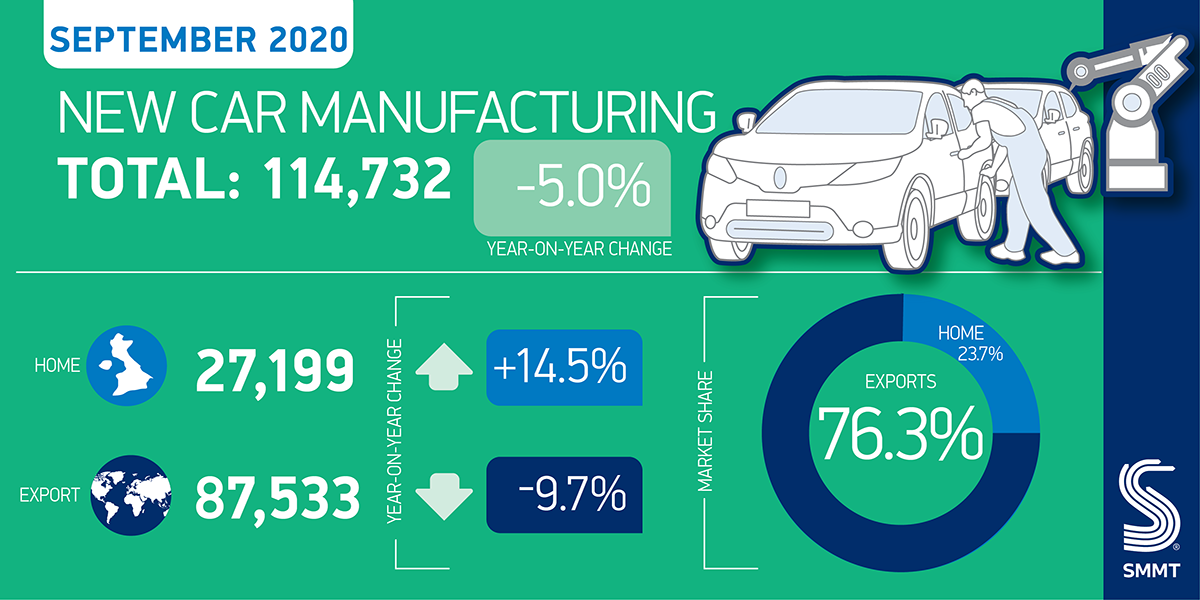

- UK car manufacturing output falls -5.0% in September to 114,732 units – the lowest level for 25 years.

- Exports decline -9.7% to 87,533 units but account for more than three quarters of production.

- Output for domestic market rises 14.5%, but equivalent to just 3,440 vehicles.

- SMMT welcomes return to negotiations but calls for both sides to prioritise auto to safeguard innovation and jobs across Europe.

UK car production fell in September, with output down -5.0%, to register the worst performance for the month in 25 years,1 according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Factories turned out 114,732 cars, a decline of some 6,000 units on the same month in 2019, as companies continued to wrestle with the uncertain economic and political environment and Covid-related challenging global market conditions.

Exports declined -9.7% in September to 87,533 units – some 9,500 fewer vehicles year-on-year, as shipments to key overseas destinations, including China, the EU and US fell -1.2%, -3.3% and -30.0% respectively. Production for the UK, meanwhile, climbed 14.5%, equivalent to a rise of 3,440 vehicles, largely a result of new models that were in ‘run out’ in the same month last year.

After the first nine months of 2020, UK car production has dropped -35.9% behind 2019 levels, with 632,824 vehicles built. The latest independent outlook forecasts factories to make fewer than 885,000 cars this year – the first time volumes will have dipped below one million since 2009.2

Bucking the overarching trends, September production of the latest battery electric vehicles (BEVs) grew 37.0% year-on-year, with the overwhelming majority (76.6%) exported, many of these into the EU. With the prospect of ‘no deal’ still on the table, these figures come as SMMT analysis shows how a 10% World Trade Organisation (WTO) tariff would increase the cost of UK-made electric cars exported to the EU by an average £2,000 per vehicle.3

As the UK looks to increase its zero emission vehicle production capability, tariffs would have the opposite effect, making the country a less attractive destination for international investment and severely damaging industrial competitiveness at the worst possible time. With countries across Europe experiencing a surge in Covid cases, and with local lockdowns already in place across many parts of the UK and beyond, the final quarter of 2020 looks increasingly challenging.

Mike Hawes, SMMT chief executive, said,

These figures are yet more grim reading for UK Automotive as coronavirus continues to wreak havoc both at home and in key overseas markets. With the end of transition now just 63 days away, the fact that both sides are back around the table is a relief but we need negotiators to agree a deal urgently, one that prioritises automotive, enhances innovation and supports the industry in addressing the global threat of climate change. With production already strained, the additional blow of ‘no deal’ would be devastating for the sector, its workers and their families.

Notes to editors

1: September 1995 UK car production 111,182 units

2: 2009 UK car production 999,460 units

3: SMMT calculations using September 2020 retail prices for UK made BEVs