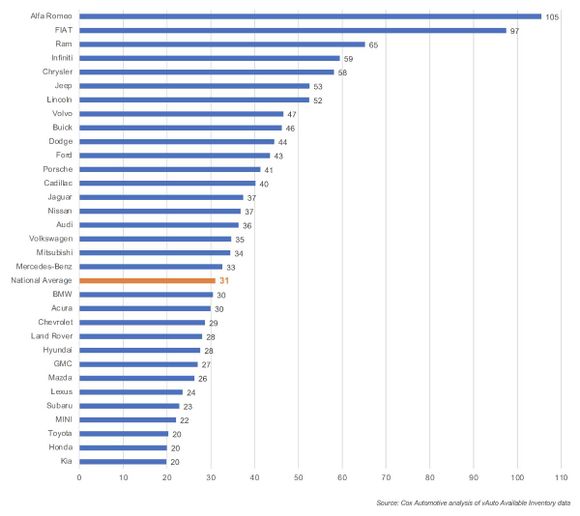

National Days Supply by Vehicle Brand

Chart: Cox Automotive

After slumping to historic lows in July, new-vehicle inventory, based on days of supply, showed signs of stabilizing as the U.S. industry entered August, according to a Cox Automotive analysis of vAuto Available Inventory data released Aug. 11. Still, overall inventory remains far lower than normal while average listing prices keep climbing.

The total U.S. supply of available unsold new vehicles stood at 1.2 million units as July closed, down from 1.3 million at the end of June. As August opened, inventories were running 53% below 2020 levels and 68% below 2019 levels, according to a Cox Automotive analysis. Supply has been trending lower since mid-December, just before the global computer chip shortage came to light and triggered production cuts.

Because the pace of new-vehicle sales slowed, the days’ supply edged higher throughout July to 31, compared with a record-low 29 days’ supply at the end of June.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period. New-vehicle sales lost momentum throughout June and July as consumers could not find the vehicles they wanted or balked at high prices. New-vehicle sales were up only 4% in July compared with a year ago. The July sales pace (seasonally adjusted annual rate or SAAR) dropped to 14.8 million, after averaging more than 17 million a month in the first half of 2021.

“The new-vehicle market is starting to show signs of stabilization around inventory levels,” said Cox Automotive Senior Economist Charlie Chesbrough. “The sales pace has been falling as supply is constrained and consumers wait for improvement. While the days’ supply is stabilizing – and, in fact, it rose slightly at the end of July – inventories remain tight and are far from normal.”

Higher Vehicle List Prices

As August opened, the average listing price for new vehicles set another record. It rose to $41,729, up from $40,999 a month earlier. The average listing price heading into August was running 9% above 2020 levels and 14% above 2019.

The non-luxury average listing price was $38,583, up from $37,637 a month earlier. For luxury vehicles, the average listing price remained just above the $60,000 mark at $60,069, nearly $600 below a month earlier.

Prices are expected to remain high until inventory levels improve. In addition, little older inventory is leftover, as is usually the case this time of year when dealers sell down old stock to make way for the new model year products.

Kia, Honda and Toyota Tie for the Bottom

The Kia, Honda and Toyota brands tied for the lowest level of inventory at a scant 20 days’ supply. Chevrolet, GMC and Mazda were below average for days’ supply.

The new Kia Carnival that replaced the Sedona minivan had only a 10 days’ supply. Since its launch earlier this year, it has had low inventory. The only model with less inventory was the Chevrolet Corvette. The popular Kia Telluride had 26 days’ supply. But Kia cars – the Forte and K5 – also had very low inventory.

The redesigned Honda Civic that launched earlier this year has been hampered by the chip shortage and has only a 21 days’ supply. But other Honda models had skimpy inventories as well, including the CR-V, Odyssey minivan and Ridgeline pickup truck.

Toyota has had among the lowest, and often the very lowest, amount of inventory of all brands for months. Toyota is leading in selling electrified models, which pushed inventories of those to less than 20 days’ supply. The models include the new Sienna hybrid minivan, the hybrid only Venza, RAV4 and its hybrid version and Prius Prime plug-in hybrid. Other Toyota models had similarly low supplies, including the Highlander SUV, Corolla, Camry, CH-R and, as always, its Tacoma and Tundra trucks. Toyota is about to launch its redesigned Tundra pickup.

On the luxury side, Lexus was again the brand with the lowest inventory, but Land Rover, Acura and BMW were below average as well.

Minivans, Hybrids, Small Cars Have Low Supply

Once again, minivans saw the lowest inventories among all segments, mostly due to the low supply of the Kia Carnival, Toyota Sienna and Honda Odyssey. Stellantis’ minivan plant in Canada was re-opened after several months of being idle, boosting Chrysler Pacifica’s inventory.

Generally, the lowest inventories, besides in minivans, have been in SUVs and trucks while car supplies have been more abundant. That remained somewhat true as August approached except that inventories for full-size pickup trucks, due to Ram’s healthy supply, were above average. In contrast to the past, compact cars fell to the second-lowest spot, pushed down by high-volume sellers Toyota Corolla and Honda Civic being in short supply. Alternative fuel vehicles like hybrids also had been more plentiful, but this month, due to Toyota’s tight supplies, they were below average.

Across the price spectrum, the days’ supply for vehicles under $20,000 was lowest followed by the $30,000 to $40,000 category and then the $20,000 to $30,000 segment.

Originally posted on Vehicle Remarketing