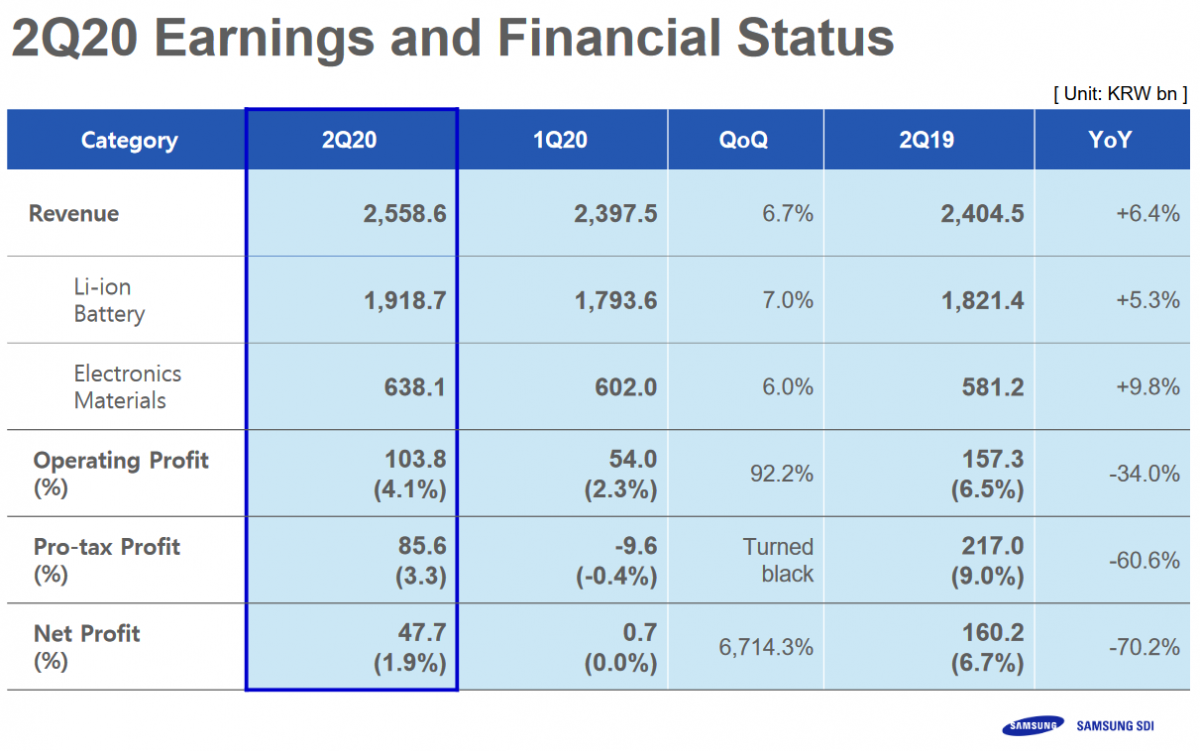

Samsung SDI increased its revenues in the second quarter of 2020 by over 6%, despite the COVID-19 lockdown hampering the results, especially in Europe.

The net profits went down significantly in Q2, although it is actually good to show any profits these days.

- Revenue: ≈$2.14 billion (up 6.4% year-over-year)

- Revenue (Li-ion Battery – xEV and non-automotive): ≈$1.60 billion (up 5.3% year-over-year)

75% of total revenue - Net Profit: ≈$40 million (down 70.2% year-over-year)

1.9% of net margin

According to the South Korean manufacturer, and battery supplier to carmakers like BMW and Audi, the second quarter of 2020 is expected to bring a “sharp rise” in battery sales.

One of the main reasons is new EV incentives in Europe, which drive plug-in sales up significantly.

The company wrote:

2H, Revenue and profitability growth are expected

- xEV sales to grow with European electric vehicle support policies

- ESS sales to increase continuously led by overseas utility projects