New Delhi: Great Wall Motors has extended the term of its initial agreement to acquire General Motors‘ India factory by six months, as the Chinese SUV maker still awaits New Delhi’s green signal for its billion-dollar foreign investment proposal.

New Delhi: Great Wall Motors has extended the term of its initial agreement to acquire General Motors‘ India factory by six months, as the Chinese SUV maker still awaits New Delhi’s green signal for its billion-dollar foreign investment proposal.

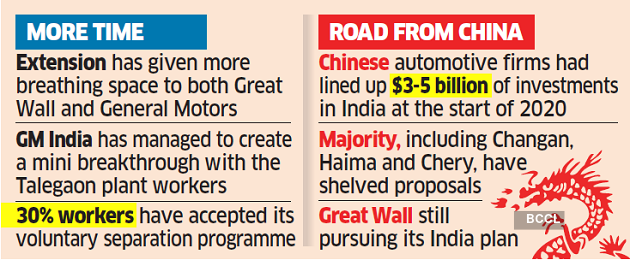

The term sheet, which was set to expire in the middle of 2021, has been extended to December, giving more breathing space to both Great Wall and General Motors to conclude the deal, several people in the know said.

India’s hardened stand on investments from China following last year’s border skirmishes in Ladakh and continuing labour strike at GM’s plant at Talegaon in Maharashtra have delayed signing of a definitive agreement.

Chinese automotive firms, including parts suppliers, had lined up $3-5 billion of investments in India at the start of 2020.

New entry strategy

While a majority of them, including Changan Automobiles, Haima and Chery, have either backed out or frozen their proposals after the geopolitical environment got tense, Great Wall continued to pursue its India plan.

Meanwhile, GM India has managed to create a mini breakthrough with the Talegaon plant workers, with 30% of the workers accepting its voluntary separation programme. The plant has been non-functional since December last year and GM has offered to sell it sans the workers.

GM India confirmed that the deadline of the term sheet with Great Wall had been extended, but declined to share the new timelines. Great Wall did not respond to an email seeking comment till the time of going to press on Friday. With its entry getting pushed by over a year, Great Wall has changed its entry strategy for India. The plan now is to focus on cleaner technologies – hybrid, electric and hydrogen fuel-cell – and use them as differentiators to establish itself in this highly competitive market, people aware of the company’s plans said. In a recent interaction with ET, George Svigos, GM’s director for international communication, said the company continued to pursue approval for the foreign investment.