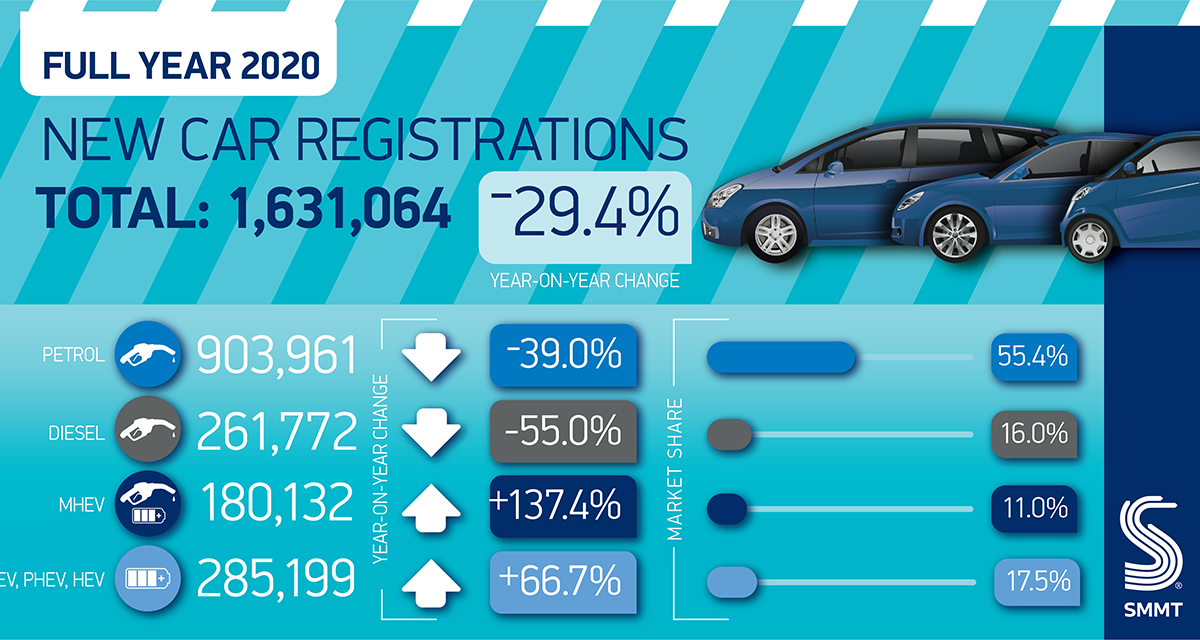

- UK annual new car registrations drop to 1.63 million in toughest year for market since 1992.

- Covid-enforced showroom closures drive overall demand down -29.4% – a 680,076-unit decline equivalent to £20.4bn in lost turnover.

- Best-ever year for electric cars with battery and plug-in hybrid vehicles market share up to 10.7%.

- Investment in charging infrastructure and battery gigafactories now essential to reboot industry and meet post-Brexit electrification challenge.

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK new car market fell by almost a third (-29.4%) in 2020, with annual registrations dropping to 1,631,064 units, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT). A -10.9% decline in December wrapped up a turbulent 12 months, which saw demand fall by 680,076 units to the lowest level of registrations since 1992.1

Against a backdrop of Covid restrictions, an acceleration of the end of sale date for petrol and diesel cars to 2030 and Brexit uncertainty, the industry suffered a total turnover loss of some £20.4 billion.2 Private vehicle demand fell by -26.6% overall, amounting to a £1.9 billion loss of VAT to the Exchequer.3 The year saw also saw -31.1% fewer vehicles joining large company car fleets.

In an atypical year, demand fell across all segments bar specialist sports, which grew by 7.0%, although Britain’s most popular class of car remained the supermini, retaining a 31.2% market share despite a -25.9% decline in registrations. Meanwhile, although falling by a combined -32.9%, petrol and mild hybrid (MHEV) petrol cars made up 62.7% of registrations, while diesel and MHEV diesels, down -47.6%, comprised almost a fifth (19.8%) of the market.

It was, however, a bumper year for battery and plug-in hybrid electric cars, which together accounted for more than one in 10 registrations – up from around one in 30 in 2019. Demand for battery electric vehicles (BEVs) grew by 185.9% to 108,205 units, while registrations of plug-in hybrids (PHEVs) rose 91.2% to 66,877. Encouragingly, there is room for further growth as most of these registrations (68%) were for company cars, indicating that private buyers need stronger incentives to make the switch, as well as more investment in charging infrastructure, especially public on-street charging.

More than 100 plug-in car models are now available to UK buyers, and manufacturers are scheduled to bring more than 35 to market in 2021 – more than the number of either petrol or diesel new models planned for the year. To increase uptake will require others to match the industry’s commitment to electrification and SMMT will continue to work with government on the detail of a strategy to deliver a successful, rapid transition that benefits all of society and safeguards automotive manufacturing with sufficient battery production capacity.

Looking ahead, another lockdown across England and ongoing tough restrictions across the rest of the UK will further impact the industry and, while click and collect can continue to provide a lifeline, it cannot offset the impact of showroom closures. With a vaccine programme now underway, however, in 2021 there is the potential to drive a recovery that would also support the UK’s environmental goals.

Additionally, with the UK-EU Trade and Cooperation Agreement now in force, the industry has avoided a catastrophic ‘no deal’ scenario and can plan for a future with more certainty over trading conditions. Given seven out of 10 new cars registered in the UK in 2020 were imported from Europe, the continuation of tariff- and quota-free trade is critical to a strong new car market in the UK.

Mike Hawes, SMMT Chief Executive, said,

2020 will be seen as a ‘lost year’ for Automotive, with the sector under pandemic-enforced shutdown for much of the year and uncertainty over future trading conditions taking their toll. However, with the rollout of vaccines and clarity over our new relationship with the EU, we must make 2021 a year of recovery. With manufacturers bringing record numbers of electrified vehicles to market over the coming months, we will work with government to encourage drivers to make the switch, while promoting investment in our globally-renowned manufacturing base – recharging the market, industry and economy.

Notes to editors

1 1992 registrations: 1.594 million

2 Based on an average price from JATO of £30,000

3 Based on expected VAT from private sales only, from an average price from JATO of £30,000