Zhejiang Geely Holding Group Co. held informal talks about the potential takeover of

Fiat Chrysler Automobiles NV before the Chinese manufacturer turned its attention toward Daimler AG, according to people familiar with the matter.

Li Shufu, the Chinese billionaire who controls Geely, approached the Italian-American carmaker in the middle of last year as he was scouting for options to expand outside China, said the people, who asked not to be identified as the move wasn’t disclosed. Li opted not to make a formal offer as the two parties had different views on future valuations of Fiat Chrysler after the company’s five-year growth plan through 2018, they said.

Representatives for Geely and Fiat Chrysler declined to comment.

Having moved on from Fiat Chrysler, Li announced the purchase of a 7.3 billion-euro ($9 billion) stake in

Daimler last week. With that deal — the biggest investment by a Chinese company in an international automaker — Geely has become the German company’s largest shareholder. Geely already owns Volvo Car AB and last year agreed to buy an almost $4 billion stake in truckmaker

Volvo AB.

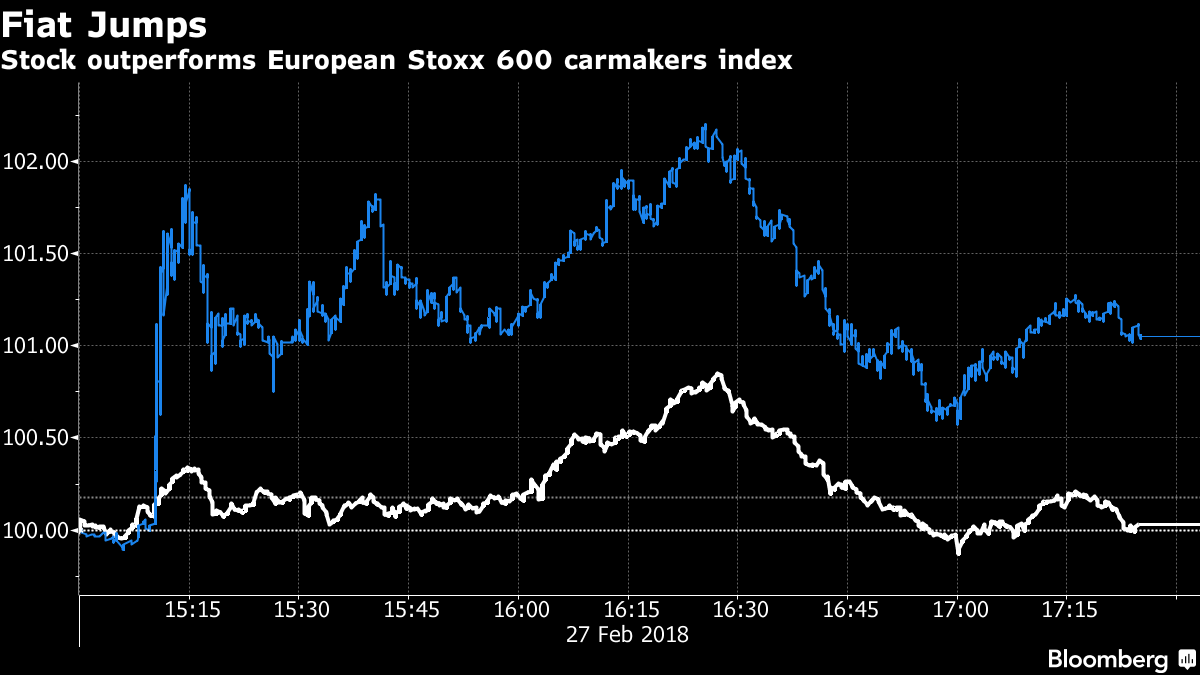

Fiat Chrysler has a market value of 27 billion euros, after the shares advanced 70 percent in the past 12 months. The stock rose as much as 2 percent in Milan, and was up 0.8 percent to 17.66 euros Tuesday afternoon in Milan, for the second-highest gain on the STOXX 600 Automobiles and Parts index.

Duplicate Technology

As Geely and other Chinese automakers seek to expand in Europe and the U.S., Fiat Chrysler Chief Executive Officer Sergio Marchionne has been a vocal proponent of consolidation, arguing that the industry wastes money by developing multiple versions of the same technology. However, since

General Motors Co. rebuffed his idea for a merger in 2015, the CEO has switched focus to cutting debt and has said the carmaker no longer needs a partner.

Fiat Chrysler is making progress toward a target to almost double profit by the end of this year from 2016, while the stock has also gained on speculation the company

was courted by Chinese competitors. Great Wall Motor Co. said in August it was interested in the carmaker and specifically in buying its Jeep unit.

Fiat CEO Sees Room to Double Profit by 2022 on Global Jeep Push

Fiat Chrysler said in August it was “not approached” by Great Wall Motor and that the carmaker is “fully committed” to a five-year plan through 2018.

The size of China’s car market has already surpassed the U.S. It’s one area where local companies like Geely and Great Wall Motor are encouraged by the government to go overseas to secure key technologies and access to resources.

— With assistance by Tommaso Ebhardt, Ying Tian, and Ruth David