The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in your inbox.

Hello and welcome back to The Station, a weekly newsletter dedicated to all the ways people and packages move (today and in the future) from Point A to Point B.

We are days away from TC Sessions: Mobility 2021, a one-day virtual event scheduled for June 9 that is bringing together some of the best and brightest minds in transportation. I’ll keep it short and sweet.

If you want to check things out but are short on cash, register and type in “station” for a free pass to the expo and breakout sessions. If you want access to the main stage — where folks like Mate Rimac, Chris Urmson and GM’s Pam Fletcher will be interviewed — then type in “Station50” to buy a full access pass for a 50% discount. Tickets can be accessed here.

Buying a ticket will also give you a months-free subscription to Extra Crunch and access to all the videos of the conference. We have a star-studded group of folks coming from Aurora, AutoX, Gatik, GM, Hyundai, Joby Aviation, Motional, Nuro, Rimac Automobili, Scale AI, Starship Technologies, Toyota Research Institute, WeRide, and Zoox. (to name a handful).

Email me at kirsten.korosec@techcrunch.com to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Micromobbin’

The big micromobility news of the week revolves around Spin, and it’s not about whether or not Ford is spinning out the company; they kept a pretty tight lip on that, but clearly big changes are happening. Co-founder Derrick Ko is stepping down as CEO and moving into an advisory role, along with his other two co-founders Zaizhuang Cheng and Euwyn Poon. In Ko’s place is Ben Bear, who previously served as CBO of Spin.

Along with this news came a flurry of other announcements, but it makes sense to start with Spin’s latest public strategy for winning the e-scooter business. Spin is actively seeking out limited vendor permits with cities. In other words, the company doesn’t want to see its cities messing around with other operators. Spin is seeking exclusive partnerships and is prepared to better itself to get them. It’s positioning itself as the most desirable for cities as it shares even more news…

If Spin wants to have a kind of deal that Lyft-owned CitiBike has with NYC, then it needs to bring more to the table. It’s starting with e-bikes. 5,000 of them, to be specific, in the coming months, starting with Providence, RI in June and spreading outward into a few other mid-tier cities over the summer.

Spin is also flexing its tech that will help make its scooters safe and reliable — just what a city wants in a long-term commitment. This week, it brought its Drover AI-equipped scooters to Milwaukee (with plans to launch in Miami, Seattle and Santa Monica, as well) that are equipped to detect sidewalk and bike lane riding and validate parking. Seattle, Santa Monica and Boise, Idaho will soon be graced by Spin’s new S-200, a three-wheeled adaptive scooter built with Tortoise’s repositioning software that allows a remote operator to move scooters out of gutters or into more dense urban areas.

Tier gets some more money

Berlin-based Tier Mobility, which recently won a London permit, has raised $60 million so it can expand its fleet of vehicles and battery charging networks. Technically, it’s a loan. The asset-backed financing comes from Goldman Sachs.

Let’s talk about bikes

Lyft has got a new e-bike piloting this month, starting in San Francisco, then Chicago and New York. It’ll be dropping the sleek, white bikes with soft purple LEDs at random around the city for people to test out. TechCrunch’s Brian Heater gave it a spin, and his general consensus was, Yeah, it’s a good bike. Can’t complain.

While Lyft may have anti-theft protection on its e-bikes, the rest of us are not so lucky. According to market research company NPD Group, we saw a 63% YOY growth for bike sales in June. Bike Index, a national bike registry group, tells us that the number of bikes stolen has seen similar increases. The number of bikes reported stolen to the service was a little over 10,000 between April and September, compared to nearly 6,000 during the same period in the previous year. That’s an uptick of nearly 68%. So, when are apartment complexes going to be forced to build bike storage rather than car parks?

Best cities for biking

If you are going to risk theft and bike around, you’ll want to do it in one of the cities PeopleForBikes just announced are the best for biking.

“Topping this year’s ratings in the United States are Brooklyn, NY; Berkeley, CA and Provincetown, MA (each ranking first in the large, medium and small U.S. city categories, respectively). Top international performers include Canberra and Alice Springs in Australia; Utrecht and Groningen in the Netherlands and Gatineau, Longueuil and Montreal in Canada, all located in the province of Quebec.”

