WM Motor Technology Co., set to take on Tesla Inc. with an electric SUV going on sale this year, is open to holding an initial public offering in the U.S. as its founder shrugs off a potential trade war between the world’s two biggest economies.

The company has a team looking into proposals for an IPO in the U.S., Hong Kong or China, Chief Executive Officer Freeman Shen said, without giving a timing for a listing. WM Motor said in December it has raised a total of 12 billion yuan ($1.9 billion) from investors including Chengwei Capital, Envision Energy, Baidu Capital, SIG Asia and Ameba Capital.

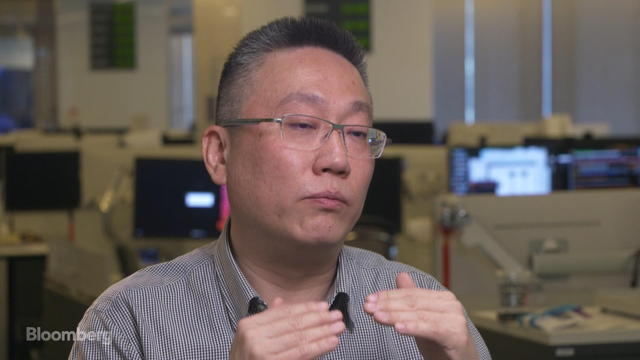

“Our first market will be China, so obviously listing in a market with our target customers will bring a lot of benefits,” Shen, a former Volvo Car AB executive,

told Bloomberg TV in Beijing on Friday. “On the other hand, our team is very global. Listing in the U.S. will also open up a lot of possibilities to work with different partners globally.”

Shanghai-based WM Motor Founder and CEO Freeman Shen speaks about crafting a strategy unique from the likes of Tesla.

(Source: Bloomberg)

WM Motor is set to debut its Weltmeister EX5 electric SUV this year as Shen seeks to capitalize on growing demand for electric vehicles, with the Chinese government pushing gas guzzlers off its roads. The carmaker is challenging local rivals such as NIO, backed by Asia’s biggest technology company

Tencent Holdings Ltd., and

Byton, a Nanjing-based company started by former

BMW AG executives, while preparing to compete with Tesla and giants such as

Volkswagen AG and Toyota Motor Corp.

Shen’s company is betting on lower pricing than some of its rivals to attract users in the fast-growing market. The carmaker has said the EX5 will cost about 200,000 yuan, compared with more than 800,000 yuan for Tesla’s Model X.

WM Motor has no urgency to raise more funds as it has enough to introduce two to three new products over the next few years, Shen said. About

$1 billion was received in WM Motor’s initial round in 2016, a rare feat for a startup’s first round of funding.

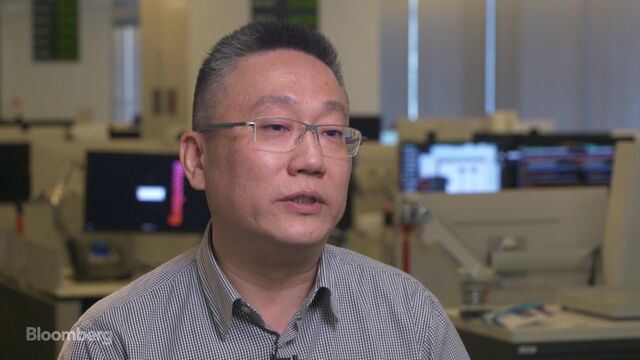

Freeman Shen criticized President Trump and Elon Musk for their recent comments on China’s auto tariffs.

(Source: Bloomberg)

Shen took a differing view from Tesla’s Elon Musk, who criticized China’s 50 percent ownership cap for foreign carmakers in local joint ventures and the country’s 25 percent tariff for imported cars. Shen called the two policies more of a “formality,” saying U.S. auto companies such as General Motors Co. and Ford Motor Co. have been making big profits in China with the help of local partners, while the number of cars traded between the two countries is very limited.

Despite its electric-car market leadership in the U.S., Tesla risks remaining a niche brand in China if it cannot deliver a mass-market model and secure local production to evade the tariff. The company’s negotiations with the Chinese government on setting up a plant in Shanghai have stalled as the sides haven’t reached agreement on tariffs and ownership structure.

— With assistance by Yan Zhang, Emma O’Brien, Dong Lyu, Haze Fan, and Ying Tian