- UK’s overall CV output grows by 3.3% in September, as van production gets fleet order boost.

- Bus and coach manufacturing remains in critical condition, with output plunging -43.2%, to just 63 units.

- Year-to-date CV output down -16.8% after months of restricted production and falling business confidence.

- Industry calls for tariff-free deal with key trading partner as negotiating time running out.

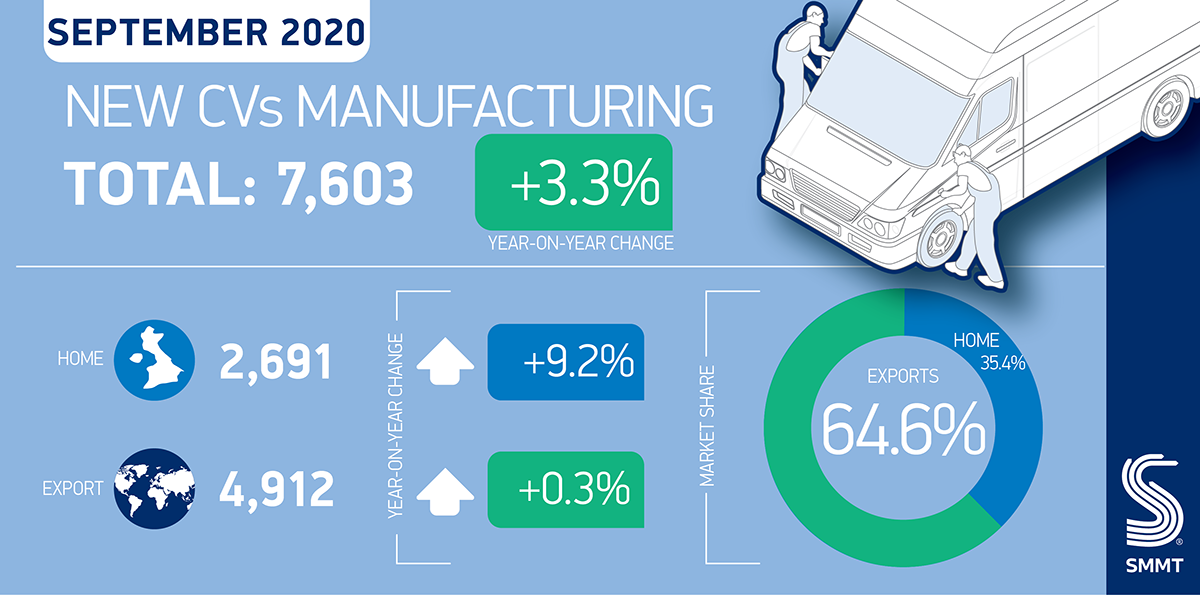

UK commercial vehicle (CV) production increased 3.3% in September, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). 7,603 vans, trucks, taxis and buses were built in Britain last month, an increase of 240 units driven by production to fulfil several large UK fleet orders.

Output for the domestic and overseas markets grew 9.2% and 0.3% respectively, with exports making up 64.6% of vehicles produced. Nearly all (95.5%) of the units exported overseas were for the EU market, the key trading partner for UK Automotive.

Although overall September performance looks positive and in line with previous years,1 bus and coach manufacturing continued to suffer from the effects of Covid, with volumes down -43.2% to just 63 units. Demand for new buses came to a virtual standstill when the nation entered lockdown in April and, with social distancing measures discouraging public transport usage for most of the year, the fall in demand has caused production to plummet -54.2% to just 756 units so far this year compared with 1,652 in the first nine months of 2019.

Total CV production in the year to date remains at a low level, down -16.8% on last year, with a shortfall of almost 9,000 units in the first three quarters.

Mike Hawes, SMMT Chief Executive, said,

Fluctuating fleet buying cycles mask the underlying impact of the pandemic on commercial vehicles, but it is the bus and coach sector that is bearing the brunt. While manufacturers and their supply chains can flex and adjust, they cannot sustain such low demand for much longer and we urgently need government’s pledge to invest in the buses turned into action. More widely, as time to agree a Brexit deal runs out, we need negotiators to keep up the momentum to agree an FTA that will safeguard the sector’s future competitiveness in 2021 and beyond.

Notes to editors

1. 2020 – 7,603, 2019 – 7,320, 2018 – 8,288, 2017 – 7,208, 2016 – 9,742