Biking is not all about fun and commuting. For some of us, it’s work. URB-E, the compact container delivery network that wants to replace trucks with small electric bikes, has announced PackItFresh as its final-mile refrigeration provider. PackItFresh’s totes can keep food at safe temperatures for up to 24 hours, yet another reason supermarkets need to be nixing the delivery trucks in favor of these more sustainable alternatives.

— Rebecca Bellan

Deal of the week

I hesitate to put this one under deal of the week, because, well, the deal ain’t done. But it is interesting, and this is my show, so here we are. I’m talking about Aurora, the autonomous vehicle company, and a potential merger with a special purpose acquisition company.

Here’s the tl;dr for those who didn’t catch my Friday story. Several sources within the financial sector told me that Aurora is close to finalizing a deal to merge with Reinvent Technology Partners Y, the newest special purpose acquisition company launched by LinkedIn co-founder and investor Reid Hoffman, Zynga founder Mark Pincus and managing partner Michael Thompson. It appears the valuation is going to be somewhere in the $12 billion neighborhood. The deal is expected to be announced as early as next week. I should add that both Aurora and Reinivent declined to comment.

The Hoffman, Pincus, Thompson trio, who are bullish on a concept that they call “venture capital at scale,” have formed three SPACs, or blank-check companies. Two of those SPACs have announced mergers with private companies. Reinvent Technology Partners announced a deal in February to merge with the electric vertical take off and landing company Joby Aviation, which will be listed on the New York Stock Exchange later this year. Reinvent Technology Partners Z merged with home insurance startup Hippo.

Is it possible that the deal could fall apart? Sure. But my sources tell me that it has progressed far enough that it would take a significant issue to derail the agreement. One more note: there is the tricky issue of Hoffman and Reinvent’s existing relationship with Aurora. Hoffman is a board member of Aurora and Reinvent is an investor. While Hoffman and Reinvent showing up on two sides of a SPAC deal would be unusual, it is not unprecedented. Connie Loizos’s accompanying article digs into the increasing cases of conflicts of interest popping up in SPAC deals.

Other deals that got my attention …

Getir, the Istanbul-based grocery delivery app, raised $550m in new funding. This latest injection of capital, which tripled its valuation to $7.5 billion, came just three months after its last financing, the Financial Times reported. The company, which just started to expand outside of Turkey in early 2021, is now planning a U.S. launch this year.

Faction Technology, the Silicon Valley-based startup building three-wheeled electric vehicles for autonomous delivery or human driven jaunts around town, raised $4.3 million in seed funding led by Trucks VC and Fifty Years.

Flink, a Berlin-based on-demand “instant” grocery delivery service built around self-operated dark stores and a smaller assortment (2,400 items) that it says it will deliver in 10 minutes or less, has raised $240 million to expand its business into more cities, and more countries.

FlixMobility, the parent company of the FlixBus coach network and the FlixTrain rail service, has closed more than $650 million in a Series G round of funding that values the Munich-based company at over $3 billion. Jochen Engert, who co-founded and co-leads the company with André Schwämmlein, described the round in a press call that TechCrunch participated in as a “balanced” mix of equity and debt, and said that the plan will be to use the funds to both expand its network in the U.S. market as well as across Europe.

Locus, a startup that uses AI to help businesses map out their logistics, raised $50 million in a new financing round as it looks to expand its presence. The new round, a Series C, was led by Singapore’s sovereign wealth fund GIC. Qualcomm Ventures and existing investors Tiger Global Management and Falcon Edge also participated in the round, which brings the startup’s to-date raise to $79 million. The new round valued the startup, which was founded in India, at about $300 million, said a person familiar with the matter.

Realtime Robotics announced a $31.4 million round. The funding is part of the $11.7 million Series A the company announced all the way back in late 2019. Investors include HAHN Automation, SAIC Capital Management, Soundproof Ventures , Heroic Ventures, SPARX Asset Management, Omron Ventures, Toyota AI Ventures, Scrum Ventures and Duke Angels.

