Hyundai bets on mostly battery-electric cars in its new strategic plan.

Hyundai recently announced a bold business plan – “Strategy 2025” – which outlines the goals for 2025 and beyond. Electrification is one of the three strategic directions.

The South Korean brand aims to become one of the top three EV manufacturers by 2025. Sales of all-electric and hydrogen fuel cell cars are expected to reach hundreds of thousands annually by 2025:

- BEVs: 560,000

- FCVs: 110,000 (about one-fifth of BEVs)

- PHEVs: an undisclosed number

- Total 670,000 annually

Hyundai would like to “offer most new models with EV drivetrain by 2030, 2035 in emerging markets”, which clearly hints at electrification of the entire lineup.

“In particular, Hyundai aims to secure leadership in electrification by selling 670,000 electric vehicles annually and become one of the world’s top three manufacturers of battery and fuel cell EVs by 2025.”

“In particular, Hyundai will address vehicle electrification by first targeting younger demographics and enterprise customers with affordable battery electric vehicles (BEVs) to achieve economies of scale. By 2025, the company aims to sell 670,000 electric vehicles annually, comprising 560,000 BEVs and 110,000 fuel-cell electric vehicles (FCEVs). The goal is to electrify most new models by 2030 in key markets such as Korea, US, China, and Europe, with emerging markets such as India and Brazil following suit by 2035.”

The premium/luxury brand Genesis is scheduled to introduce its first all-electric model in 2021 (adding new models in the following years). The first EVs are expected also from the high-performance N brand, but no details were provided.

“The Genesis brand will launch its first fully-electric models in 2021, before expanding its electric lineup in 2024. The high-performance N brand also plans to launch SUVs and EVs, further boosting Hyundai’s competitiveness in electrification.

To keep the cost at a reasonable level, the South Korean group (which includes the Kia brand) is working on a new global modular EV platform:

“For cost innovation, the company will adopt a new global modular EV architecture to enhance efficiency and scalability of product development, starting with vehicles being launched in 2024. The company also has plans to revamp its sales model through network optimization and new sales methods, to optimize production based on demand, and to expand partnerships with other OEMs.”

One of the interesting new topics for Hyundai will be the very first Personal Air Vehicle (PAV).

The total investment over a six-year period from 2020 through 2025 will reach KRW 61.1 trillion ($52 billion), which once again shows us how big a transformation is ahead of us in the automotive industry.

To find revenues for all those expenses, Hyundai set a target for the operating margin in the automotive business at 8% and 5% market share by 2025 (compared to 4% in 2018).

