Ola Kallenius, the first non-German CEO of Daimler and its Mercedes-Benz brand, has been tested by a range of unforeseen challenges, from the coronavirus pandemic to the global semiconductor shortage

Ola Kallenius, the first non-German CEO of Daimler and its Mercedes-Benz brand, has been tested by a range of unforeseen challenges, from the coronavirus pandemic to the global semiconductor shortage, during his first two years in charge. The native of Sweden has also presided over the launch of Mercedes’ first electric vehicle in the luxury class, the EQS, and is pushing the automaker farther into the digital realm with plans to digitalize the entire sales and distribution network, all while aiming to lower the company’s break-even point, trim fixed costs and broaden Daimler’s lineup and customer base. He discussed these topics and more in an interview with Automotive News Europe Associate Publisher & Editor Luca Ciferri and Correspondent Nathan Eddy.

Since taking over from Dieter Zetsche in early 2019 you have undertaken a radical overhaul of Daimler. Where do you stand now in this process?

The transformation of the auto industry is obviously picking up speed. Every type of technological trend is driving this transformation. That includes the move toward zero-emissions vehicles and the car turning into a supercomputer with a very sophisticated software architecture that is fully connected with everything. In both these dimensions, we are significantly increasing our base of development. On the electrification side, this is an important year for us. We are launching four electric cars. With the EQS, we are launching a vehicle on the first fully dedicated large EV platform in the U.S. The transformation is going to continue and increase in intensity over the next few years. In this decade, the auto industry will be turned on its head, and we will significantly change both our technological industrial footprint and in some areas also our business model. What we have also been working on, during the last 18 to 24 months, is to improve the company’s financial performance. That includes lowering our break-even point and trimming our fixed costs to be able to fund this significant technological shift. We are functioning almost like our own venture capitalist, making sure that we produce healthy cash flows to find a way to help to cover the costs of the transformation. But when it comes to where we are in this process, I will use a term from American football: we are only in the first quarter of this transformation.

Meet the boss

Name: Ola Kallenius

Title: Daimler CEO

Age: 51

Main challenge: Maintaining Mercedes’ strong profitability despite the pandemic and global chip shortage.

Could you share what your break-even point was before and what it is now?

It is difficult to give an exact number because it is so dependent on the model mix and the market circumstances during any specific year. However, in general financial market terms, we stand by what we forecast in our capital markets day last October. At that time, we showed three scenarios: rainy, partly cloudy and sunny. In rainy conditions — a year where the market is down significantly — we still want to be able to make a single mid to high digit percentage return on sales. Partly cloudy is a profit margin of 8 to 10 percent, which has been our traditional target range. Under sunny market conditions, we want the margin to be in the double digits. The key is this: If your break-even point is too high under rainy conditions, you could end up in a “loss” situation. The last time we lost money was during the global financial crisis in 2009. In 2020, despite the sharp drop in the market during the first couple of months due to the corona shutdowns, we still had reasonably healthy profitability, even though we ended the year with relatively low volume. Our cash flow in 2020 was also quite healthy. That shows the positive effects of the measures we took ahead of and during the pandemic.

What is your prediction for that 2021? Will it be partly cloudy or partly sunny?

This year will be partly cloudy. This isn’t because we don’t have the demand. We have tremendous demand and a very strong product portfolio. Like many automakers we are held back by the shortage of semiconductors. This will prevent us from realizing our full market potential this year. Having said that though, from a financial point of view, I foresee partly sunny conditions because of the strong start we had in the first quarter. In a crisis situation the quality of your revenues is crucial. We have benefited here because of the macro market conditions. In addition, the refinement of our market strategy puts more focus on making sure we manage the contributions from our sales in an intelligent way. We will chase the value crown and not the volume crown. A key part of our strategy is being very disciplined in terms of our price premiums and discount policies.

What is your outlook for next year?

