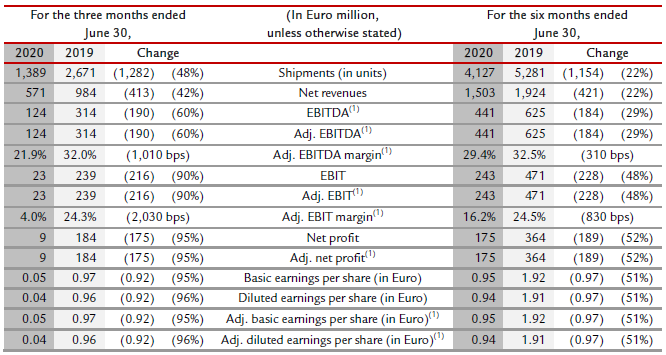

- Total shipments of 1,389 units, halved versus prior year, as a result of both production and delivery suspensions

- Net revenues of Euro 571 million, decreased by 42.0%

- Adj. EBITDA(1) of Euro 124 million, with an Adj. EBITDA margin of 21.9%

- Adj. EBIT(1) of Euro 23 million, with an Adj. EBIT margin of 4.0%

- Negative industrial free cash flow(1) of Euro 158 million, due to ongoing investments, inventory build up and actions to support the distribution network

Narrowed 2020 Guidance versus previous May 2020 Guidance:

- Net revenues: > Euro 3.4 billion (from Euro 3.4-3.6 billion)

- Adj. EBITDA: Euro 1.075-1.125 billion (from Euro 1.05-1.20 billion)

- Adj. EBIT: Euro 0.65-0.70 billion (from Euro 0.6-0.8 billion)

- Adj. diluted EPS: Euro 2.6-2.8(1) per share (from Euro 2.4-3.1(2) per share)

- Industrial free cash flow: Euro 0.10-0.15 billion (from Euro 0.1-0.2 billion)

Shipments(5)(6)

Shipments totaled 1,389 units in the second quarter of 2020, down 1,282 units or 48.0% versus prior year, impacted by the disruptions of the Covid-19 pandemic, including production suspension and dealers’ closure during the initial part of the quarter. Sales of 8 cylinder models (V8) were down 49.4% while the 12 cylinder models (V12) decreased by 42.9%. The first few deliveries of the F8 Spider and the 812 GTS commenced in the quarter, while the 488 Pista family approaches the end of its lifecycle.

EMEA(6) down 40.9%, Americas(6) declined by 52.6%, Mainland China, Hong Kong and Taiwan posted much lower shipments mostly as a consequence of the deliberate anticipation of deliveries in 2019, in addition to the effects of the Covid-19 pandemic, while Rest of APAC(6) decreased by 27.9%.

Total net revenues

Net revenues for the second quarter of 2020 were Euro 571 million, down 42.6% at constant currency(1). The decrease of revenues in Cars and spare parts(7) to Euro 450 million (down 41.3% or 42.0% at constant currency(1)) was driven by the Covid-19 production suspension that led to lower deliveries as well as a lower contribution from personalizations, partially offset by deliveries of the Ferrari Monza SP1 and SP2. Engines(8) revenues (Euro 20 million, down 60.6% also at constant currency(1)) continued to decline, reflecting lower shipments to Maserati. Sponsorship, commercial and brand(9) revenues (Euro 83 million, down 37.0% or 37.3% at constant currency(1)) were also significantly impacted by the Covid-19 pandemic, including the temporary suspension of the Formula 1 season resulting in a reduced number of Formula 1 races and corresponding lower revenue accrual in the second quarter, as well as reduced in-store traffic and museum visitors. Other(10) revenues (Euro 18 million, down 47.8% or 48.7% at constant currency(1)) were mostly impacted by the cancellation of the Moto GP at the Mugello racetrack and reduced other sports-related activities. Currency – including translation and transaction impacts as well as foreign currency hedges – had a positive impact of Euro 8 million (mainly USD).

Adjusted EBITDA(1) and Adjusted EBIT(1)

Q2 2020 Adjusted EBIT(1) was Euro 23 million, a decrease of 90.3% or 91.5% at constant currency(1), mostly due to the Covid-19 impact on Volumes (negative for Euro 152 million). Mix / price variance (down Euro 7 million) performance was negative due primarily to the lower contribution from personalization programs in line with the decrease of shipments, partially offset by deliveries of the Ferrari Monza SP1 and SP2. Industrial costs / research and development costs increased (Euro 15 million) mainly due to higher depreciation and amortization of fixed assets. The variance also included the full cost of employees’ paid days of absence during the Covid-19 production suspension and the ongoing commitment in Formula 1 racing activities, partially offset by the effects of technology incentives recognized in the quarter. SG&A decreased (Euro 9 million) mainly driven by fewer marketing initiatives. Other (down Euro 58 million) decreased due to the Covid-19 impact on the Formula 1 racing calendar, lower traffic for brand-related activities, cancellation of the Moto GP at the Mugello racetrack as well as lower engine sales to Maserati.