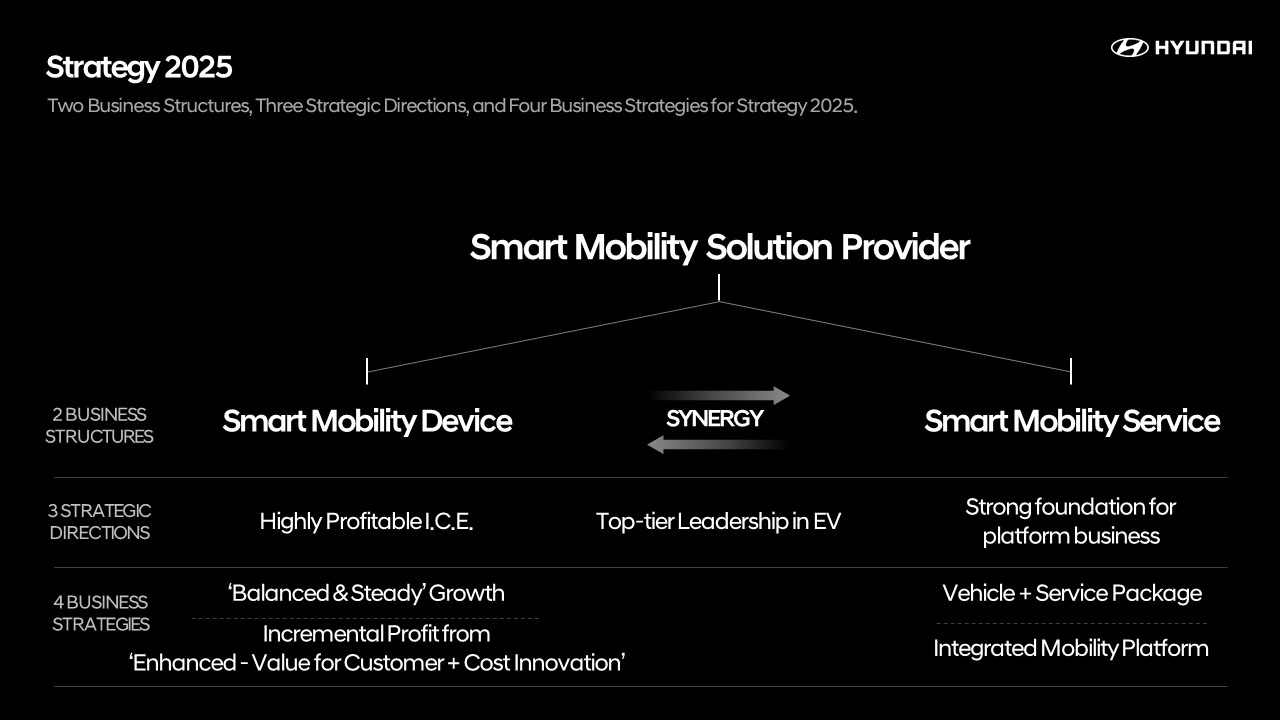

Hyundai Motor Unveils ‘Strategy 2025’ Roadmap to Transition into ‘Smart Mobility Solution Provider’

- Hyundai to transition into Smart Mobility Solution Provider by 2025 with two pillars

– Smart Mobility Device will expand beyond automobiles to include Personal Air Vehicle (PAV), robotics, last-mile mobility

– Smart Mobility Service will offer personalized services and contents on integrated platform - Hyundai announces a set of strategic goals

– achieve balanced and steady growth

– boost profitability with enhanced customer value and cost structure innovations

– sell 670,000 BEVs and FCEVs annually; become top three EV manufacturer by 2025

– offer most new models with EV drivetrain by 2030 in major markets, 2035 in emerging markets - Hyundai identifies financial targets

– Invest KRW 61.1 trillion into R&D and future technologies through 2025

– Target operating margin of 8% in automotive business, 5% market share by 2025

– Buy back KRW 300 billion shares from market through February 2020

SEOUL, December 3, 2019 – Hyundai Motor Company today announced a bold roadmap to secure its position as a frontrunner in the future mobility industry.

Under the new roadmap, named Strategy 2025, the company will foster Smart Mobility Device and Smart Mobility Service as two core business pillars, and the synergy between the two pillars is expected to facilitate the company’s transition into a Smart Mobility Solution Provider.

The Smart Mobility Device business will supply products optimized for the services and lay the groundwork to help foster the service business. On the other hand, the Smart Mobility Service business will provide personalized contents and services on the devices to help secure a broader customer base.

Hyundai’s plans for Smart Mobility Device include a wide range of product groups beyond automobiles such as Personal Air Vehicle (PAV), robotics, and last-mile mobility. Hyundai will reinforce its manufacturing capabilities to build products that offer customers a seamless mobility experience.

*Hyundai Motor will develop Urban Air Mobility (UAM) platform business by combining Personal Air Vehicle (PAV) and mobility services.

Smart Mobility Service is a new area of business for Hyundai that will be fostered as a key strategic pillar for future businesses. Services and contents will be personalized and offered through an integrated platform to maximize value for customers.

The two pillars sit atop three key directions that the company has defined: enhancing profitability in internal combustion engine (ICE) vehicles, securing leadership in vehicle electrification, and laying the groundwork for platform-based businesses.

