Posted Feb 24 2020 at 8:00 am

The contrast is striking. One after the other, the car manufacturers are announcing sales at half mast, degraded margins, drastic restructuring. Latest, Renault, which is even fell in the red for the first time since 2009. Conversely, the annual results of the tricolor equipment manufacturers published this week show good resistance.

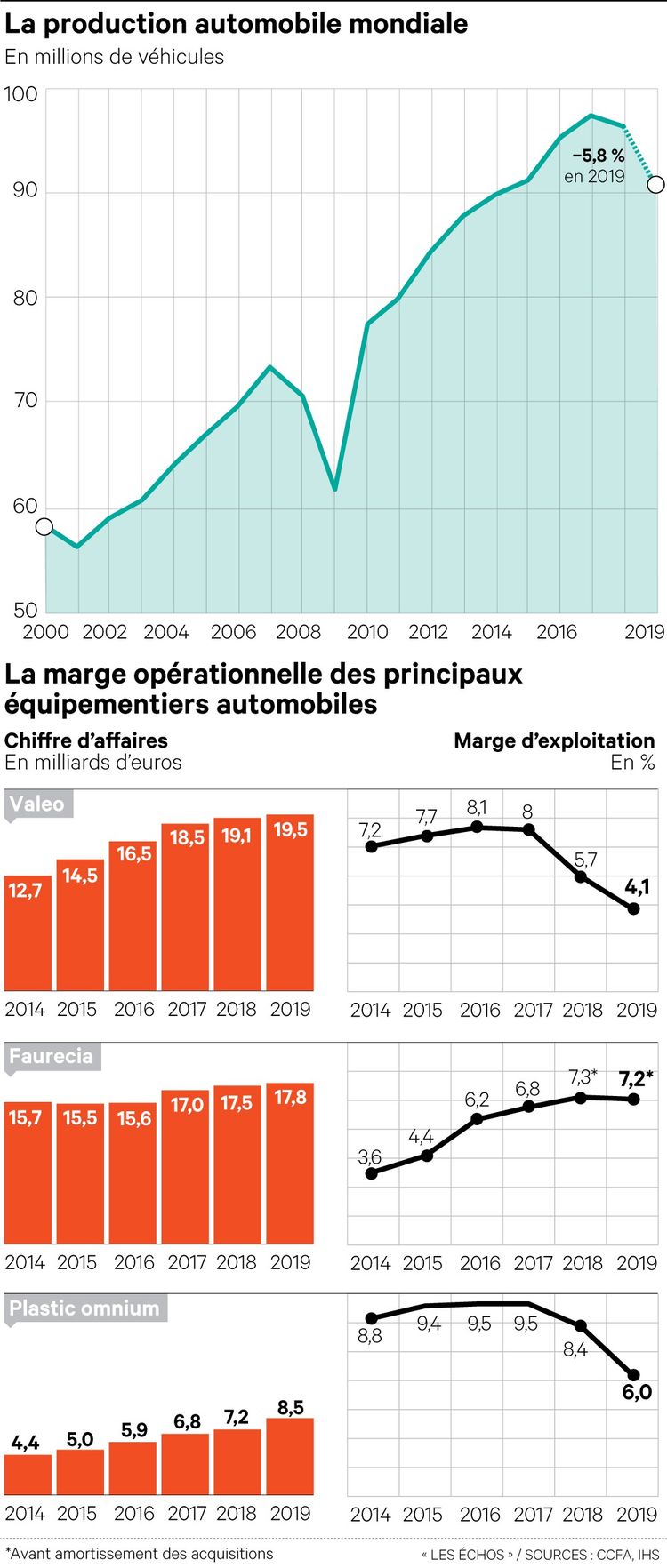

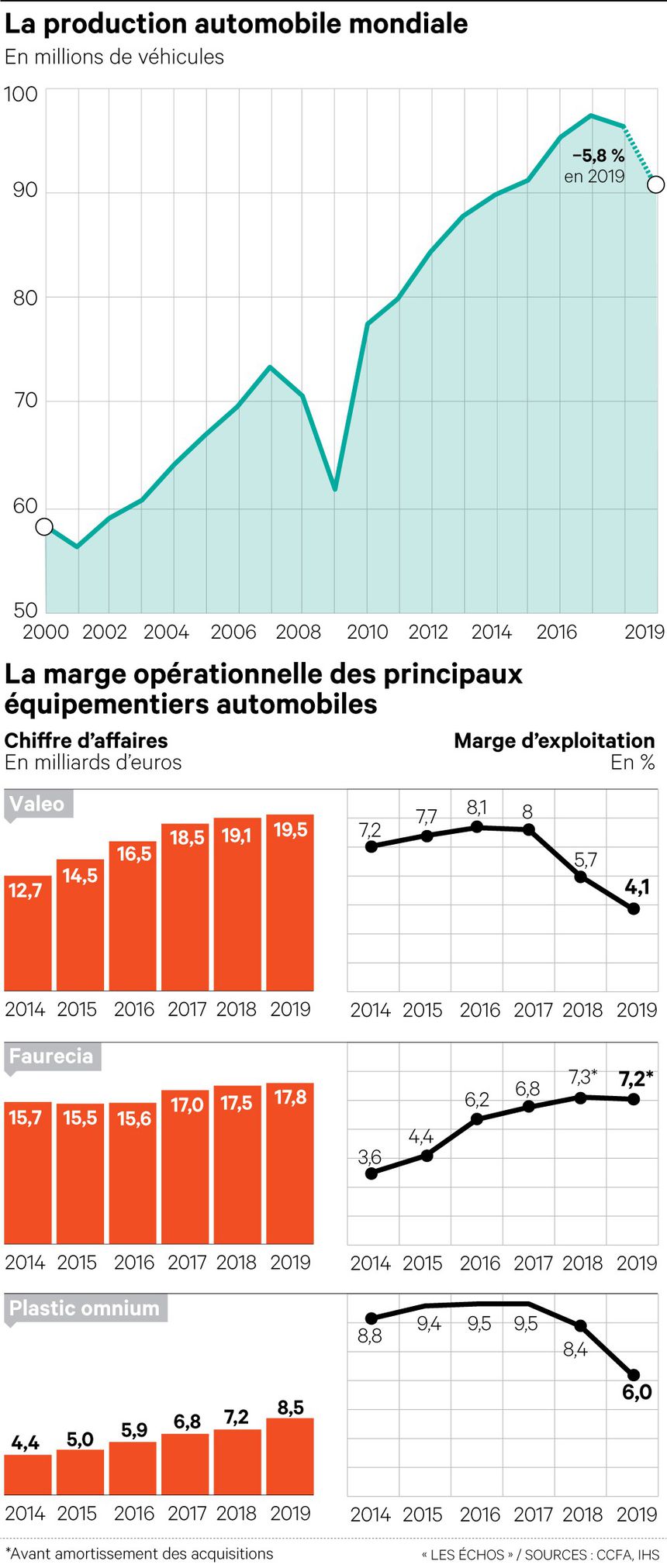

Faurecia, Plastic Omnium and Valeo all gained market share last year. While vehicle sales worldwide fell by 5.8%, Faurecia (seats, interiors and pollution control) saw its sales decrease, at constant scope and exchange rates, by 3% to 17.8 billion euros.

Plastic Omnium (bumpers, tanks and depollution) even saw its revenues increase, by 1.4% (also at constant scope and exchange rates), to 8.5 billion. As for those of Valeo (propulsion systems, thermal systems, lights, driving aids), they remained stable, at 19.2 billion.

General Motors strike

The first two have even managed to preserve their profitability. Faurecia’s operating margin remained at 7.2%. If that of Plastic Omnium fell from 8.4% to 6%, it is due to the mid-2018 acquisition of HBPO, a specialist in car front end modules.

“It is an assembly activity, not production, which is structurally less profitable since it does not require heavy capital investment”, specifies Laurent Burelle, president of the equipment supplier. The group also suffered from the failed start-up of a factory in South Carolina, which cost it $ 90 million – a problem now under control, he said.

Only Valeo saw his performance seriously degraded , with an operating margin fell from 5.7% in 2018 to 4.1% last year. The group led by Jacques Aschenbroich suffered, on the one hand, from the prolonged strike at General Motors, which had an impact of 50 million euros on its result. Above all, Valeo is still weighed down by the results of its joint venture with Siemens, whose losses reached 520 million euros (or, 260 million for Valeo’s share).

Technology platforms

