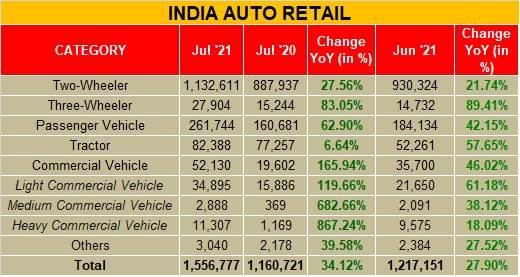

The monthly vehicle retail sales data announced by the Federation of Automobile Dealers Associations (FADA) indicate that July 2021 sales are 28 percent higher compared to June 2021 at 15,56,777 vehicles (June 2021 retail sales: 1,217,151 vehicles)

According to FADA, the increase in demand in the commercial vehicles, especially the M&HCV segment is primarily on the back of the infrastructure projects underway across the country.

Even on a year-on-year comparison the numbers are higher primarily on account of low base effect. Vinkesh Gulati, president, FADA said, “With the entire country now open, July continues to see robust recovery in auto retails as demand across all categories remain high. The low base effect also continues to play its part.”

However, the passenger vehicle segment continues to be an area of concern. Despite the unusually high demand, especially with the robust pipeline of new launches, the waiting period due to supply side constraints have been persisting and according to the FADA it is “now becoming a deep-rooted issue for OEMs.”

Even in the two-wheeler segment, though the numbers are in the black, the rate of recovery continues to be sluggish as the customers at the bottom of the pyramid have been going through financial uncertainties as a direct impact of the second wave of Covid-19 in rural markets across the country.

The silver lining, according to the FADA president, is the fact that the deficit in sales when compared to pre-Covid months is now narrowing down, “When compared to July 2019, the gap reduces to low double digits of -13 percent. With tractor retails already above pre-covid levels during the last month, passenger vehicles for the first time have reached the same by growing 24 percent.”

Semiconductor shortage worrying for PV OEMs

Giving its near-term projection for the auto sector, FADA says August 2021 has begun on a positive note as demand and enquiry levels continue to improve across all categories. In addition, the forecast of a normal monsoon between August- September and expected pickup in sowing activities will have a rub off effect on rural sales, especially in the tractor segment.

Addressing its concern on the global semi-conductor shortage, FADA says it has been raising the red flag on demand-supply mismatch for some time now. A number of OEMs including Tata Motors and Mahindra & Mahindra have said that their production schedules are getting hampered by the global supply chain problem of semiconductors.

In an internal survey conducted by FADA, 60 percent PV dealers said that they have at least two-month waiting period for select variants. 35 percent dealers also said that the waiting period is more than four months among select variants.

Poor supplies of semiconductors – a crucial component which silently power modern infotainment systems, driver aids and multiple electrical components – have been affecting companies for over a year now. The problem stems from the hugely increased demand for personal computers, tablets and smartphones at the height of the Covid-19 pandemic, which largely diverted supply away from the automotive sector.

A passenger vehicle typically uses around 1,000 semiconductors and any slowdown in the supply chain means manufacturing operations can come to a grinding halt. Also, like many countries, India too has an over-reliance on the world’s biggest supplier of microprocessors – Taiwan.

/news-national/july-sales-up-but-semiconductor-shortage-could-chip-away-at-pv-sales-fada-79797 July sales up but semiconductor shortage could chip away at PV sales: FADA According to FADA, the increase in demand in the commercial vehicles, especially the M&HCV segment is primarily on the back of the infrastructure projects. https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/0166d04c-6ed9-4751-abad-5ea2c7369390.jpg