To materialize Strategy 2025 on the Device side, Hyundai will aim for growth that is balanced and steady, seeking balance between markets as well as models while prioritizing long-term sustainability over short-term targets. The company also plans to boost profitability by simultaneously pursuing enhanced value for customers and innovations in cost structures.

In particular, Hyundai aims to secure leadership in electrification by selling 670,000 electric vehicles annually and become one of the world’s top three manufacturers of battery and fuel cell EVs by 2025.

On the Smart Mobility Service side, the company will aim for a business model that combines product and service and launch an integrated mobility platform to offer customers personalized contents and services.

To this end, Hyundai will earmark KRW 61.1 trillion of investment until 2025 for research and development (R&D) and further exploration of future technologies. In the same timeframe, the company will target an operating margin of 8 percent in its automotive business and aim for a 5 percent share of the global vehicle market.

Separately, Hyundai announced plans to conduct a KRW 300 billion share buyback by February 2020 as part of its continuous efforts to boost shareholder and stakeholder value and enhance transparent communication with the market.

Hyundai’s comprehensive mid- to long-term strategic direction was presented by the company’s President and CEO Wonhee Lee during the “CEO Investor Day” forum held today in Seoul, which was attended by various stakeholders including shareholders and investors.

“The key to our future strategy is to focus on customers and to present the most desirable products and services. We want to offer smart mobility experiences that meet shifting needs of our customers by leveraging advanced technology,” said President Lee. “Transforming into a Smart Mobility Solution Provider with comprehensive mobility solutions that combine devices and services will be the centerpiece of Hyundai’s future strategy”

(1) Smart Mobility Device

In the Smart Mobility Device domain, Hyundai has set out strategies to maintain its competitiveness in the core manufacturing business by bolstering profitability in ICE vehicles and securing leadership in electrification.

The company plans to achieve balanced and steady growth with a portfolio that takes into account various regional and product needs.

In particular, Hyundai will address vehicle electrification by first targeting younger demographics and enterprise customers with affordable battery electric vehicles (BEVs) to achieve economies of scale. By 2025, the company aims to sell 670,000 electric vehicles annually, comprising 560,000 BEVs and 110,000 fuel-cell electric vehicles (FCEVs). The goal is to electrify most new models by 2030 in key markets such as Korea, US, China, and Europe, with emerging markets such as India and Brazil following suit by 2035.

The Genesis brand will launch its first fully-electric models in 2021, before expanding its electric lineup in 2024. The high-performance N brand also plans to launch SUVs and EVs, further boosting Hyundai’s competitiveness in electrification.

The company will also simultaneously implement quality and cost innovations to enhance customer value while innovating cost structures.

Quality innovations will maximize customer value based on three smart elements: innovative digital user experience (UX), artificial intelligence (AI) based connected services, and safety-first autonomous driving. With regards to autonomous driving technology, SAE Level 2 and 3, as well as Advanced Driver Assistance System (ADAS) for parking, will be available in all models by 2025, alongside the company’s aim to develop a full autonomous driving platform by 2022 and begin mass production by 2024. Hyundai’s plan to offer differentiated vehicle features to customers is expected to reduce incentive spending and improve customer perception of the brand.

For cost innovation, the company will adopt a new global modular EV architecture to enhance efficiency and scalability of product development, starting with vehicles being launched in 2024. The company also has plans to revamp its sales model through network optimization and new sales methods, to optimize production based on demand, and to expand partnerships with other OEMs.

(2) Smart Mobility Service

Smart Mobility Service will be a key future growth driver for Hyundai, bringing together device and service to offer customers a personalized mobility lifestyle.

The company plans to leverage its existing customer base to provide services linked to vehicles, including maintenance, repair, financing, insurance, and charging. It will also make efforts to reach a broader group of customers with a more comprehensive range of services. Hyundai will build an integrated mobility platform that analyzes data from in and around the vehicle through car connectivity. Through an enhanced understanding of customers, the company will offer services tailored to the needs of customers in every aspect of their lives, including shopping, delivery, streaming, and multi-modal mobility services.

