By Andy Mukherjee

India’s currency is strong, the stock market is surging, and long-term interest rates are under control. The technical recession that blighted the June and September quarters is probably already over. Prime Minister Narendra Modi has rolled out the red carpet for industries ranging from automobiles and solar panels to specialty steel. The iPhone supply chain is keen to set up assemblies.

So is it all looking up for India’s post-coronavirus economy? Hardly.

The trouble is with demand. Firms are protecting operating profit — or preventing losses — by pruning jobs and cutting pay. The rupee hasn’t suffered the double-digit declines seen this year from Brazil and Argentina to Turkey and Russia. That’s because imports collapsed after Modi’s Covid-19 lockdown in March, and the trade deficit narrowed.

Goldman Sachs Group Inc. has raised India’s equity-market rating to “overweight” on vaccine optimism, while the local bond market is sanguine because of austerity, mistimed as it is. Twelve large states, accounting for three-fourths of overall gross domestic product, may have to cut back capital expenditure by up to $36 billion in the fiscal year through March, ICRA Ltd., an affiliate of Moody’s Investors Service, estimates.

How will the gap in private consumption and public investment get filled? The global economy is hardly in shape to absorb much new merchandise, and improving market share takes time. This week, the government approved $20 billion of production-linked incentives for 10 industries that could give India a better tomorrow. They’re spread over five years. They won’t help today.

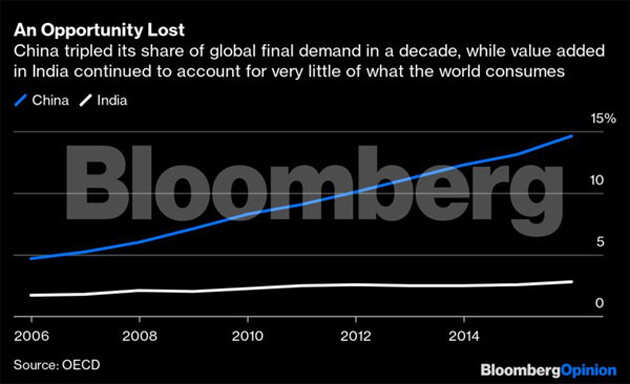

One obstacle is the low starting point. India’s exports never had much overseas value addition embedded in them, reflecting the country’s isolation from global supply chains. Over time, these “backward linkages” have weakened, according to economists at IDFC First Bank Ltd. The forward links — the value that India adds to products consumed globally — hasn’t gone anywhere, either. The contrast with China couldn’t be more striking:

An Opportunity Lost

An Opportunity Lost

To get into the game, India needs more than sops. The bureaucracy has to shed its deep-rooted, Soviet-era suspicion of imports. A country with $560 billion in foreign exchange reserves, or 20% of GDP, shouldn’t make it difficult to import tires and axles for firms re-exporting trailers.

India is the second largest exporter of human hair. If wig-makers source shampoo and conditioners duty-free from overseas, they won’t exactly be bankrupting local soap makers who have 1.3 billion scalps to lather at home.

Asian exporting powerhouses, from South Korea to China, have addressed the issue of fair and fast tax rebates on imported inputs. Additionally, India’s goods and services tax rate on exports must be zero. After all, the GST is a levy on local consumption. Exporters shouldn’t have to tie up working capital chasing refunds, or get bogged down in unnecessary paperwork.

Some laws are changing. Cultivators have been given the freedom to sell produce outside of state-designated market yards. They can enter into contract farming agreements with buyers. As many as 44 federal labor codes have been consolidated into four. Over time, Indian firms should become bigger and more productive. Rapid adoption of digital technologies will boost competitiveness. Using 5G and the Internet of Things to check power theft will help lower tariffs for industrial customers.

But these supply-side reforms won’t create their own demand. On Thursday, India said it will shoulder the burden of social security payments if private employers create new jobs at the bottom of the wage pyramid. Moves like this work well in developed economies. They don’t go far enough when a majority of workers don’t have provident fund accounts.

One way to stoke demand may be for the government to clear its overdue bills, says economist Indira Rajaraman. Take solar panels. For them to be made locally, renewable energy producers must ramp up investment after this year’s Covid disruption. For that, their customers — financially weak state distribution utilities — need to pay promptly. In BloombergNEF’s calculations, a one-year delay for half the payment makes the internal rate of return on a newly commissioned solar project fall below its cost of debt.

Government departments settling bills on time will ease a $27 billion logjam, improving the private sector’s cash flow and its capacity to take on new projects. Just doing this won’t create the eight to 10 million jobs the country needs every year. India has to persuade investors to set aside its reputation as a tough place to do business. Only then will the supply side deepen and demand strengthen.

About 10% of Modi’s financial incentives are earmarked for drugmakers. That’s just as well. Being able to supply a Covid vaccine to its own population and to other developing countries could give its manufacturing sector and the broader economy a confidence boost. With some luck, both today and tomorrow will look better.