Roadster, the Palo Alto-based digital platform that gives dealers tools to sell new and used vehicles online has been acquired for $360 million by retail automotive technology company CDK Global Inc. As part of the all-cash deal, Roadster is now a wholly owned subsidiary.

Sennder, a digital freight forwarder that focuses on moving cargo around Europe (and specifically focusing on trucks and “full truck load”, FTL, freight forwarding), has raised $80 million in funding, at a valuation the company confirms is now over $1 billion.

Toyota AI Ventures, Toyota’s standalone venture capital fund, dropped the “AI” and has been reborn as, simply, Toyota Ventures. The firm is commemorating its new identity with a new $300 million fund that will focus on emerging technologies and carbon neutrality. The capital is split into two early-stage funds: the Toyota Ventures Frontier Fund and the Toyota Ventures Climate Fund. The introduction of these two new funds brings Toyota Ventures’ total assets under management to over $500 million

Trellis Technologies, the insurance technology platform, raised $10 million in Series A funding led by QED Investors with participation from existing investors NYCA Partners and General Catalyst.

VTB, Russia’s second-largest lender, has bought a $75 million minority stake in car-sharing provider Delimobil, Reuters reported.

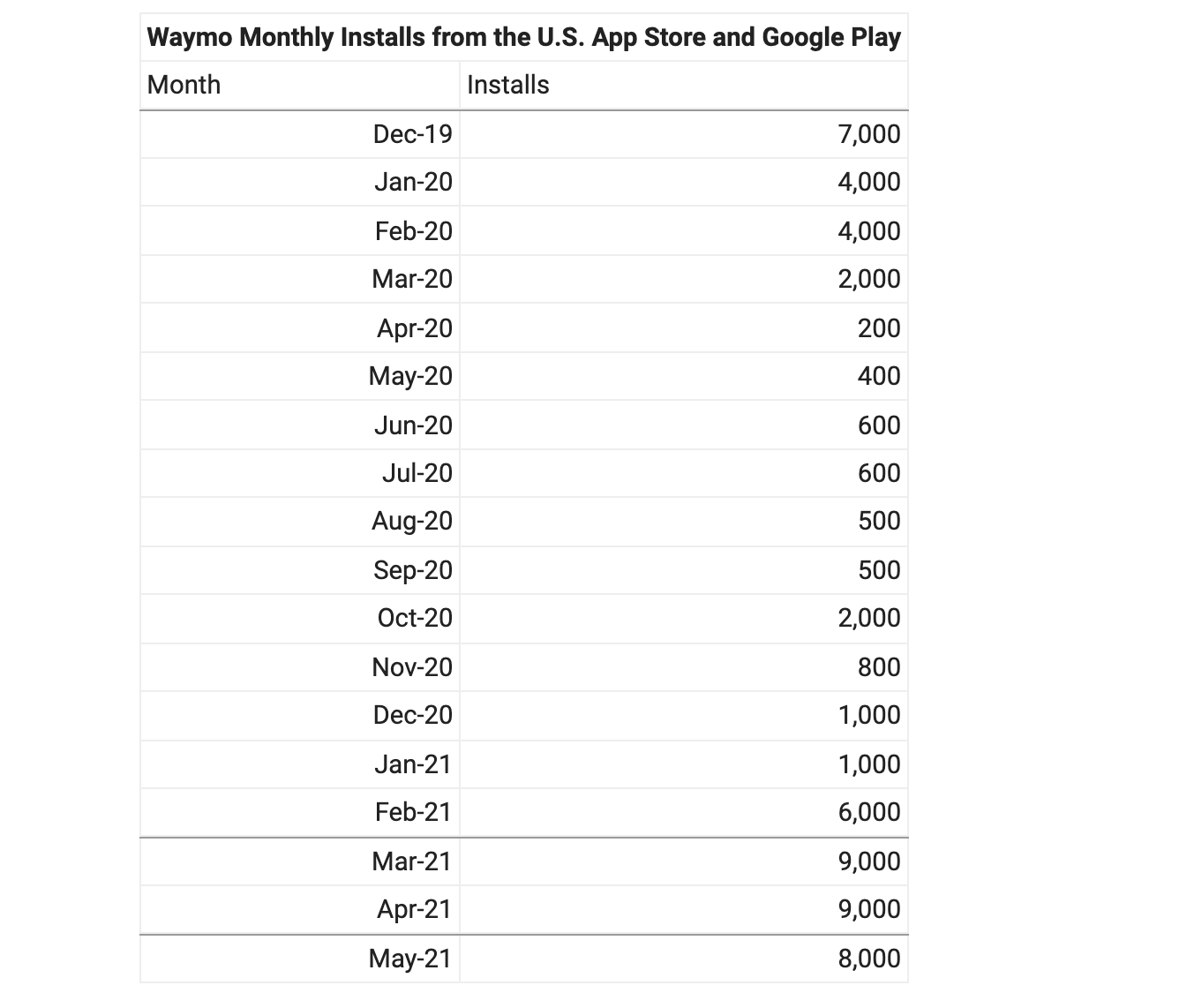

Waymo: by the numbers

Waymo has been on my mind lately — and not because of the executive departures that I wrote about last month. No, I’ve been thinking about Waymo and how, or if, it’s been scaling up its Waymo One driverless ride-hailing service, which operates in several Phoenix suburbs. The latest example is that Waymo One can now be accessed and booked through Google Maps.

But what about ridership? The folks at Sensor Tower, the mobile app market intelligence firm, recently shared some numbers that give the tiniest of glimpses into who is at least interested in trying the service.

First, a bit of history. Waymo started an early rider program in April 2017, which allowed vetted members of the public, all of whom signed NDAs, to hail an autonomous Chrysler Pacifica hybrid minivan. All of these Waymo-branded vans had human safety operators behind the wheel.

In December 2018, the company launched Waymo One, the self-driving car service and accompanying app. Waymo-trained test drivers were still behind the wheel when the ride-hailing service began. Early rider program members were the first to be invited to the service. As these folks were shifted over to the Waymo One service, the NDA was lifted.

