- UK new light commercial vehicle (LCV) registrations end 2020 down -20.0%, some 73,121 units fewer than last year.

- Sector growth slowed at the end of a turbulent year, with registrations falling -1.0% in December.

- 292,657 of the latest, cleanest models hit UK roads in 2020 to renew and expand existing fleets.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

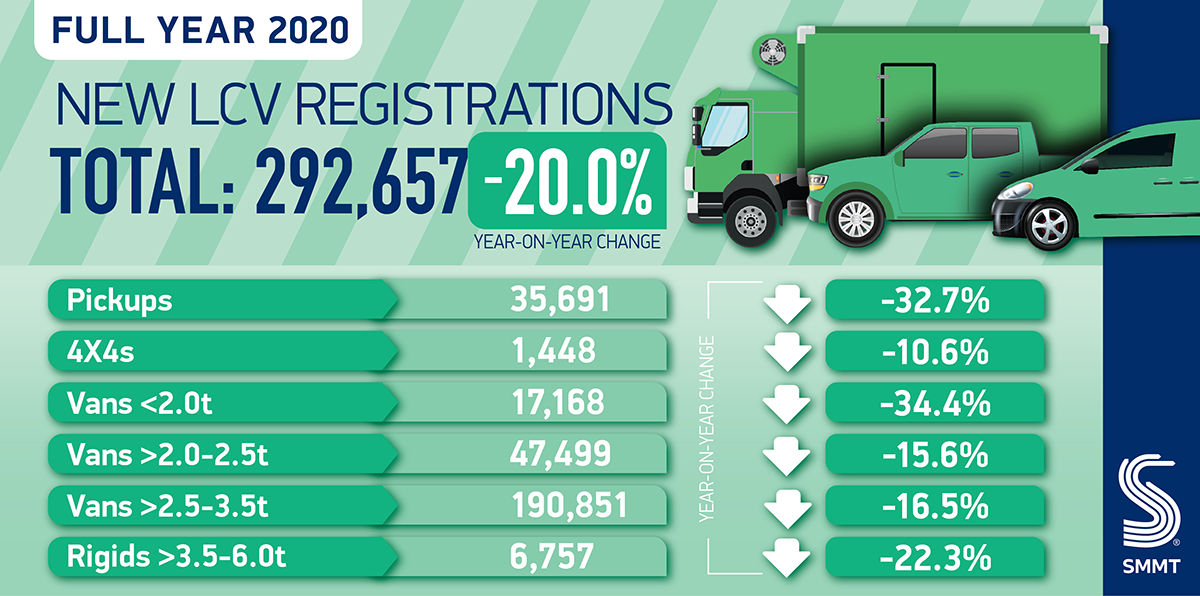

UK new light commercial vehicle (LCV) registrations ended 2020 down -20.0%, with the van market rounding off the year in decline following three months of growth, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). 292,657 vehicles were registered in 2020, as the impact of Covid and uncertainty over the future relationship with the EU brought down demand toward the end of the year, with registrations in the final month of the year dropping -1.0%, albeit with volumes consistent with previous Decembers.1

Throughout the year the LCV market responded to fluctuating demand, flexing to adjust as lockdown measures affected consumer behaviour and business operations. The first sub-300,000-unit year since 20132 delivered a shortfall of more than 73,000 with a cost to the sector of some £2 billion in retail value.3 Despite the sector stepping up to meet demand brought about by the rise of online shopping and corresponding deliveries, the effect of the pandemic on businesses, and thus the wider economy, has overall subdued demand, shrinking the van market by a fifth in 2020.

All van segments saw a decrease in the year, with small vans weighing less than or equal to 2.0 tonnes down -34.4%, medium vans weighing more than 2.0-2.5 tonnes down -15.6% and larger vans weighing more than 2.5-3.5 tonnes down -16.5%. Demand for new pickups and 4x4s fell by

-32.7% and -10.6% respectively.

Mike Hawes, SMMT Chief Executive, said,

It’s been a truly extraordinary and testing year for the commercial vehicle sector. From keeping services running, to getting key workers, goods and medicines from A to B, manufacturers and operators alike have adapted to multiple unpredictable challenges. Undeniably the LCV market, having shrunk by a fifth, has a lot of hurdles to overcome as we enter 2021. However, investment in fleet renewal will be key to driving recovery, and the sector’s resilience, now coupled with added clarity over UK-EU trading relations and the rollout of vaccines, offers hope for both the van market and the wider economy.

Notes to editors

1. December 2015-2019 five-year average – 27,753

2. 2013 – 271,013

3. SMMT calculations