Financial charges in the quarter increased to Euro 11 million, up Euro 2 million versus the prior year, mostly reflecting higher interest expenses incurred as a result of the decision to early refinance part of the upcoming debt maturities and to secure longer tenors.

The tax rate in the quarter was 20%, mainly attributable to the effects of Patent Box, deductions for eligible research and development costs and the hyper and super-depreciation of fixed assets in accordance with tax regulations in Italy.

As a result of the items described above, the Net Profit for the period was Euro 9 million, compared to Euro 184 million in Q2 2019 and the Adjusted diluted earnings(1) per share for the quarter reached Euro 4 cents, compared to Euro 96 cents in the corresponding prior year period.

Industrial free cash flow(1) for the quarter ended June 30, 2020, was negative for Euro 158 million, mostly due to higher inventories and management actions to grant certain temporary, short-term payment extensions and early payments for commercial incentives to the dealer network. The long-term product development continued to be fueled with capital expenditures(1) of Euro 133 million. The prior year industrial free cash flow(1) was supported by the collection of the Ferrari Monza SP1 and SP2 advances.

Net Industrial Debt(1) as of June 30, 2020, was Euro 776 million, compared to Euro 401 million as of March 31, 2020. The increase versus March 31, 2020 was due to the cash impact of the Euro 209 million dividend distribution(2) as well as the negative impact of industrial free cash flow(1) for the quarter ended June 30, 2020. Lease liabilities per IFRS 16 as of June 30, 2020, were Euro 68 million.

As of June 30, 2020, total available liquidity was Euro 1,812 million (Euro 1,230 million as of March 31, 2020), including undrawn committed credit lines of Euro 700 million as well as the proceeds from the issuance of Euro 650 million 1.50% notes on May 27, 2020, due in May 2025.

Narrowed 2020 Guidance

The guidance for 2020 reflects better visibility and some refinements of the assumptions outlined on May 4, 2020:

- Continuing strong order book;

- Refinement of production schedule resulting in a recovery of some 500 cars partially offsetting the loss of approximately 2,000 units incurred during the plant shutdown;

- Delays in the full production ramp up of the SF90 Stradale, implying a softer mix;

- Delivery of engines to Maserati reflecting their current annual targets.

Unchanged assumptions:

- Formula 1 revenues continue to reflect the uncertainties regarding the remaining part of the 2020 calendar: so far 13 races confirmed, with most races expected to be held without the presence of fans;

- Substantial reduction in Brand activities turnover reflecting a slow recovery;

- SG&A and R&D spending reflects cost containment initiatives taken and prioritization based on medium term impact analysis;

- Capital expenditures for 2020 confirmed at approximately Euro 750 million;

- No further disruption from current pandemic has been considered.

Considering the aforementioned assumptions, the Group’s guidance for the year is narrowed as follows:

Second quarter 2020 highlights

Ferrari back at full capacity

On May 8, 2020, Ferrari factories in Maranello and Modena returned to full production, in line with the “Back on Track” program.

Scuderia Ferrari Mission Winnow and Italian Institute of Technology present FI5

On May 13, 2020, Scuderia Ferrari Mission Winnow and the Italian Institute of Technology joined forces to present FI5, a revolutionary low cost and lightweight pulmonary ventilator that can be used by hospitals around the world dealing with emergencies such as the current Covid-19 pandemic. The technical specification of FI5, the drawings, the firmware, software and list of components were made available as an open source project free of charge to all those wishing to produce the new ventilator.

Subsequent events

Ferrari Receives Equal Salary Certification

On July 2, 2020, Ferrari S.p.A. was awarded the Equal Salary Certificate in recognition of the same compensation amongst women and men for equivalent roles and jobs. This testifies to the Company’s continued commitment to creating an inclusive and diverse working environment while fostering career development for all.

Mugello Circuit to host Scuderia Ferrari’s 1000th Grand Prix

On July 10, 2020 it was announced that the Mugello racetrack will host a Formula 1 Grand Prix for the first time on the weekend of September 11 to 13, 2020, on the occasion of Scuderia Ferrari’s 1000th Grand Prix race.

Capex and R&D

Non-GAAP financial measures

Operations are monitored through the use of various non-GAAP financial measures that may not be comparable to other similarly titled measures of other companies.

Accordingly, investors and analysts should exercise appropriate caution in comparing these supplemental financial measures to similarly titled financial measures reported by other companies.

We believe that these supplemental financial measures provide comparable measures of financial performance which then facilitate management’s ability to identify operational trends, as well as make decisions regarding future spending, resource allocations and other operational decisions.

Certain totals in the tables included in this document may not add due to rounding.