Strategy 2025 also details regional optimization for Smart Mobility Service. In the US, car sharing and robotaxi service demonstrations will capitalize on the anticipated commercialization of autonomous vehicles of SAE Level 4 or higher. In Korea, Asia, and Australia, Hyundai plans to enter the mobility service market by partnering with leading local players. In Europe and Russia, where the service industry is mature, the company will first focus on businesses that combine products and services.

Organization and management reform plans are also in place for the successful implementation of Strategy 2025. The company will adopt new systems for data-based decision making, employee performance management, process innovation, and next-generation enterprise resource planning (ERP). It will also create a more flexible organizational structure and foster a harmonious corporate culture centered around communication and collaboration.

Hyundai also identified key financial targets required to achieve the goals outlined in Strategy 2025.

Over a six-year period from 2020 through 2025, the company will invest a total of KRW 61.1 trillion, or roughly KRW 10 trillion per year, in R&D and future core technologies to smooth its transition into a Smart Mobility Solution Provider. In particular, KRW 41.1 trillion will be allocated for product and capex to enhance competitiveness in existing businesses, while approximately KRW 20 trillion will be dedicated to future technologies including electrification, autonomous driving, AI, robotics, PAV, and new energy area.

The six-year investment plan has been refreshed and updated from the company’s existing plan – announced in February 2019 – under which the company disclosed a KRW 45.3 trillion spending plan in the 2019-2023 period.

Hyundai’s newly set target for operating profit margin in its automotive division stands at 8 percent by 2025, which rolls over from the previous target of 7 percent by 2022.

Supported by enhanced profitability and cost competitiveness, the company will increase the share of electrified vehicles in its product lineup and lay the groundwork for new mobility service businesses to reach this goal. The successful footprint of the Genesis brand in the global luxury vehicle market is also expected to further enhance the company’s profitability.

An array of cost innovation programs – such as platform integration, standardized vehicle architecture, and commonization of parts – will help boost efficiency in the company’s parts supply chain. Vehicle architecture processes will be optimized by region, and innovative manufacturing technologies will be implemented to further enhance efficiency and profitability.

An improved product mix, combined with competitive new models, will help reduce incentive spending, while pre-emptive quality control efforts will decrease quality-related costs. The company will also pursue increased investment efficiency for the Genesis brand.

Hyundai’s goal to achieve 5 percent market share in the global automotive industry by 2025 is a 1 percentage point increase from roughly 4 percent achieved in 2018. To meet this target, the company will address fluctuating demand in individual markets with regional flexibility and offer competitive mobility services.

Hyundai also announced plans to buy back KRW 300 billion worth of its own shares from the market by February next year as part of its continuous efforts to boost shareholder value and market-friendly policies.

Since first announcing plans to maximize shareholder return in 2014, the company’s dividend gradually increased to KRW 4,000 per share in 2015 compared to KRW 1,950 in 2013. In 2018, Hyundai executed a large-scale share buyback and cancel program, which applied to an equivalent of 3 percent of total outstanding shares.

“Hyundai will always prioritize its customers and strive to connect people’s lives with quality time,” said President Lee. “We will do our utmost to equip ourselves for the future, to lead the future mobility industry, and maximize shareholder value.”

###

About Hyundai Motor

Established in 1967, Hyundai Motor Company is committed to becoming a lifetime partner in automobiles and beyond with its range of world-class vehicles and mobility services available in more than 200 countries. Hyundai sold more than 4.5 million vehicles globally in 2018 and is currently employing more than 110,000 employees worldwide. Hyundai Motor continues to enhance its product line-up with vehicles that are helping to build solutions for a more sustainable future, such as NEXO, the world’s first dedicated hydrogen-powered SUV.

More information about Hyundai Motor and its products can be found at:

http://worldwide.hyundai.com or http://globalpr.hyundai.com

Disclaimer: Hyundai Motor Company believes the information contained herein to be accurate at the time of release. However, the company may upload new or updated information if required and assumes that it is not liable for the accuracy of any information interpreted and used by the reader.