The equipment manufacturer hopes that this company, specializing in the engines of electric cars, will not burn any more cash in 2022, when its 11 billion euros of orders will have started to turn into turnover. “This company is a leader in the electric vehicle, a growing segment, insists Jacques Aschenbroich. I’m not worried, the peak of development is now behind us, we have created standards that will now apply. The group expects a turnover of 600 million in 2020 for the joint venture, and 1.4 billion in 2022.

More generally, equipment manufacturers are counting on the innovation efforts undertaken in recent years to make their mark in a difficult context. Having long invested huge sums in R&D (7.9% of its revenues in 2019), Valeo presented during its investor day in mid-December , twelve technological platforms of the future already industrialized. “We will now be able to reduce the R&D effort and investments,” says Jacques Aschenbroich.

Faurecia has also invested heavily in the electrification of drive modes, as well as in electronics and on-board software, with the ambition to become a leader in the cockpit of the future and in clean mobility . “We have managed to continue the transformation of the group despite the market conditions,” insists its managing director, Patrick Koller.

High growth segments

For this, Faurecia has set up a joint venture in hydrogen with Michelin around Symbio, or bought the Japanese Clarion, specialist in automotive electronics and driving aids. 17% of the orders collected last year concerned these new activities.

Plastic Omnium, which also invests heavily in innovation, in pollution control systems or hydrogen, for example , gained 10 new customers last year, including several exclusively dedicated to the electric car (Polestar, Rivian, etc.).

Thus positioned in the segments promising strong growth, the equipment manufacturers hope to be able to continue to improve their performance even if the downturn in the markets continues. And cross your fingers so that the coronavirus does not turn into berezina for the sector. “There will necessarily be an impact on our results,” says Laurent Burelle. But at this stage, we must beware of all catastrophism. “