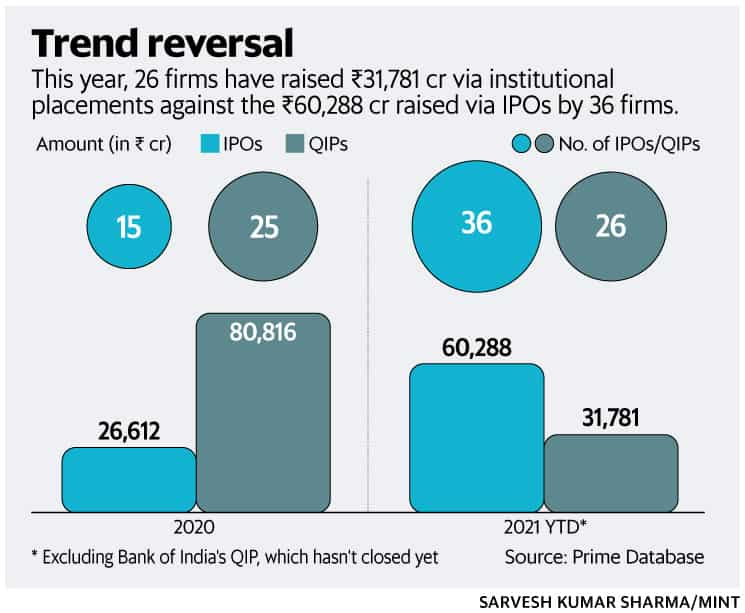

More Indian companies raised capital through initial public offerings in 2021 than via qualified institutional placements (QIPs), indicating a trend reversal from 2020 when QIPs dominated the market.

So far this year, 26 companies have raised ₹31,781 crore through QIPs. That compares with ₹60,288 crore raised through IPOs by 36 companies, data from Prime Database showed. In 2020, the total amount raised through QIPs stood at ₹80,816 crore, far outstripping the ₹26,612 crore raised via IPOs.

The underperformance of QIPs, the preferred way for listed firms to raise funds, comes as Indian markets continue to reach new highs and are flush with liquidity.

Industry experts attributed the fewer QIPs this year to the availability of cheaper debt and expectations of a further rise in stock prices, prompting promoters to pause before diluting their shareholdings. In addition, the reduction or deferment of capital spending because of the pandemic has reduced the need for corporates to tap the capital markets.

“Most corporates are trying to utilize existing capacity and, for that, they are supported by enhanced working capital support by lenders, which is certainly at a cheaper rate than it was during the pre-covid period,” said Sachin Chandiwal, managing director, DAM Capital (erstwhile IDFC Securities).

“Equity is the most expensive instrument. Promoters are expecting elevation in overall valuations, which is also the reason for delaying their fundraising plans,” he added.

Chandiwal said that the funds raised through QIPs are being deployed mainly to cut debt and build a war chest for strategic acquisitions. “We have also witnessed QIP funds deployment for expansion,” he said.

Excluding lenders, companies that have tapped the capital markets through QIPs in 2021 include PVR Ltd, Max Healthcare Ltd, Godrej Properties, Brigade Enterprises Ltd and Apollo Hospitals Enterprise Ltd.

The IPO rush has resulted in a pipeline of 42 draft prospectuses waiting for the regulator’s approval, with many more already approved and ready to start their share sales.

“The reason why more IPOs are coming to the market is that historically, the IPO window tends to be of a shorter duration, a few months, but this time around, the window has been active for a year now. So, while earlier some companies would think that an IPO is a bit premature for them and would wait till the next cycle, this time, people are advancing their plans to take advantage of this window and liquidity in the markets,” said Venkatraghavan S., managing director and head-equity capital markets at Equirus Capital.

“QIPs, on the other hand, are a function of actual requirement of capital for the company. Companies that really need the capital are the ones that are raising. In a bull market where stock prices have been going up, QIPs can sometimes be a bit of a challenge as the price is determined by the Sebi (Securities and Exchange Board of India) formula, which may be higher than the prevailing market price. So, in some instances, we have seen some companies opting for a preferential allotment rather than a QIP,” he added.

This article was first published on livemint.com