The past few days have seen news about inordinate delays in Indian industry receiving import consignments from China, possibly a result of the collateral damage in the relationship between the two countries as a result of recent clash in Ladakh.

It is understood that import consignments from China are being subjected to 100 percent manual inspection, which is resulting in inordinate delays in clearance. While there is no official government for such manual checks, the much-delayed consignments are bad news for India Auto Inc and the supply chain.

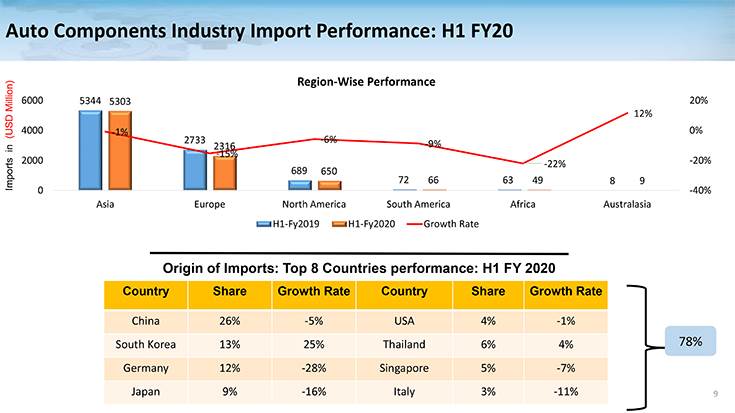

China has the largest share – 26 percent – of auto imports. India imports a varied range of parts covering drive, transmission and steering; engine parts; electricals and electronics; suspension and braking; cooling systems and vehicle interiors.

Of the top 8 countries that India imports automotive components, China has the largest share – 26%, followed by South Korea (13%), Germany (12%), Japan (9%), USA (4%), Thailand (6%), Singapore (5%) and Italy (3%). In FY2019, the value of imports of components from China was US$ 4.5 billion of the overall US$ 17 billion dollars of imports China 4.5 billion. India imports a varied range of parts from China covering drive, transmission and steering; engine parts; electricals and electronics; suspension and braking; cooling systems and vehicle interiors.

Explaining the complexity of the automotive value chain and the need for permittinclearance of imports, Deepak Jain, president, ACMA, said, “The auto component industry in India is committed to the ‘Atma-nirbhar vision’ of our prime minister. The entire automotive value chain in the country is around US$ 118 billion (Rs 873,318 crore) of which import of auto components is US$ 4.75 billion (Rs 35,154 crore), 4% of the total auto industry turnover. Some of the items imported from China are critical components such as parts of engines and electronics items for which we are yet to develop domestic competence.”

“The automotive value chain is a highly complex, integrated and inter=dependent one; non-availability of even a single component can, in fact, lead to stoppage of the vehicle manufacturing lines. Post the lockdown, production in the component industry is gradually picking up in tandem with growth in vehicles sales. It is, therefore, in the best interest of the industry and the economy that any further disruptions are best avoided.”

/news-national/acma-flags-off-supply-chain-issues-due-to-delay-in-getting-chinesemade-parts-56685 ACMA flags off supply chain issues due to delay in getting Chinese-made parts ACMA flags off supply chain issues due to delay in getting Chinese-made parts https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/76fad0f6-730b-4432-8428-0f19be9dd5b0.jpg