With the lockdown restrictions easing across India and the vaccination drive gaining traction, the two-wheeler sales see some signs of pick-up on a monthly basis.

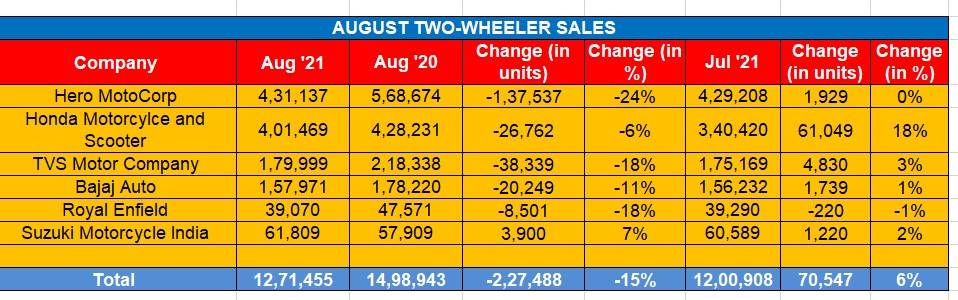

While cumulative sales numbers from six leading OEMs – 1,271,455 units indicate a 6 percent upmove month-on-month, it declined 15 percent year-on-year. Semiconductor shortages is one of the major concerns in terms of delaying production schedule and reflects an industry-wide trend including passenger vehicles and commercial vehicles.

Hero MotoCorp: 431,137 units / -24 %

One of the top manufacturers, Hero MotoCorp sales dropped 24 percent to 431,137 units in August 2021 (August 2020: 568,674 units). Month-on-month the sales were almost flat, albeit a tad higher compared to 429,208 units sold in July.

Motorcycles accounted for nearly 90 percent of sales and Splendor, HF Deluxe, Passion and Glamour are amongst the top selling bikes. Keen on increasing the share of exports, Hero MotoCorp further augmented its premium motorcycle portfolio in Bangladesh with the launch of Hero Hunk 150R in August. The company exported a total of 22,742 units last month.

The bike maker is hopeful of a revival in the upcoming festive season on the back of a reasonably good monsoon, vaccination drive gaining pace and last mile retail picking up. As a result, it fuels expectations that consumers will spend more in the festive season that will kick off in few weeks.

Honda Motorcycle & Scooter India: 401,469 units / -6%

Honda Motorcycle & Scooter India clocked growth in August compared to July but on an annual basis, it is a tad lower. It domestic sales surpassed the four lakh mark and grew 18 percent compared to the July reading at 401,469 (July 2021: 340,420 units). However, on a year-on-year basis sales dipped 6 percent (August 2020: 428,231 units).

Going forward, HMSI expects a steady recovery during the festive season. Yadvinder Singh Guleria, Director – Sales & Marketing, Honda Motorcycle & Scooter India said, “With a steady month on month recovery in terms of enquiries and customer walk-ins, we are cautiously optimistic moving forward.”

Guleria added that the bike-maker will start deliveries of the recently unveiled motorcycle CB200X in September. However, the semiconductor shortage and rising cost of raw materials continue to be key overhang for the two-wheeler manufacturer.

TVS Motor Co: 179,999 units / -18%

TVS Motor’s August sales declined 18 percent to 179,999 units year-on-year (August 2020: 218,338 units). On the MoM basis, TVS posted a 3 percent growth compared to 175,169 units in July 2021. The company said that the production and sales of premium two-wheelers were severely affected due to the shortage of semiconductors. The company launched its ‘Built To Order’ (BTO) platform, marking its foray into the factory customisation and personalisation segment. This platform will debut with its flagship motorcycle, TVS Apache RR 310 and will be introduced across other products in a phased manner.

Bajaj Auto: 157,971 units / -11 %

Pune-based Bajaj Auto is riding a wave of export-led demand. In August, its overseas shipments of 180,339 units saw it record strong 26 percent year-on-year growth (August 2020: 142,838). Domestic sales however declined 11 percent to 157,971 units (August 2020: 178,220 units).

Royal Enfield: 39,070 units / -18%

Royal Enfield’s sales also declined 18 percent to 39,070 motorcycles in August (August 2020: 47,571 units). Exports too grew to 6,790 bikes in August but compared to July, its sales were a tad lower (July 2021: 39,290 units). The company kicked off September with the launch of 2021 Model Year Classic 350 which gets a fair number of changes. While the styling takes cues from RE’s vintage G2 model, the big changes are on the powerplant front.

Suzuki Motorcycle India: 61,809 units/ +7%

Suzuki Motorcycle India clocked a 7 percent growth in August sales in the domestic market at 61,809 units (August 2020: 57,909 units) and exports came in at 11,654 units.

Satoshi Uchida, Managing Director, Suzuki Motorcycle India said, “The customer sentiment is improving day by day which is positive news for the industry.”

Growth Outlook

The August automobile sales reflect some impact of semiconductor shortages and indicates that high fuel inflation and escalating cost of ownership continue to weigh on sentiment. Though the chip shortage is expected to extend into next year, manufacturers are betting on demand arising from a satisfactory monsoon, healthy pace of vaccination and expect a volume recovery in the forthcoming festive season.

/analysis-sales/muted-twowheeler-sales-in-august–industry-pins-hope-on-festive-season-79966 Muted two-wheeler sales in August, industry pins hope on festive season While most of the two-wheeler manufacturers record slight pick-up compared to July, consumer sentiment still remains muted. https://www.autocarpro.in/Utils/ImageResizer.ashx?n=http://img.haymarketsac.in/autocarpro/3d8af2a6-bd8a-4230-bc13-ba34f5a4e9bb.jpg