reached Euro 0.90, up 16.9% vs. prior year.

Industrial free cash flow(2) for the three months ended September 30, 2019 was Euro 138 million, mainly driven by the Adjusted EBITDA(2), partially offset by capital expenditures of Euro 145 million.

Net Industrial Debt(2)(12) as of September 30, 2019 – after Euro 303 million of share repurchases accomplished during the first nine months of 2019 and Euro 195 million dividend distribution – was Euro 369 million, which compares with Euro 370 million as of December 31, 2018. Lease liabilities per IFRS 16 as of September 30, 2019 remained close to stable at Euro 63 million.

Third quarter 2019 highlights

Universo Ferrari – the first event dedicated exclusively to Ferrari in its hometown

On September 2, 2019 the first exhibition dedicated to the world of Ferrari in Maranello, Universo Ferrari, opened its doors. Over 14,000 customers, prospects and Ferrari enthusiasts visited the Universo Ferrari during the entire month of September having the chance to experience the many facets of the marque in a holistic manner.

The Ferrari F8 Spider and the Ferrari 812 GTS

On September 9, 2019 the Company unveiled the 812 GTS, which made its return 50 years after the debut of the last sport front mounted V12 spider. The model was revealed during the Universo Ferrari event held in Maranello. The exhibition was also the stage for the launch of the F8 Spider, the new generation drop-top sports car equipped with the most successful mid-rear-mounted V8 in history.

Subsequent events:

Under the common share repurchase program, from October 1, 2019 to October 25, 2019, the Company has purchased a further 316,283 common shares for a total consideration of Euro 43.3 million. At October 25, 2019 the Company held in treasury an aggregate of 8,373,857 common shares. As of the same date, the Company held 3.26% of the total issued share capital including the common shares and the special voting shares, net of shares assigned under the Company’s equity incentive plan.

Brand Diversification

Strategy On November 4, 2019, during the Q3 2019 earnings call, management will present a synopsis of the Ferrari’s finalized brand diversification strategy.

Capex and R&D

Non-GAAP financial measures

Operations are monitored through the use of various non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies.

Accordingly, investors and analysts should exercise appropriate caution in comparing these supplemental financial measures to similarly titled financial measures reported by other companies.

We believe that these supplemental financial measures provide comparable measures of financial performance which then facilitate management’s ability to identify operational trends, as well as make decisions regarding future spending, resource allocations and other operational decisions.

Certain totals in the tables included in this document may not add due to rounding.

Total Net Revenues, EBITDA, Adj. EBITDA, EBIT and Adj. EBIT at constant currency eliminate the effects of changes in foreign currency (transaction and translation) and of foreign currency hedges.

EBITDA is defined as net profit before income tax expense, net financial expenses and depreciation and amortization.

Adjusted EBITDA is defined as EBITDA as adjusted for certain income and costs which are significant in nature, expected to occur infrequently, and that management considers not reflective of ongoing operational activities.

Adjusted Earnings Before Interest and Taxes (“Adjusted EBIT”) represents EBIT as adjusted for certain income and costs which are significant in nature, expected to occur infrequently, and that management considers not reflective of ongoing operational activities.

Adjusted net profit represents net profit as adjusted for certain income and costs (net of tax effect) which are significant in nature, expected to occur infrequently, and that management considers not reflective of ongoing operational activities.

Adjusted EPS represents EPS as adjusted for certain income and costs (net of tax effect) which are significant in nature, expected to occur infrequently, and that management considers not reflective of ongoing operational activities.

Basic and diluted EPS(14)

Net Industrial Debt, defined as total Debt less Cash and cash equivalents (Net Debt), further adjusted to exclude the debt and cash and cash equivalents related to our financial services activities (Net Debt of Financial Services Activities).

Free Cash Flow and Free Cash Flow from Industrial Activities are two of management’s primary key performance indicators to measure the Group’s performance. Free Cash Flow is defined as cash flows from operating activities less investments in property, plant and equipment and intangible assets. Free Cash Flow from Industrial Activities is defined as Free Cash Flow adjusted to exclude the operating cash flow from our financial services activities (Free Cash Flow from Financial Services Activities).

On November 4, 2019, at 3.00 p.m. CET, management will hold a conference call to present the Q3 2019 results to financial analysts and institutional investors. The call can be followed live and a recording will subsequently be available on the Group website http://corporate.ferrari.com/en/investors. The supporting document will be made available on the website prior to the call.

1 The constant currency presentation eliminates the effects of changes in foreign currency (transaction and translation) and of foreign currency hedges

2 Refer to specific note on non-GAAP financial measures

3 Calculated using the weighted average diluted number of common shares for 2019 as at October 25, 2019 of 187,864 thousand and excluding net profit attributable to non-controlling interests.

4 Calculated using the weighted average diluted number of common shares for 2018 and excluding net profit attributable to non-controlling interests

5 These results have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board and IFRS as endorsed by the European Union

6 Excluding the XX Programme, racing cars, Fuori Serie, one-off and pre-owned cars

7 EMEA includes: Italy, UK, Germany, Switzerland, France, Middle East (includes the United Arab Emirates, Saudi Arabia, Bahrain, Lebanon, Qatar, Oman and Kuwait) and Rest of EMEA (includes Africa and the other European markets not separately identified); Americas includes: United States of America, Canada, Mexico, the Caribbean and Central and South America; Rest of APAC mainly includes: Japan, Australia, Singapore, Indonesia, South Korea, Thailand and Malaysia

8 Includes the net revenues generated from shipments of our cars, including any personalization revenue generated on these cars and sales of spare parts

9 Includes the net revenues generated from the sale of engines to Maserati and the revenues generated from the rental of engines to other Formula 1 racing teams

10 Includes the net revenues earned by our Formula 1 racing team through sponsorship agreements and our share of the Formula 1 World Championship commercial revenues and net revenues generated through the Ferrari brand, including merchandising, licensing and royalty income

11 Primarily includes interest income generated by our financial services activities and net revenues from the management of the Mugello racetrack

12 Net Industrial Debt redefined as Net Debt less Net Debt of Financial Services Activities

13 Capitalized as intangible assets.

14 For the three and nine months ended September 30, 2019 and 2018 the weighted average number of common shares for diluted earnings per share was increased to take into consideration the theoretical effect of the potential common shares that would be issued under the Company’s equity incentive plans (assuming 100 percent of the related awards vested).

15 Free Cash Flow from Industrial Activities for the three and nine months ended September 30, 2018 include Euro 1 million of quick refund to shareholders due to eligibility for withholding exemption.