Logistics and supply chain startups bagged bigger rounds this week. Meanwhile, Mensa Brands, the Thrasio-style venture of Ananth Narayanan, secured $50 million in a mix of equity and debt.

Logistics and supply chain startups bagged bigger rounds this week. Meanwhile, Mensa Brands, the Thrasio-style venture of Ananth Narayanan, secured $50 million in a mix of equity and debt.

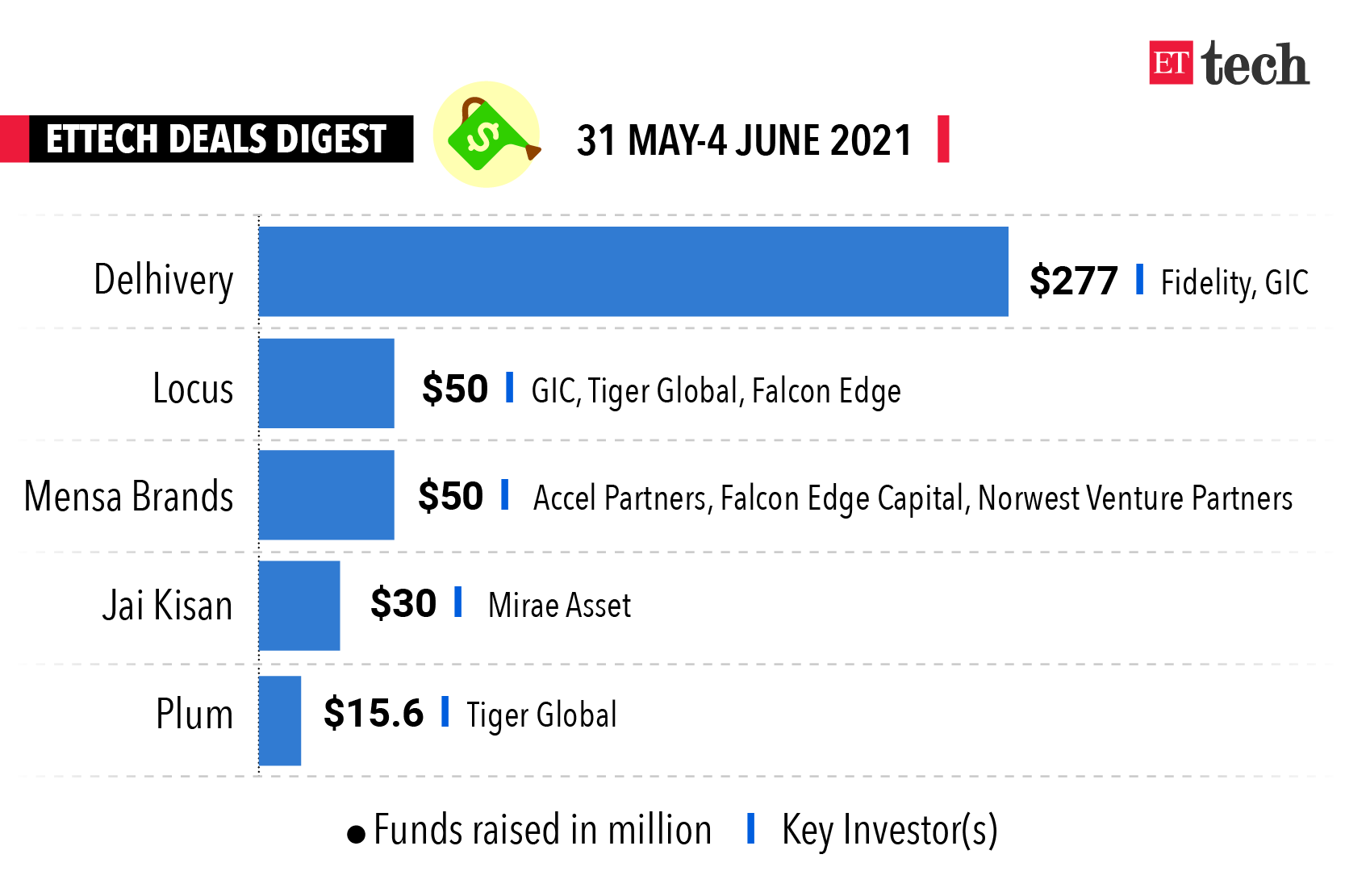

Logistics startup Delhivery has picked up around $277 million in a new funding round led by US-based Fidelity with Singapore’s sovereign wealth fund GIC also participating, latest regulatory filings accessed by ET showed. Scotland’s Baillie Gifford and Abu-Dhabi-based fund Chimera have come in as new investors in the Gurgaon-based company, which is planning to launch its initial public offering (IPO) next year.

Also Read: A decade of Delhivery

Why it matters: Delhivery’s valuation post-money has jumped to almost $3 billion, from a little over $2 billion following a secondary investment from Steadview Capital in December 2020. The fundraise is expected to be largely a secondary share sale with some primary capital coming in to help its growth plans. Marquee names like Japan’s SoftBank, New York-based Tiger Global, Carlyle and Canada’s pension fund are among its prominent investors.

Locus

Locus, a business-to-business (B2B) logistics optimisation startup, has raised $50 million in a Series-C funding round led by Singapore’s sovereign wealth fund GIC. ET was the first to report on this deal May 27.

Qualcomm Ventures and existing investors Tiger Global and Falcon Edge also participated in the round, as did angel investors Amrish Rau (CEO of Pine Labs) Kunal Shah (CEO of Cred) Raju Reddy (founder of Sierra Atlantic) and Deb Deep Sengupta (former president and managing director, SAP South Asia). The deal values the company at $300 million, sources said.

Mensa Brands

Mensa Brands, the new venture of former Myntra CEO and Medlife co-founder Ananth Narayanan, has received around $50 million in a mix of equity and debt.

The Series A round was led by Accel Partners, Falcon Edge Capital and Norwest Venture Partners, and also included prominent angel investors such as Kunal Shah, Mukesh Bansal, Rahul Mehta of DST Global and Scott Shleifer of Tiger Global. Alteria Capital and InnoVen Capital provided debt to the firm.

What’s the plan? Mensa will look to pick up a majority stake (60-65%) in profitable online-first brands that have a revenue of Rs 10-70 crore, and may eventually buy them out over three years. The venture is loosely based on US-based Thrasio.

Other key deals

Jai Kisan has bagged $30 million in debt-and-equity funding from Mirae Asset, the rural fintech startup said on Monday. Veda Corporate Advisors was the exclusive financial adviser to Jai Kisan for the fundraising.

Plum Benefits, a health insurance startup, has landed $15.6 million in a Series A funding round led by New York-based investment firm Tiger Global.

Wipro has sold its entire stake in IT services provider Ensono for $76.24 million as part of the Illinois-based company’s acquisition by private equity giant KKR which was announced in April.

xto10x, a SaaS-based consultancy, has acquired HR tech startup Dockabl for an undisclosed amount.

Artha Venture Fund, a micro-venture capital fund, has raised Rs 225 crore toward the final close of its maiden fund. This includes Rs 25 crore as part of its green shoe option.

Infra.Market, a tech-enabled marketplace for construction materials, purchased a majority stake in Equiphunt, a Hyderabad-based construction equipment rental service.

Former Karnataka chief minister M Veerappa Moily’s son, Harsha Moily, will launch a $200 million venture capital fund that will focus on the nascent climate technology sector.