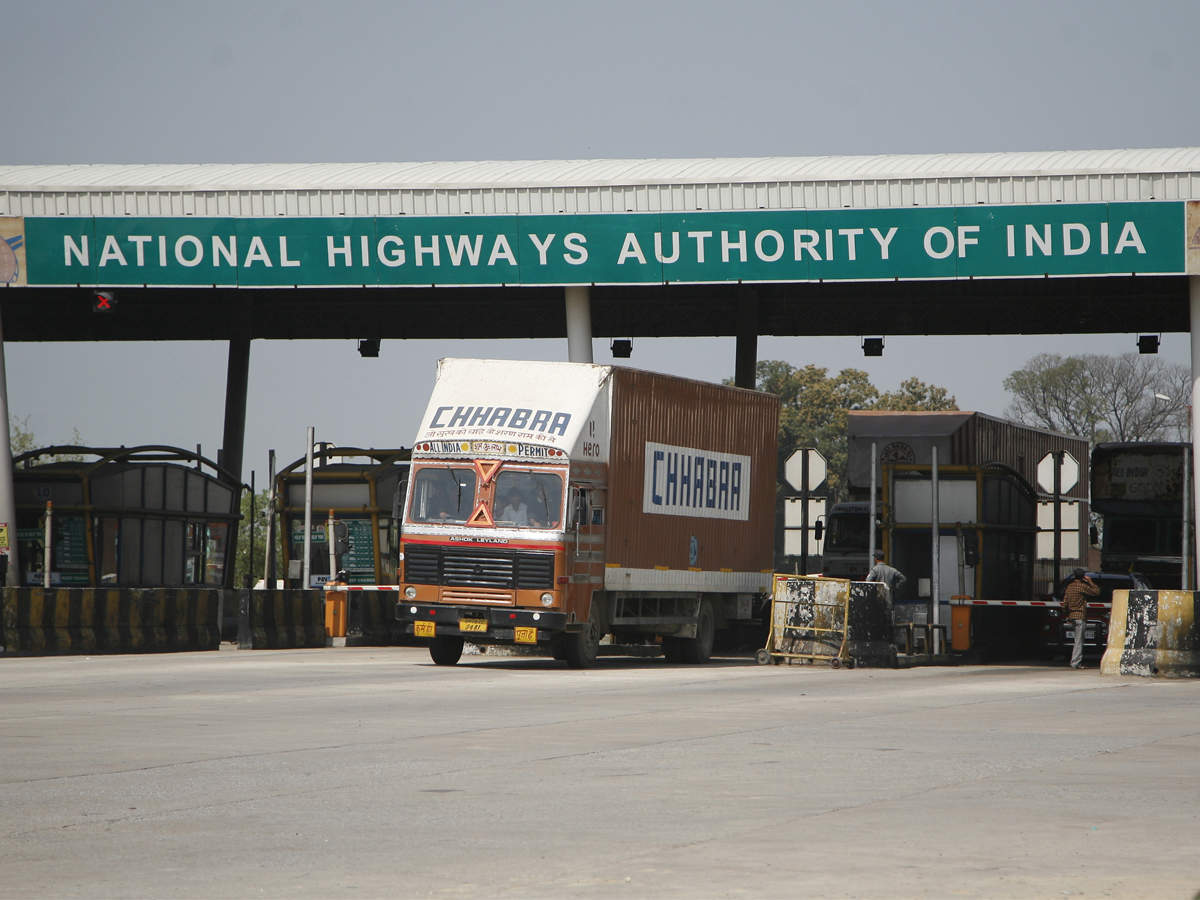

NEW DELHI: The National Highways Authority of India (NHAI) on Monday filed draft papers with markets regulator Sebi for floating an Infrastructure Investment Trust (InVIT) through which it seeks to raise Rs 5,100 crore. InvITs are instruments on the pattern of mutual funds and are designed to pool small sums of money from a number of investors to invest in assets that give cash flow over a period of time.

NHAI plans to mop up total of Rs 5,100 crore through fresh issue, as per the draft papers filed with the Securities and Exchange Board of India (Sebi).

In addition, there would be an offer-for-sale (OFS). However, the OFS amount has not been specified in the draft papers.

The units are proposed to be listed on the National Stock Exchange and the BSE.

ICICI Securities, Kotak Mahindra Capital Company and SBI Capital Markets have been appointed as merchant bankers to the issue.

In December 2019, the Union Cabinet had given nod to the NHAI to set up an InvIT and monetise national highway projects.

The move was aimed at enabling NHAI to monetise completed national highways that have a toll collection track record of at least one year and it reserves the right to levy toll on the identified highway.

In January this year, state-owned Power Grid Corporation of India filed draft papers with Sebi for launching an InVIT through which it was seeking to garner more than Rs 5,000 crore.

While Sebi first notified the regulations for InVITs and REITs (Real Estate Investment Trusts) in 2014, only a few such trusts have listed their units in the country so far.

The regulator has extended various relaxations for listing of these trusts which are popular in some advanced markets.