Rolling coverage of the latest economic and financial news

- UK car sales drop 39.5% in January

- Worst start to a year since 1970

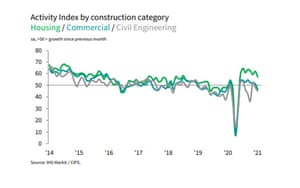

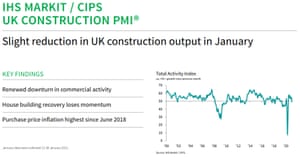

- UK construction output fell last month too

Updated

The Windrush Volkswagen garage in Slough, Berkshire, during last month’s lockdown

Photograph: Maureen McLean/REX/Shutterstock

CMA investigating Teletext Holidays over pandemic refunds

Teletext Holidays is the latest travel firm to feel the heat from the Competition and Markets Authority (CMA) for failing to refund travellers.

The CMA said it has launched its investigation under consumer protection law after receiving hundreds of complaints that people were not receiving refunds for package holidays cancelled due to the coronavirus pandemic.

In some instances, Teletext customers reported that they were promised refunds by a certain date, only to have that date pushed back.

The CMA will now engage with Teletext to gather further evidence on whether the company has broken consumer protection law.

Andrea Coscelli, CEO of the CMA, said:

“We understand that the pandemic is presenting challenges for travel businesses, but it is important that the interests of consumers are properly protected and that businesses comply with the law.

“We’ll be engaging with Teletext to establish whether the law has been broken and will take further action if necessary.”

Today’s announcement follows significant action by the CMA in relation to holiday cancellations. The CMA has written to over 100 package holiday firms to remind them of their obligations to comply with consumer protection law,.

The CMA is also investigating whether airlines have breached consumers’ legal rights by failing to offer cash refunds for flights they could not lawfully take due to the pandemic.

Competition & Markets Authority

(@CMAgovUK)We’ve launched an investigation into Teletext Holidays to establish whether it broke consumer protection law over refunds for holidays cancelled due to #coronavirus.

Find out more: https://t.co/89E20wfWjt pic.twitter.com/XKcAcGWvbA

Royal Dutch Shell plunged to a loss of almost $20bn last year after the impact of the Covid-19 pandemic on the global oil market stripped around $22bn from the value of its oil and gas assets.

The oil company was forced to write down its assets following a slump in oil and gas market prices, leading the company to a loss of $19.9bn compared with a profit of $15.3bn the year before.

The company’s adjusted financial result – which excludes the heavy hit to the value of its assets – fell by more than 80% to a profit of $4.8bn for the year, the company’s weakest full-year profits in at least two decades.

The historic financial toll caused by the coronavirus also hit BP which reported its first full-year financial loss since the Deepwater Horizon disaster earlier this week, and US oil company ExxonMobil reported its first annual loss ever.