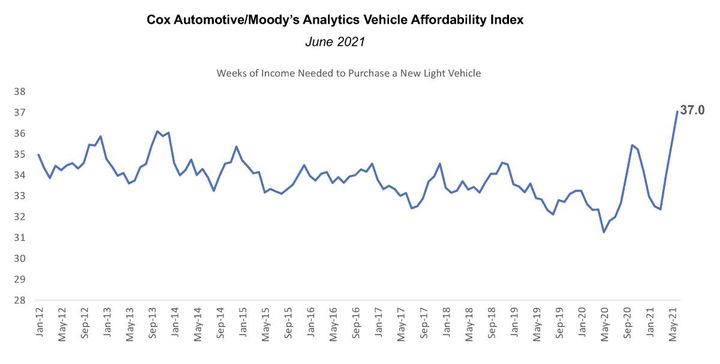

Chart: Cox Automotive

With market dynamics leading to record prices and record low incentives, new vehicle affordability declined this spring. In addition, with waning stimulus support, affordability declined in June to a new low on the affordability index, which dates to 2012.

The number of median weeks of income needed to purchase the average new vehicle in June increased to 37 weeks in June from an upwardly revised 35.5 weeks in May.

Most factors moved against affordability in June. The price paid moved higher, incentives declined, and estimated median incomes fell. Offsetting some of the inflation, the average financing rate decreased, which helped to limit what would have been an even higher increase in the monthly payment.

With the decline in June, new-vehicle affordability was much worse than a year ago when prices were lower, incentives were much higher, and government stimulus support was larger. Affordability in June was worse than at any month covered by the index data, which dates to January 2012. The second worse affordability month was October 2013.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on Aug. 17, 2021.

Originally posted on Vehicle Remarketing