I think 2022 could be even stronger than 2021, but making predictions is always difficult. While there are a lot of unknown external factors, vehicle demand is likely to grow in the second half of this year and that trend is expected to continue into 2022. That should help the industry on its path toward recovery from the pandemic. In our particular case, the fresh portfolio we have today because of the number of products that we are launching, should result in a strong 2021 for us, and that should continue in 2022.

Daimler

There have been reports that Mercedes plans to exit the compact segment. What is your plan for this part of the market?

Over the last two generations, our compact vehicles have been phenomenally successful at broadening our lineup and growing Mercedes’ customer base. They have also been financially successful in terms of lifting the overall scale for our brand. Therefore, we are not exiting that segment per se, because there are many positions in our compact portfolio that generate healthy profitability. What we will not do is go down and start competing with the volume automakers. Instead, we will carefully choose the portfolio positions in that segment that offer the highest contribution reward and are the most representative of the Mercedes brand promise. That’s what I mean when I speak about profitable growth, not growth at all costs. So, we will continue to compete in the upper end of the compact segments that we are in. We are not exiting those segments.

Since 2020 was an oddity, let us compare your present targets with 2019. Does Daimler plan to be more profitable or less profitable this year than in 2019? What are the biggest tailwinds and headwinds?

The tailwinds are a fantastic product portfolio and the market reaction to a lineup that includes models such as the new S-Class, the new C-Class and the EQS, which had a tremendous reception ahead of its market debut in late summer. In Europe, we also have the EQA, which seems to have hit the spot for customers because demand is very strong. The existing cars in our portfolio are also strong sellers. The headwinds are constraints from the semiconductor shortage as well as some commodities. This has come about because many businesses had to slam on the brakes during the pandemic. Now everybody is up and running again and that has created a bit of a traffic jam, which has put some pressure on commodities prices. This has the potential to negatively influence the financials.

There was strong demand for electric vehicle in Europe during the first quarter. Did Mercedes’ full-electric EQ subbrand benefit and are on track to hit your 2021 sales target in Europe?

We are absolutely on track, not just in Europe but around the world. When we started talking about our EV plans in 2019 and how we would meet our CO2 target in Europe many people were skeptical. However, quarter by quarter, our 2020 EV sales increased quite significantly, especially in the fourth quarter. Therefore, we expect to meet the CO2 targets for Europe for 2020. The strong performance from Q4 2020 has carried over into the first quarter of 2021 as we further strengthen our lineup by launching more EQ vehicles. Second half sales will exceed our volumes in the first half. That shows we are on track to meet the CO2 targets again in 2021.

Daimler

What percentage of your global sales will be EQ models and what percentage will be plug-in hybrid?

In 2020, our xEVs — plug-in hybrids and full-electric models — accounted for a single-digit percentage of our global sales. In the first quarter of this year, we were at about 10 percent globally and 25 percent in Europe. In volumes, xEVs in the quarter were about 59,000 units, of which 16,000 pure electric. By the way, our plug-in hybrids are class leading in terms of their performance range, which is more or less 100 km based on WLTP guidelines.

In 2020 there was some leeway in meeting Europe’s CO2 target because of the supercredits given for low-emissions cars and because you could avoid counting the 5 percent of your highest emitting models. In 2021, those things disappear and the entire fleet must comply under the tougher WLTP standards instead of the NEDC rules. Some competitors have said that means CO2 in 2021 will need to be cut by another 12 to 15 percent compared to 2020. Is that correct?

That’s about right. Therefore, after taking a big step in 2020 we need to take another big step in 2021. In 2020, we were around 104 grams per kilometer of CO2 based on NEDC, which means we were a few grams below where we needed to be. But, according to WLTP rules, we were at roughly130 grams. That being said, we are on track to meet the tougher target in 2021.

Last year Mercedes had to buy emissions credits in China and the U.S. because it prioritized EV sales in Europe. Will Mercedes be able to comply this year in all its major markets without the help of credits?

