(ATTN: CHANGES photo; ADDS details and background throughout)

SEOUL, March 18 (Yonhap) — Shareholders of Hyundai Mobis Co., South Korea’s biggest auto parts maker and a key affiliate of Hyundai Motor Group, on Wednesday approved the reappoinment of the group’s heir apparent to the company’s board to push forward his future mobility initiative.

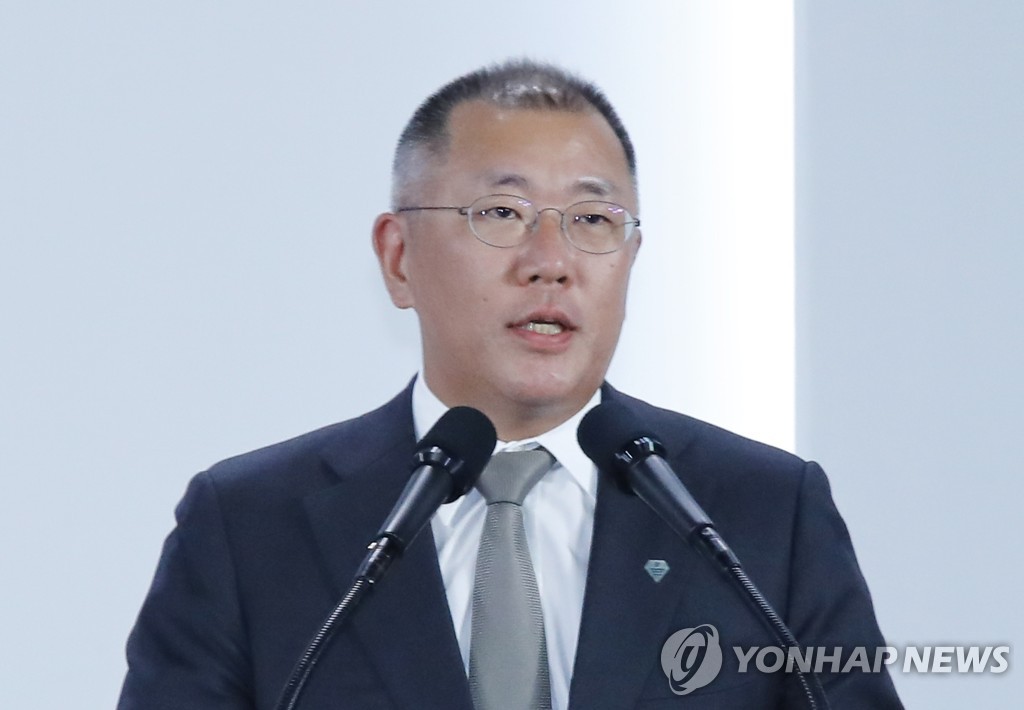

In a general meeting, Hyundai Mobis shareholders voted to accept the company’s board reappointment of Hyundai Motor Group Executive Vice Chairman Chung Eui Sun as executive director by 2022.

The board recommended the executive vice chairman, saying he is “qualified” to lead the de facto holding company of Hyundai Motor Group as he has provided a “vision” in autonomous driving, hydrogen fuel cell and next-generation mobility technologies.

Overseas pension funds that have a stake in Hyundai Mobis expressed concerns that his reappointment as executive director may not guarantee independence of the board.

Shareholders also approved the board’s decision to extend the term of former Opel Chief Executive Karl-Thomas Neumann as an outside director by three years, while approving the appointment of Jang Young-woo, a former head of UBS financial firm in Seoul, as an outside director in charge of protecting shareholders’ rights and interests.

In March last year, the company invited Neumann and U.S. financial expert Brian D. Jones to join its board following a row with U.S. activist hedge fund Elliott Management over its dividend plans and board member appointments in 2018. Jones will serve as an outside director for the next two years.

Elliott’s attacks made Hyundai Motor Group drop its attempt to overhaul its governance structure, a move that could help Chung Euisun take over the country’s second-biggest conglomerate from his father, Chairman Chung Mong-koo.

In an interview with Yonhap News Agency in October last year, Neumann said Elliott provided some of the right influence and input, but from his perspective, the U.S. fund looked like it was taking “a very radical approach” given it asked Hyundai Mobis to pay 2.5 trillion won (US$2.1 billion) in dividends in 2019 for the firm’s earnings results for 2018.

It was far higher than the combined 1.1 trillion won in dividends offered by the company in early 2019 for the following three years.

In January, Elliott reportedly sold all its stakes — 2.9 percent of Hyundai Motor, 2.1 percent of Kia Motors and 2.6 percent of Hyundai Mobis — 20 months after it purchased them for 1.05 trillion won.

In other plans to boost shareholder value, Hyundai Mobis plans to buy back 330 billion won worth of treasury shares this year and cancel 62.5 billion won worth of stocks.

Last year, the company announced it will pay out dividends, buy back shares and cancel stocks that are valued at overall 2.6 trillion won for the next three years.

For 2019, its net profit jumped 22 percent on-year to 2.29 trillion won from 1.89 trillion won. It earns 90 percent of its overall auto parts sales from Hyundai Motor Co. and Kia Motors Corp.

kyongae.choi@yna.co.kr(END)