The first meaningful signs that Waymo was ready to put people in vehicles without human safety operators popped up in fall 2019. TechCrunch contributor Ed Niedermeyer was among the first (media) to hail a driverless ride. These driverless rides were limited and free. And importantly, still fell under the early rider program, which had that extra NDA protection. Waymo slowly scaled until about 5 to 10% of its total rides in 2020 were fully driverless for its exclusive group of early riders under NDA. Then COVID-19 hit.

In October 2020, the company announced that members of Waymo One — remember this is the sans NDA service — would be able to take family and friends along on their fully driverless rides in the Phoenix area. Existing Waymo One members were given first access to the driverless rides. The company started to welcome more people directly into the service through its app, which is available on Google Play and the App Store.

Waymo said that 100% of its rides would be fully driverless, which it has maintained. Today, anyone can download the app and hail a driverless ride.

OK, back to the numbers. Sensor Tower shared monthly estimates for Waymo’s installs from the U.S. App Store and Google Play. The company said that most of the installs are on iOS, as it looks like the Waymo app only became available on Android in April 2021. This isn’t a ridership number. It does show how interest has grown, and picked up since February 2021.

Policy corner

Hi folks, welcome back to Policy Corner.

Another infrastructure bill was proposed in Washington this week. The House Committee on Transportation and Infrastructure introduced a new bill that would invest $547 billion over the next five years on surface transport. While much of those funds would go toward improving America’s roads, bridges, and passenger rail, the INVEST in America Act would dedicate around $4 billion in electric vehicle charging infrastructure and around $4 billion to invest in zero-emission transit vehicles.

And that’s in addition to major infrastructure bills already proposed by President Joe Biden and House Democrats. It’s likely that this bill, should it pass, would be significantly scaled back — just as Congressional Republicans are attempting to do with Biden’s infrastructure plan. You can read more about the bill here.