We are not going to be there yet in 2021, but it’s a situation that improves every year and we have a clear plan to be compliant.

The European Union recently introduced a mechanism to collect real world emissions data using device that will be installed on new cars starting this year. Green groups say this device will prove that plug-in hybrid are not as environmentally friendly as advertised unless they are charged regularly. What is your view on this and how will the EU use this data?

We all know that we need a standardized measurement for certification. That is why we switched to WLTP from NEDC. But your individual consumption can vary depending on how you drive. The EU’s goal is to make sure individual consumption during real world driving and the certification numbers reached during testing don’t diverge. Our goal is to reduce CO2. The ultimate task here is to get to zero emissions. There’s no question about this. Ultimately, it will lead to complete electrification. When it comes to plug-in hybrids, we are now on the third generation of those cars, but a lot of the talk about them is still based on data from the first generation where the batteries were smaller and the range was shorter. As we offer customers a longer range, they will use plug-in hybrids much more in the spirit as they were intended. Many customers can drive back and forth to work for the whole week in full-electric mode. The EU will be monitoring this data and so will we because it is in our interest to help our customers get the most out of the technology. People who use the Mercedes me app can opt in to share their fuel consumption data to see where they rank according to their real driving. To make eco-driving more appealing, we have launched an app and we have designed some gaming graphics in the instrument cluster to encourage customers to drive in an energy-efficient way. So, along with technologically mastering this challenge, we are also looking to change people’s driving behavior by encouraging them and working with them during this journey.

“I’m not saying that there should not be a Euro 7 regulation, I’m just saying that we should take a very careful and balanced approach to this, not an ideological one,” Daimler CEO Ola Kallenius said.

Is it true that Euro 7 tailpipe pollution standards will not be as strict as originally expected because those initial guideline appears to make it impossible for the internal combustion engine to survive?

Discussion and deliberations are currently underway in Brussels between the industry and other stakeholders. The very first proposal we saw last year did look like it was technically impossible to realize. The latest proposal is still extremely ambitious. And we are not talking about CO2 and climate change here, we are talking about pollutants such as NOX [oxides of nitrogen] and particulate matter that affect air quality. As matter of fact, some of the steps needed to reduce those things can be counterproductive for decreasing CO2. What we have asked for, is that we make sure we get this right. If the goals measurably lead to better air quality, primarily in cities, let’s go for that. But let’s not create a regulation where the most extreme and rarest cases are the foundation of what has to be met. There is a finite amount of capital to put into R&D, since the truly zero emissions vehicle is the electric car. So maybe getting the electric car to ramp up faster, as opposed to spending too much effort on the combustion engine, is the better compromise. I’m not saying that there should not be a Euro 7 regulation, I’m just saying that we should take a very careful and balanced approach to this, not an ideological one. Because in the end, we as an industry, and certainly we as a company, have signed up to the end goal, which is zero emissions. That’s the direction we are heading. The only discussion points are the speed of reaching this, the technological path and the economics. Before the final target is set, I hope we can have a fact-based exchange on this, to make sure that we get this compromise exactly right.

Have you set a date for when Mercedes will stop making models with internal combustion engines?

