Panasonic‘s report for the second quarter of 2020 is pretty weak as most of its business was hit hard by the COVID-19 lockdown.

There are losses for the quarter and the full-year forecast says that net profits will be halved compared to 2019.

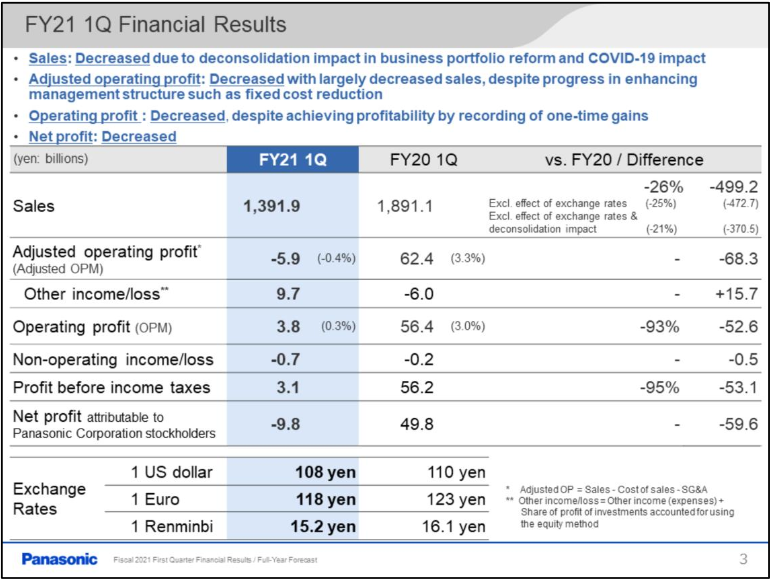

Let’s take a look at the general results. Panasonic was hit hard by COVID-19 and reports a decline in all metrics: sales, operating profits and net profits.

- Sales: 1,392 billion yen ($13.2 billion) – down 26% year-over-year

- Operating profit: 3.8 billion yen ($36 million) – down 93% year-over-year

- Net loss: -9.8 billion yen (-$93 million)

compared to net profit of 49.8 billion yen a year ago

Our focus is on the Automotive category, which includes lithium-ion batteries for xEVs. Unfortunately, it’s not profitable.

- Sales: 210.8 billion yen ($2 billion) – down 44% year-over-year

- Operating profit: -9.5 billion yen ($-90 million) – improved 5% year-over-year

The Automotive Batteries subcategory shows some positive signs with the profitable Tesla Gigafactory in Nevada in June (on a monthly basis).

Panasonic supplies Tesla with:

- 21700 cylindrical cell type for the Model 3/Model Y (produced at the Gigafactory 3 in Nevada)

- 18650 cylindrical cell type for the Model S/Model X (imported from Japan to the U.S.)

It’s great to see that at least the Tesla Gigafactory production is profitable for Panasonic, as it might encourage the Japanese manufacturer to continue investments in the EV battery segment.

We already know that energy density improvements are coming to Gigafactory.

Anyway, the overall forecast for the Panasonic and its Automotive segment in particular is weak. Overall profits to be less than half of what it was, while Automotive will remain unprofitable.