President Biden has set his sights on battery manufacturing as a way to recover and reuse critical minerals in the EV supply chain. This is after it was reported that he walked back earlier signals that he might support domestic mining for these minerals, like lithium. Instead, it looks like his plan is to push for continued importing of the metals from foreign countries and then to recycle and reuse them at the end of a battery’s life.

This news is a blow to America’s mining industry but sure to be a boost for metal recyclers, like Redwood Materials in Nevada and Canadian company Li-Cycle, which is expanding its operations in the States.

Some of the biggest pushback against mining has come from environmental and conservation groups. A good example is the situation currently unfolding out in Nevada, where a proposed lithium mine may be halted due to the presence of a rare wildflower. Conservation groups want to get protected status for the flower. If they succeed? No more mine.

The final piece of news this week is a recent survey from Pew Research Center which found that 51% of Americans oppose phasing out the production of gas-powered cars and trucks. The report also found that those reported hearing “a lot” about EVs were more likely to seriously consider one for their next vehicle purchase. Also, while Americans are roughly in agreement that EVs are better for the environment, they’re equally in agreement that they’re more costly.

The upshot is that more and more Americans are coming around to the idea of EVs and the question of their benefits (on the environment, for example) is pretty well understood. But policymakers and OEMs clearly still have a ways to go in convincing a huge swathe of Americans to get on board.

— Aria Alamalhodaei

A few more notes

I won’t be providing the looooonnnnggggg roundup of news this week, but here are a few little bits including some hires and other tidbits.

7-Eleven said it plans to install 500 direct-current fast charging ports at 250 locations across North America by the end of 2022. These charging ports will be owned and operated by 7-Eleven, as opposed to fuel at its filling stations, which must be purchased from suppliers.

Baraja, the lidar startup, appointed former Magna and DaimlerChrysler veterans to its executive team, including Paul Eichenberg as chief strategy officer and Jim Kane as vp of automotive engineering.

Brian Heater, hardware editor here at TechCrunch, covered a recent gathering of ride-hailing drivers in Long Island City, Queens. The group protested outside of Uber’s offices ahead of a proposed state bill. The drivers support the proposed bill that would make it easy for gig economy workers in the state to unionize.

Cruise, the autonomous vehicle subsidiary of GM that also has backing from SoftBank Vision Fund, Microsoft and Honda, has secured a permit that will allow the company to shuttle passengers in its test vehicles without a human safety operator behind the wheel.

The permit, issued by the California Public Utilities Commission as part of its driverless pilot program, is one of several regulatory requirements autonomous vehicle companies must meet before they can deploy commercially. This permit is important — and Cruise is the first to land this particular one — but it does not allow the company to charge passengers for any rides in test AVs.

DeepMap has developed a crowdsourced mapping service called RoadMemory that lets automakers turn data collected from their own fleets of passenger vehicles and trucks into maps. The company says the tool is designed to expand geographic coverage more quickly and support hands-off autonomous driving features everywhere.

Joby Aviation is partnering with REEF Technology, one of the country’s largest parking garage operators, and a real estate acquisition company Neighborhood Property Group to build out its network of vertiports, with an initial focus on Los Angeles, Miami, New York and the San Francisco Bay Area.

Populus, the platform that helps cities manage shared mobility services, streets and curbs, launched a new digital car-sharing parking feature in Oakland. The gist is that this feature helps cities collect data on car-sharing and deploy curbside paying payments. The company launched this particular product in 2018 and has been expanding to different cities.

Starship Technologies, the autonomous sidewalk delivery startup, has hired a new CEO. The company tapped Alastair Westgarth, the former CEO of Alphabet’s Loon, to lead the company as it looks to expand its robotics delivery service. Loon, Alphabet’s experiment to deliver broadband via high-altitude balloons, was shut down for good at the beginning of this year. Prior to working at Loon, Westgarth headed the wireless antennae company Quintel Solutions, was a vice president at telecommunications company Nortel and director of engineering at Bell Mobility.

Yuri Suzuki, a partner at design consultancy firm Pentagram, recently conducted a research project into the crucial role electric car sound has on a user’s safety, enjoyability, communication and brand recognition, out of which he developed a range of car sounds.