Total Net Revenues, EBITDA, Adj. EBITDA, EBIT and Adj. EBIT at constant currency eliminate the effects of changes in foreign currency (transaction and translation) and of foreign currency hedges.

EBITDA is defined as net profit before income tax expense, net financial expenses and depreciation and amortization.

Adjusted EBITDA is defined as EBITDA as adjusted for certain income and costs which are significant in nature, expected to occur infrequently, and that management considers not reflective of ongoing operational activities.

Adjusted Earnings Before Interest and Taxes (“Adjusted EBIT”) represents EBIT as adjusted for certain income and costs which are significant in nature, expected to occur infrequently, and that management considers not reflective of ongoing operational activities.

Adjusted net profit represents net profit as adjusted for certain income and costs (net of tax effect) which are significant in nature, expected to occur infrequently, and that management considers not reflective of ongoing operational activities.

Adjusted EPS represents EPS as adjusted for certain income and costs (net of tax effect) which are significant in nature, expected to occur infrequently, and that management considers not reflective of ongoing operational activities.

Basic and diluted EPS(1)

Net Industrial Debt, defined as total Debt less Cash and cash equivalents (Net Debt), further adjusted to exclude the debt and cash and cash equivalents related to our financial services activities (Net Debt of Financial Services Activities).

Free Cash Flow and Free Cash Flow from Industrial Activities are two of management’s primary key performance indicators to measure the Group’s performance. Free Cash Flow is defined as cash flows from operating activities less investments in property, plant and equipment (excluding right-of-use assets recognized during the period in accordance with IFRS 16 – Leases) and intangible assets. Free Cash Flow from Industrial Activities is defined as Free Cash Flow adjusted to exclude the operating cash flow from our financial services activities (Free Cash Flow from Financial Services Activities). Prior to the first quarter of 2020, we defined Free Cash Flow and Free Cash Flow from Industrial Activities without excluding from investments in property, plant and equipment the right-of-use assets recognized during the period in accordance with IFRS 16 – Leases. Applying the current definition of Free Cash Flow and Free Cash Flow from Industrial Activities to the three and six months ended June 30, 2019 would result in an immaterial difference compared to the figures presented below. The following table sets forth our Free Cash Flow and Free Cash Flow from Industrial Activities for the three and six months ended June 30, 2020 and 2019.

On August 3, 2020, at 3.00 p.m. CEST, management will hold a conference call to present the Q2 2020 results to financial analysts and institutional investors. Please note that registering in advance is required to access the conference call details. The call can be followed live and a recording will subsequently be available on the Group’s website http://corporate.ferrari.com/en/investors. The supporting document will be made available on the website prior to the call.

1Refer to specific note on non-GAAP financial measures

2Calculated using the weighted average diluted number of common shares as of June 30, 2020 (185,460 thousand)

3Calculated using the weighted average diluted number of common shares as of March 31, 2020 (185,574 thousand)

4These results have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board and IFRS as endorsed by the European Union

5Excluding the XX Programme, racing cars, Fuori Serie, one-off and pre-owned cars

6EMEA includes: Italy, UK, Germany, Switzerland, France, Middle East (includes the United Arab Emirates, Saudi Arabia, Bahrain, Lebanon, Qatar, Oman and Kuwait) and Rest of EMEA (includes Africa and the other European markets not separately identified); Americas includes: United States of America, Canada, Mexico, the Caribbean and Central and South America; Rest of APAC mainly includes: Japan, Australia, Singapore, Indonesia, South Korea, Thailand and Malaysia

7Includes net revenues generated from shipments of our cars, including any personalization net revenues generated on cars, as well as sales of spare parts

8Includes net revenues generated from the sale of engines to Maserati for use in their cars, and the revenues generated from the rental of engines to other Formula 1 racing teams

9Includes net revenues earned by our Formula 1 racing team through sponsorship agreements and our share of the Formula 1 World Championship commercial revenues, as well as revenues generated through the Ferrari brand, including merchandising, licensing and royalty income

10Primarily relates to financial services activities, management of the Mugello racetrack and other sports-related activities

11Capital expenditures excluding right-of-use assets recognized during the period in accordance with IFRS 16 – Leases

12In May 2020 the Company paid Euro 195 million out of the total dividend distribution to owners of the parent and the remaining balance, which relates to withholding taxes, is expected to be paid in the third quarter of 2020

13Capitalized as intangible assets

14For the three and six months ended June 30, 2020 and 2019 the weighted average number of common shares for diluted earnings per share was increased to take into consideration the theoretical effect of the potential common shares that would be issued under the equity incentive plans

15Free cash flow from industrial activities for the three and six months ended June 30, 2020 includes Euro 14 million related to withholding taxes, which are expected to be paid in Q3 2020. Free cash flow from industrial activities for the three and six months ended June 30, 2019 includes Euro 12 million related to withholding taxes, which were paid in Q3 2019.