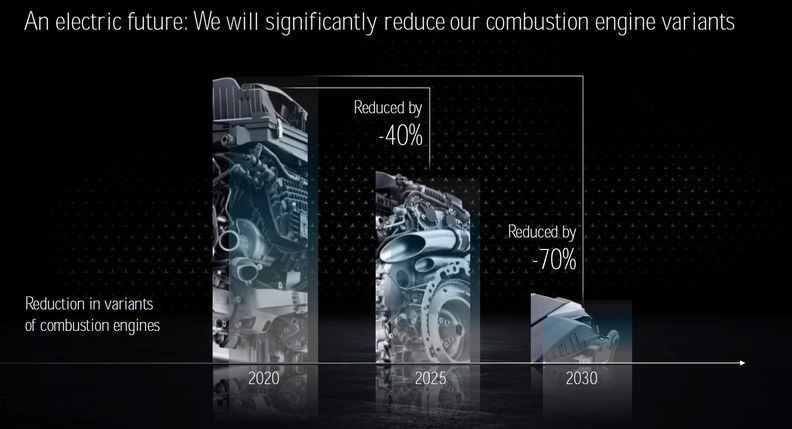

We have not set an official date. What we have said is that we want to be CO2-neutral by 2039, which is 10 years ahead of the Paris Agreement. This commitment is not one-dimensional focused only on product. We are talking about the supply chain and our own production. About three-quarters of our supply base have committed to join us on this path. We have created tremendous momentum toward making our complete value chain CO2 neutral by 2039, so I’m more optimistic than ever that 2039 is our most conservative scenario. We very likely will get into this position, at least on the product side, quicker. From a capital allocation and engineering resource perspective, we are already putting ourselves in position to become a dominant electric company that covers all our portfolio positions by between 2025 and 2030. In that context, we have not yet selected a more official date, but I’m confident that we can go faster.

You have acknowledged that the move toward electrification will result in job losses and that now is the time to act responsibly to address this. Does that mean you believe this transition should be slowed to protect jobs?

I’m sure we won’t slow down because technological progress needs to be maintained. We are going to be one of the companies that continues to push this forward. If anything, we should speed up. But, on the powertrain side, we have to do this in a socially responsible way. Some of the powertrain jobs will be transformed, obviously, to the electric drivetrain. But it’s no secret that the number of people needed to make an electric powertrain is less than that for a combustion engine. Let’s be honest about this and work with the works councils to make sure that we get this transition right. That being said, it’s not like we will push a button and this happens from one year to the next. This is at least a 10-year process, but we need to start now. Rather than artificially holding back technological progress to maintain jobs we need to find ways to transform. It’s also worth pointing out that some areas of the business will have high quality job growth, particularly on the software side, where we are significantly boosting our resources. That mean the auto company as an employer is not less attractive in the future.

How much production have you already lost to the chip shortage this year and when do you expect this issue to be resolved?

We have not disclosed the exact number of units lost in Q1, but it was a number that we noticed. Q2 will be about the same as Q1, so the challenge remains. We hope the shortage will ease in Q3 and Q4.

Daimler

Has the chip shortage caused to re-think your chip supply strategy?

The pandemic, particularly when the virus spread so rapidly last winter and spring, provided the ultimate test for the auto industry’s supply chain network because from one day to the next, nearly all production was shut down. When we ramped down production last year, I don’t think we lost a single unit because of a failure of the supply chain. We stopped to help authorities slow the spread of the virus and because we didn’t want to build up too much inventory. The automotive supply chain proved during the pandemic that it is extremely robust. With the chip shortage, three key things happened. One was the sudden stop in vehicle production during the second quarter of last year, which caused chipmakers to reallocate the production to other industries. The second event was the winter storm in Texas that knocked some chip plants offline and a fire at an important chip plant in Japan this spring. These events had nothing to do with the pandemic but they compounded the shortage. Therefore, I don’t think that we should overreact to this situation. Having said that, the amount of computing power and sensing that we will put into a vehicle in the future is only going to increase. There is a necessity for additional investment in the semiconductor area. For geopolitical reasons, the world’s major economic powers want to make sure that they have this competency in their regions. While this is a good strategy, it doesn’t mean we should replicate the same factory three times over for every single product that we make. It wouldn’t make sense economically.

If you were the EU and you had 20 billion euros to invest in the automotive industry, would you create a semiconductor plant in Europe or open four gigafactories for producing battery cells?

To meet the very ambitious climate targets, my main priority would be to invest in expanding the charging infrastructure throughout Europe. That way we preserve the precious individual freedom of mobility while also addressing CO2. That would be my No. 1 priority.