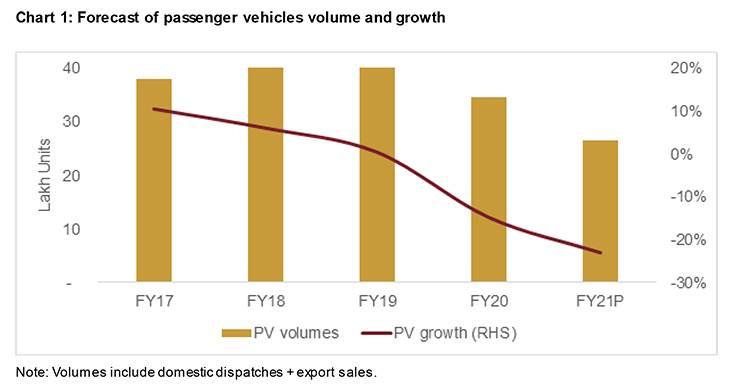

Ratings agency CRISIL expects passenger vehicles (PVs) sales volume (including exports1) to plunge by 22-25% this fiscal to a decadal low of ~26.5 lakh units. That would mark the second straight year of double-digit volume decline after the 15% fall seen in fiscal 2020.

Yet the credit quality of most passenger vehicle (PV) makers (original equipment manufacturers, or OEMs) would remain stable because of strong balance sheets and healthy liquidity. In some cases, support from strong parent/group will help navigate the rough terrain.

CRISIL analysed eight PV makers (including two that are into diverse segments), accounting for ~80% of industry sales volume. The agency has rated six of these, which accounted for ~73% of the sales volume in fiscal 2020.

-2.jpg)

CRISL says it has assumed a ~60% fall in domestic despatches in the first half of this fiscal in line with staggered opening of dealerships from May 2020, followed by a 6-8% revival in balance half of the fiscal, driven largely by improved rural demand. This along with ~15% drop in export volumes will lead to ~22-25% fall in overall sale volume in fiscal 2021. Another fallout of the pandemic is that used vehicles and new small PVs may find increased preference in fiscal 2021, after demand had swung in favour of affordable sports utility vehicles in the past 2-3 years.

According to Anuj Sethi, Senior Director, CRISIL Ratings, “With muted income growth, discretionary spending will take a backseat this fiscal. Small PVs and used vehicles will find favour owing to better affordability. Also, given increasing awareness about social distancing, consumers may reduce, if not avoid, travel by public, pooled and shared transport in the short term. However the benefit from change in commuting-pattern will only partly offset the steep downturn”.

Operating profitability of PV makers will be curtailed this fiscal because of production loss during the lockdown, fixed overheads and lower operating rates, notwithstanding soft input prices and pruned marketing spends. PV makers will continue offering discounts through the first half, and partly absorb higher cost of BS-VI (Bharat Stage VI) variants given tepid demand.

The impact of this will be ~150-200 basis points, with operating profitability settling at 6-7% this fiscal for the sample set, owing to low operating leverage, with ~80% of cost pertaining to raw materials.

Aparna Kirubakaran, Associate Director, CRISIL Ratings, said: “The eight PV makers had ~Rs 50,000 crore of surplus liquidity as of March 2020, which will help them tide over these difficult times. Also, the average debt-to-Ebitda of these players is estimated at ~1.1 time at end of fiscal 2020. This ratio is likely to go up, but remain adequate at close to 2 times by end of fiscal 2021, supported by pruning of capital spend by at least ~25-30%.”

The extent of the Covid pandemic, and ability of the component supply chain and automotive dealerships to stabilize operations will remain key monitorables.

Also read: India auto retail sales for May 2020 at 202,697 units, down 89%

/news-national/passenger-vehicle-volumes-to-plunge-to-10year-low-in-fy2021-crisil-56566 PV sales in India to fall by 25% in FY2021 to 26.5 lakh units Passenger vehicle volumes to plunge to 10-year low in FY2021: CRISIL https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/92564aa0-6777-4ff1-837d-f00719a0cca1.jpg