The Indian commercial vehicle (CV) segment has been one of the worst affected segments in the domestic market. If Q1 FY2020 sales numbers are anything to go by, the segment which has been for long been considered the barometer of an economy, is now set to witness one of its worst periods ever.

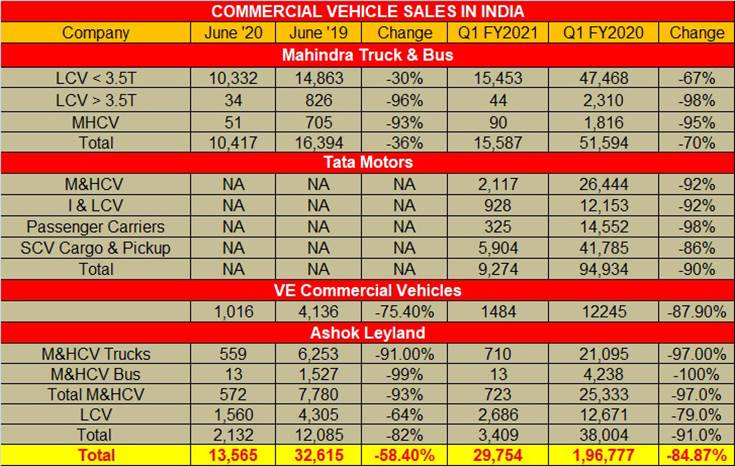

Tata Motors, the country’s largest CV maker and the market leader, has reported sales of 9,274 units in Q1 FY2021, a significant drop of 92 percent compared to the same period last year. This includes sales of 2,117 M&HCVs (-92%), 928 I&LCVs (-92%), 325 passenger carriers (-98%), and 5,904 SCV cargo pickups (-86%).

Commenting on the result, Girish Wagh, president – CVBU – Tata Motors said, “Amidst a subdued demand environment, Q1 was marked by successful transition to BS VI across the range of commercial vehicles. Domestic wholesale forQ1 FY2021 was 9,274 units, a 90 percent drop over Q1 FY2020. As the country moved to the unlock phase, all plants started operations from end of May and ramped up production gradually as parts availability improved. Retails were 67% behind wholesales due to negligible opening inventory at the dealers and muted demand. There are early recovery signs in a few sectors, and we look forward to a gradual pickup in demand on the back of overall economic recovery, while we continue to address the challenges of intermittent demand and supply disruptions from COVID-19.”

The second largest CV maker in the country Ashok Leyland managed to sell 2,132 CVs in June 2020, a drop of 82 percent in sales YoY, which compromised of 559 M&HCV truck (-91%) and 13 buses (-99%). In terms of LCV sales the company sold 1,560 units (-64%). For Q1 FY2021, Ashok Leyland sold 38,004 CVs (-91%), compromising of 21,095 M&HCV Trucks (-97%), 13 M&HCV Buses (-100%) and 12,671 LCVs (-79%).

Mahindra Truck & Bus too reported a significant drop with cumulative sales of 10,417 units (-36% YoY) in June 2020, which included sales of 10,332 LCV up to 3.5-tonne (-30%), 34 LCVs above 3.5-tonne (-96%) and 51 M&HCVs (-93%). For the first quarter this year, cumulative sales came at 15,587 units (-70%), with LCVs up to 3.5-tonne comprising 15,453 units (-67%), 34 LCVs above 3.5-tonne (-98%) and 90 M&HCVs (-95%).

According to Veejay Nakra, CEO, Automotive Division – Mahindra & Mahindra, “The automotive industry has started to see recovery both in the passenger and small commercial vehicle segments. This has been led primarily by rising rural demand and movement of essential goods across the country. Our key brands such as Bolero, Scorpio and Pik-Ups are all seeing good traction. Managing the supply chain will be our key focus area as we ramp up production to meet this increased demand.”

VE Commercial Vehicles reported domestic sales of 1,016 Eicher brand trucks & buses, a decline of 75.4 percent YoY. In the first quarter the company sold 1,484 units, a decline 87.9 percent.

Also read: India’s CV industry bottoms out in FY2020, numbers slide 27%

/analysis-sales/commercial-vehicle-sales-down-84-in-q1–oems-brace for-difficult-fy2021-56711 Commercial vehicle sales down 84% in Q1, OEMs brace for difficult FY2021 Commercial vehicle sales down 84% in Q1, OEMs brace for difficult FY2021 https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/99814a26-b0f5-4867-9f41-a08582736363.jpg